Aidvantage student loans remain a central part of the federal student loan system in the United States, influencing how millions of borrowers repay education debt, manage monthly obligations, and plan long-term finances in 2025. As one of the government’s primary loan servicers, Aidvantage is responsible for administering federal student loan accounts at a time when repayment rules, income-based options, and borrower expectations continue to evolve. For borrowers seeking clarity and stability, understanding how Aidvantage operates today is critical.

This in-depth article focuses entirely on Aidvantage student loans, explaining the servicer’s role, responsibilities, borrower experiences, and current realities. The content is written for a U.S. audience, reflects the most current confirmed status, and avoids speculation or unrelated discussion.

What Aidvantage Student Loans Mean for Borrowers

The phrase Aidvantage student loans often creates confusion, especially for borrowers who are new to repayment. Aidvantage does not issue student loans, approve borrowing amounts, or set interest rates. Instead, it functions as a federal student loan servicer.

A servicer’s role is administrative. Aidvantage manages existing federal student loan accounts on behalf of the U.S. Department of Education. This includes sending billing statements, collecting and applying payments, managing repayment plans, tracking interest, and communicating with borrowers about required actions.

The federal government remains the owner of the loans. Aidvantage follows federal laws and policies exactly as they are written. This distinction matters because it explains why the servicer cannot independently change repayment rules, approve forgiveness, or override federal decisions. Aidvantage’s responsibility is to apply rules accurately and consistently.

How Aidvantage Became a Major Federal Loan Servicer

Aidvantage became a widely recognized name after a large transfer of federal student loan accounts placed millions of borrowers under its management. This shift occurred during a period of significant disruption in the student loan system, when repayment structures and borrower protections were already under scrutiny.

As Aidvantage assumed responsibility for these accounts, it inherited not only balances and payment histories but also borrower concerns, system challenges, and heightened expectations for transparency. The rapid expansion made Aidvantage one of the largest servicers in the federal loan ecosystem almost immediately.

Since then, Aidvantage has continued to operate under a federal contract, managing accounts for borrowers across all stages of repayment. Its systems and policies now affect borrowers nationwide, making its performance especially important.

The Core Functions of Aidvantage Student Loans

Aidvantage’s responsibilities extend across every stage of federal student loan repayment. Understanding these functions helps borrowers better navigate their accounts and avoid misunderstandings.

Billing and Monthly Statements

Aidvantage generates monthly billing statements for borrowers whose loans are in repayment. These statements show the amount due, due date, interest accrued, and total remaining balance. They also indicate whether a borrower is enrolled in automatic payments or a specific repayment plan.

Accurate billing is essential. Errors or missed statements can lead to late payments, which may affect loan status and long-term costs. Borrowers are encouraged to review each statement carefully and report discrepancies promptly.

Payment Processing and Application

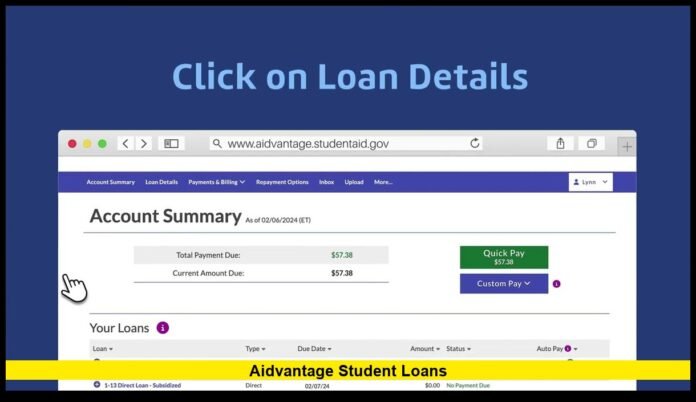

One of Aidvantage’s most critical duties is processing payments correctly. Payments may be made online, by mail, or through automatic debit. Aidvantage applies these payments to the borrower’s account, allocating amounts to interest and principal based on federal rules.

Proper payment application matters greatly for borrowers pursuing long-term repayment or forgiveness. Misapplied payments can disrupt progress and create confusion. For this reason, borrowers should regularly review payment histories in their online accounts.

Repayment Plan Administration

Federal student loans offer multiple repayment options, and Aidvantage administers these plans according to federal guidelines. Borrowers may choose from standard, graduated, extended, or income-based repayment options depending on eligibility.

Aidvantage provides calculators and tools to estimate monthly payments under different plans. While these tools help borrowers understand potential outcomes, final eligibility and plan terms are governed by federal policy.

Changes to repayment plans often require documentation and processing time. Borrowers should expect some delay, particularly during periods of high demand or policy changes.

Interest Accrual and Balance Tracking

Aidvantage tracks interest accrual on federal student loans and updates balances accordingly. Interest continues to accrue based on loan type and repayment status unless specific federal relief applies.

Understanding how interest affects loan balances helps borrowers make informed decisions. Small differences in payment timing or plan selection can significantly impact long-term costs.

Support for Forgiveness Programs

Many borrowers pursue federal loan forgiveness options that require years of qualifying payments. Aidvantage tracks payment histories and maintains records used to determine eligibility.

Although Aidvantage does not approve forgiveness, its recordkeeping plays a key role. Accurate tracking ensures borrowers receive proper credit for qualifying payments over time.

Aidvantage Student Loans in the Current Federal Landscape

The student loan system in 2025 remains influenced by legal, administrative, and policy developments. Aidvantage operates within this environment and must adapt as rules change.

Income-Based Repayment Challenges

Income-based repayment plans are a vital tool for borrowers with limited income. However, changes to federal programs and administrative backlogs have affected processing timelines.

Aidvantage continues to accept applications and documentation, but borrowers may experience longer wait times. These delays are system-wide and not limited to one servicer.

Understanding that these delays stem from broader conditions can help borrowers set realistic expectations.

Administrative Backlogs and Borrower Volume

Aidvantage manages a very large number of borrower accounts. During periods of policy change or increased enrollment in repayment plans, administrative workloads rise sharply.

This can lead to longer response times for customer service inquiries and slower processing of complex requests. Despite these challenges, core servicing functions such as billing and payment acceptance continue.

Oversight and Accountability

Aidvantage operates under federal oversight and must meet contractual performance standards. Borrowers who encounter unresolved issues have options to escalate concerns through formal channels.

Keeping detailed records of communications and transactions improves a borrower’s ability to resolve disputes efficiently.

Borrower Experiences With Aidvantage Student Loans

Borrower experiences vary widely depending on individual circumstances, loan complexity, and communication habits.

Borrowers Reporting Positive Experiences

Many borrowers successfully manage their loans through Aidvantage without major difficulty. They report consistent billing, accurate payment processing, and functional online account tools.

Automatic payments help reduce the risk of missed due dates and simplify repayment. Borrowers who regularly monitor their accounts often report smoother experiences.

Borrowers Reporting Difficulties

Other borrowers describe challenges, including long wait times for customer service, confusion about repayment plan options, or delays in processing changes.

These issues are more common in complex situations involving income-based repayment or forgiveness tracking. Such challenges highlight the importance of proactive communication and documentation.

Important Facts Borrowers Should Understand

For anyone with Aidvantage student loans, several facts are especially important in 2025.

Your Loan Remains Federal

Aidvantage manages the loan, but the federal government owns it. This ensures access to federal protections and repayment options.

Payments Remain Obligations

Unless a borrower qualifies for specific relief, payments remain due. Missing payments can lead to delinquency and increased costs.

Policy Changes Require Time

New rules take time to implement. Borrowers should monitor updates and maintain records during transitions.

Practical Strategies for Managing Aidvantage Student Loans

Borrowers can take steps to manage their loans more effectively and reduce stress.

Review Accounts Regularly

Frequent account checks help catch errors early and keep repayment on track.

Save All Records

Payment confirmations, applications, and messages should be saved for future reference.

Communicate Clearly

Clear questions and detailed notes improve outcomes when contacting customer service.

Understand Repayment Options

Knowing available plans allows borrowers to choose options that fit their financial situation.

Aidvantage’s Role in the Federal Student Loan System

Aidvantage is one of several servicers supporting the federal student loan infrastructure. Its effectiveness affects borrower trust and system stability.

Reliable servicing helps borrowers stay compliant and informed. Inconsistent servicing increases confusion and frustration. In 2025, improving borrower experience remains a priority across the system.

The Future of Aidvantage Student Loans

Aidvantage student loans will continue to be a significant part of federal repayment. While policies may change, the need for accurate servicing remains constant.

Borrowers should expect ongoing adjustments as federal rules evolve. Staying informed and proactive remains the most effective strategy.

Why Staying Informed Matters

Student loan repayment influences credit, financial planning, and long-term stability. Understanding how Aidvantage operates empowers borrowers to make better decisions.

Knowledge helps borrowers avoid costly mistakes and respond confidently to changes.

Final Perspective on Aidvantage Student Loans

Aidvantage student loans represent a substantial portion of the federal student loan system. As a servicer, Aidvantage plays a crucial administrative role, managing accounts and supporting borrowers under federal guidelines.

While challenges exist, informed and proactive borrowers can navigate repayment successfully in 2025.

How has your experience with Aidvantage student loans shaped your repayment journey? Share your thoughts and stay engaged as the federal student loan system continues to evolve.