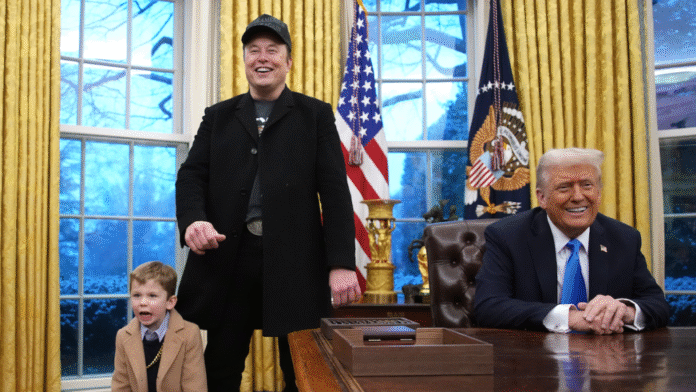

Tesla’s stock is in the spotlight again—this time not for a product launch or quarterly earnings surprise, but due to an escalating public dispute between Elon Musk and President Trump. The key phrase “Elon Musk President Trump” is dominating headlines as the Tesla CEO publicly condemned a new budget bill backed by Trump, leading to a sharp dip in Tesla’s market value. The political-business clash is more than just a feud—it’s starting to affect shareholder confidence and Tesla’s financial outlook.

A “Disgusting” Budget Bill? Musk’s X-Factor Response

The fallout began when Elon Musk labeled President Trump’s recently passed tax and spending package as a “disgusting abomination.” The bill, which Trump hailed as the “Big Beautiful Bill,” includes provisions that eliminate key federal electric vehicle (EV) tax credits, increase regulatory hurdles for clean energy projects, and introduce new fees for EV owners. As head of Tesla, the world’s most prominent EV manufacturer, Musk didn’t stay silent.

He took to his social media platform, X, formerly Twitter, slamming the bill for hurting innovation and punishing green energy progress. His posts quickly went viral and rattled investor confidence. The result? Tesla’s stock plunged over 4% in a single day, erasing billions from its market cap.

Musk warned that if Republican lawmakers continued to support policies that damage clean tech, voters should remove them in the next election. The political storm has placed “Elon Musk President Trump” at the center of a rare clash between Big Tech and Trumpian populism.

Tesla’s Market Woes Go Beyond Washington

While politics has played a major role, Tesla’s current challenges aren’t just limited to the Musk-Trump drama. The company is also seeing a dip in global sales. May figures showed a year-over-year drop in Tesla deliveries in key regions, including a significant decline in Germany and a 15% slump in vehicles shipped from Shanghai.

Even though Tesla has seen impressive gains in recent months—up nearly 95% over the past 12 months—the stock remains down by double digits for the year. Investors who were hopeful after the April earnings call are now wondering if Musk’s political focus is distracting him from steering Tesla through these sales headwinds.

Musk has promised that Tesla’s much-anticipated robotaxi reveal, scheduled for later this summer in Austin, Texas, will mark a turning point. But with the “Elon Musk President Trump” controversy heating up, that milestone may not be enough to settle Wall Street’s nerves.

The Political Risks of Being Elon Musk

Musk’s growing involvement in national politics comes with significant risks. His role in the Trump administration’s Department of Government Efficiency (DOGE) has sparked debate about whether a public CEO should serve in a partisan federal position while running a publicly traded company.

Meanwhile, the online and on-the-ground “Tesla Takedown” movement continues to gain traction. Opponents of Musk’s political alignment have organized protests and even encouraged Tesla owners to sell their vehicles as a form of economic resistance. While these efforts have yet to materially dent Tesla’s bottom line, the symbolic blow is substantial.

The line between personal politics and professional responsibilities is increasingly blurred. And as “Elon Musk President Trump” continues to trend, questions are mounting about whether Musk’s dual roles are sustainable.

A Growing List of Concerns for Tesla Investors

Here are the key risks shareholders are now watching:

- Political volatility: Musk’s open conflict with Trump could strain Tesla’s relationships with regulators and lawmakers.

- Financial uncertainty: EV tax credit rollbacks may directly impact sales.

- Brand backlash: Activist movements against Tesla could harm brand perception.

- Distraction factor: Musk’s attention split between Tesla and federal politics may impact execution of company goals.

Looking Ahead: Collision or Course Correction?

Tesla’s future may depend on whether Elon Musk can recalibrate his approach to politics—or whether the rift with Trump signals a deeper fracture in conservative support for EV initiatives. Either way, “Elon Musk President Trump” isn’t just a headline—it’s a proxy for a broader debate about the role of corporate leaders in shaping national policy.

For now, Tesla faces economic and reputational pressures on multiple fronts. Investors, customers, and political observers alike will be watching closely to see whether this public spat becomes a full-blown war or a temporary detour.

Stay updated as this story unfolds. The impact of this clash could reshape Tesla’s strategy, influence U.S. energy policy, and define the relationship between tech moguls and politicians in 2025 and beyond.

Keep following for real-time updates, analysis, and insights into what’s next for Tesla, Musk, and the evolving dynamic between business and politics.