The question of what is the SALT deduction has taken center stage in Washington, D.C., as lawmakers scramble to finalize President Donald Trump’s massive tax bill before the Memorial Day weekend of 2025. Just yesterday, on May 20, 2025, House Speaker Mike Johnson struck a tentative deal with blue-state Republicans to raise the cap on the State and Local Tax (SALT) deduction from $10,000 to $40,000 for individuals earning up to $500,000 annually. This breakthrough aims to appease moderates from high-tax states like New York, New Jersey, and California, who have fiercely advocated for relief from the current cap. However, the deal isn’t sealed—hardline conservatives are pushing back, arguing it’s a costly giveaway to wealthy residents in Democratic strongholds. As negotiations heat up, the SALT deduction remains a lightning rod in the GOP’s ambitious tax overhaul, sparking debates over fairness, fiscal responsibility, and political strategy.

Understanding the SALT Deduction: A Quick Primer

So, what is the SALT deduction? It’s a federal tax provision allowing taxpayers to deduct certain state and local taxes—think income, sales, and property taxes—from their federal taxable income. Before 2017, there was no limit on this deduction, making it a significant benefit for residents of high-tax states. The 2017 Tax Cuts and Jobs Act (TCJA), signed under Trump’s first term, capped the SALT deduction at $10,000, a move that hit affluent filers in places like New York City and Los Angeles hard. That cap is set to expire at the end of 2025, and the current push to raise it to $40,000—or even higher, with some proposing $62,000 for individuals—has ignited fierce negotiations. The deduction primarily benefits those who itemize their taxes, often high earners in blue states, which is why it’s such a contentious issue.

Why the SALT Cap Matters in 2025

The SALT cap has been a sore point since its introduction. For residents in high-cost areas, state and local taxes can easily exceed $10,000, leaving them with hefty federal tax bills. The proposed $40,000 cap, with a 1% annual increase over 10 years, aims to ease this burden. But not everyone’s on board. President Trump, who initially campaigned on expanding SALT relief, expressed frustration on May 20, 2025, urging lawmakers to stick with a $30,000 cap to avoid ballooning costs. He argued that a higher cap benefits “Democrat governors” in blue states, a claim that’s stirred tensions within the GOP. Blue-state Republicans, like Rep. Mike Lawler of New York, are holding firm, warning they’ll sink the bill without a more generous deduction. This tug-of-war highlights the delicate balance between regional interests and national fiscal priorities.

The Numbers Behind the SALT Debate

To grasp the stakes, let’s break it down:

- Current Cap: $10,000, set by the 2017 TCJA, expiring in 2025.

- Proposed Cap: $40,000 for individuals earning up to $500,000, with a 1% annual increase for 10 years.

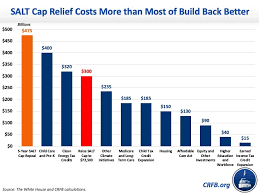

- Cost Concerns: Raising the cap to $40,000 could cost billions, with some estimates suggesting a $62,000 cap could near $1 trillion over a decade.

- Who Benefits: High earners in high-tax states like California, New York, and New Jersey, where property and income taxes are steep.

These figures fuel the debate. Conservatives like Rep. Ralph Norman of South Carolina argue that a higher cap subsidizes blue states at the expense of others. Meanwhile, moderates counter that it’s about fairness for taxpayers facing double taxation.

What Is the SALT Deduction’s Political Fallout?

The SALT tax deduction isn’t just about numbers—it’s a political minefield. Blue-state Republicans, part of the bipartisan SALT Caucus formed in 2021, see lifting the cap as critical for their constituents and their 2026 midterm prospects. Rep. Nicole Malliotakis of New York supports the $40,000 cap, but colleagues like Lawler and Nick LaLota want it higher or gone entirely. On May 20, 2025, Trump’s call to “let SALT go” and focus on the broader tax bill put these lawmakers in a tough spot. Democrats, like House Minority Leader Hakeem Jeffries, have seized the moment, accusing Trump of flip-flopping on his campaign promise to restore SALT. The tension underscores a broader GOP struggle: unifying a party split between fiscal hawks and moderates from high-tax districts.

The Economic Impact of Raising the SALT Cap

Raising the SALT cap could have ripple effects. For taxpayers, a $40,000 cap means more savings, especially in places like Marin County, California, where pre-2017 SALT deductions averaged over $30,000. But the cost is steep—potentially $225 billion over 10 years for a $30,000 cap, and far more for $40,000. Critics argue this benefits the top 10% of earners, with 91% of pre-cap benefits going to those making over $100,000. Supporters, however, say it’s not just for the rich—9.4% of taxpayers nationwide claimed SALT in 2022, including middle-class homeowners. The debate also touches on state dynamics: low-tax states like Tennessee see little benefit, while high-tax states clamor for relief.

What’s Next for the SALT Deduction?

As of May 21, 2025, the SALT tax deduction deal hangs in the balance. Johnson’s $40,000 proposal needs approval from the Joint Committee on Taxation and the Congressional Budget Office to confirm costs. If hardliners balk, the bill could stall, jeopardizing Trump’s “big, beautiful bill” that includes tax breaks on tips, overtime, and car loan interest. The SALT Caucus remains steadfast, with members like Rep. Andrew Garbarino emphasizing “fundamental fairness” for their voters. Meanwhile, posts on X reflect public sentiment, with some users decrying the cap as a subsidy for blue states, while others cheer the potential relief. The outcome will shape not just tax policy but the GOP’s unity heading into the next election cycle.

The Human Side of the SALT Debate

Imagine you’re a homeowner in suburban New Jersey, where property taxes alone can hit $15,000 a year. The current $10,000 cap means you’re paying federal taxes on income already taxed locally. A higher cap could save you thousands, easing the squeeze of living in a high-cost area. But for someone in a low-tax state like Florida, the fight feels irrelevant—or worse, like footing the bill for wealthy Northeasterners. This divide drives the passion on both sides, making the SALT deduction more than a policy wonk’s debate. It’s about real people, real money, and real political consequences.

Stay in the Loop on the SALT Deduction

The SALT deduction saga is far from over. Want to know how it’ll affect your taxes or what happens next in Congress? Keep an eye on Capitol Hill updates and check your local tax policies to see how you might benefit. Share your thoughts below—do you think the cap should stay, rise, or vanish? Your voice matters in this heated debate!