The tax filing date 2026 is officially set for April 15, 2026, marking the federal deadline for Americans to submit their 2025 individual income tax returns. As the 2026 tax season moves forward, millions of taxpayers are preparing documents, calculating credits, and planning ahead to avoid penalties or delays.

The Internal Revenue Service began accepting federal returns on January 26, 2026, officially opening this year’s filing season. With the April 15 deadline confirmed, taxpayers now have a clear timeline to follow for filing, requesting extensions, paying taxes owed, and tracking refunds.

Below is a complete breakdown of what’s confirmed for the 2026 federal tax season and how you can stay ahead.

When Is the Federal Tax Deadline in 2026?

The primary federal deadline for individual taxpayers is April 15, 2026. This is the due date to:

- File Form 1040 for the 2025 tax year

- Pay any federal income taxes owed

- Request a filing extension if additional time is needed

April 15 falls on a weekday in 2026, so no automatic date adjustment applies. Taxpayers who miss the deadline without filing or requesting an extension may face late-filing penalties and interest charges on unpaid balances.

IRS Filing Season Opened January 26, 2026

The IRS began accepting and processing federal income tax returns on January 26, 2026. From that date forward, individuals have been able to submit returns electronically using tax software, professional tax preparers, or IRS-supported filing programs.

Early filing is encouraged. Submitting returns sooner can:

- Reduce identity theft risk

- Speed up refund processing

- Prevent last-minute errors

- Avoid system slowdowns near the deadline

Extension Deadline: October 15, 2026

Taxpayers who cannot meet the April 15 deadline may request an automatic six-month extension. This moves the filing deadline to October 15, 2026.

However, it is critical to understand that:

- An extension gives extra time to file paperwork

- It does not provide extra time to pay taxes owed

- Any estimated tax due must still be paid by April 15

Failing to pay by April 15 may result in interest and penalties, even if an extension is approved.

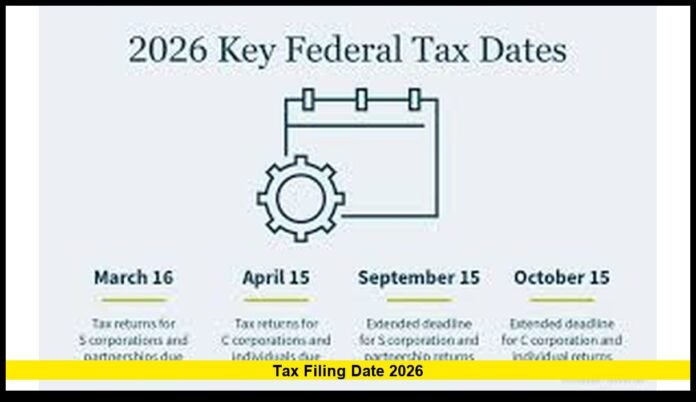

Key Federal Tax Dates for 2026

While April 15 is the central date for individual filers, several other confirmed deadlines apply to businesses and specific taxpayer groups:

- January 26, 2026 – IRS begins accepting individual tax returns

- Early February 2026 – Employers must issue W-2 and certain 1099 forms

- March 16, 2026 – Partnership and S corporation returns due

- April 15, 2026 – Individual, corporate, and trust tax returns due

- June 15, 2026 – Deadline for U.S. citizens living abroad (automatic extension)

- October 15, 2026 – Extended filing deadline for those who requested extensions

Keeping these dates in mind helps both individuals and businesses stay compliant.

Who Is Required to File a Federal Tax Return?

Filing requirements depend on income level, age, and filing status. In general, you must file a federal return if your gross income exceeds the standard deduction for your filing category.

Even if you are not legally required to file, submitting a return may benefit you if:

- Federal taxes were withheld from your paycheck

- You qualify for refundable credits

- You are eligible for the Earned Income Tax Credit

- You qualify for the Child Tax Credit

Many taxpayers leave refunds unclaimed simply because they assume they do not need to file.

What Has Changed for the 2026 Filing Season?

For returns covering the 2025 tax year, several confirmed updates affect taxpayers:

Adjusted Standard Deduction

The standard deduction has increased to reflect inflation adjustments. This may lower taxable income for many households.

Updated Tax Brackets

Income tax brackets have been adjusted upward for inflation, potentially preventing bracket creep for some earners.

Child Tax Credit and Other Credits

Eligibility thresholds and phaseout levels have been adjusted. Taxpayers claiming child-related credits should review updated income limits to determine qualification.

Retirement Contribution Limits

Contribution limits for certain retirement accounts increased for 2025, which may impact deductions claimed on 2026 filings.

These updates affect how much tax you owe or how large your refund may be.

Refund Timing in 2026

Most taxpayers who file electronically and choose direct deposit typically receive refunds within about 21 days after the IRS accepts the return.

Refund timing can vary depending on:

- Accuracy of the return

- Claiming certain credits

- IRS processing volume

- Identity verification requirements

Returns claiming refundable credits such as the Earned Income Tax Credit or Additional Child Tax Credit may experience slightly longer processing times due to mandatory review periods.

Filing early and selecting direct deposit remains the fastest way to receive your refund.

How to Prepare for the tax filing date 2026

Preparation is the best strategy for avoiding stress as April approaches. Consider taking the following steps now:

1. Gather Required Documents

Collect W-2 forms, 1099 statements, mortgage interest statements, investment summaries, and documentation for deductible expenses.

2. Review Last Year’s Return

Comparing your 2024 and 2025 income may help identify changes that impact your 2026 filing.

3. Check Eligibility for Credits

Tax credits can significantly increase refunds. Review qualifications for child-related credits, education credits, and earned income credits.

4. Confirm Banking Information

Direct deposit requires accurate routing and account numbers. Errors can delay refunds.

5. File Electronically

Electronic filing reduces mistakes and speeds processing compared to paper returns.

What Happens If You Miss the Deadline?

Missing the April 15 deadline without filing or requesting an extension can trigger penalties.

There are two primary penalties:

- Failure-to-file penalty

- Failure-to-pay penalty

Interest accrues on unpaid balances until the amount is paid in full. Filing an extension can prevent the failure-to-file penalty, but paying estimated taxes owed remains essential.

Taxpayers facing financial hardship may be eligible for payment plans or installment agreements.

Tips for Self-Employed and Gig Workers

Independent contractors and gig workers must pay close attention to estimated tax requirements. If you earned income without tax withholding during 2025, you may owe additional taxes at filing time.

Self-employed individuals should ensure they have:

- Accurate income records

- Documented business expenses

- Estimated tax payment records

Failure to make quarterly estimated payments can result in underpayment penalties.

Filing for Americans Living Abroad

U.S. citizens residing overseas automatically receive an extension until June 15, 2026, to file their returns. However, any taxes owed remain due by April 15 to avoid interest.

Additional reporting requirements may apply for foreign bank accounts or overseas income.

Why Filing Early Makes Sense

Filing early offers several advantages:

- Faster refunds

- Reduced fraud risk

- More time to fix errors

- Peace of mind

As the April deadline approaches, IRS systems experience heavier traffic. Early submission helps avoid delays.

The Bottom Line on tax filing date 2026

The confirmed tax filing date 2026 is April 15, 2026. With the IRS already accepting returns, now is the time to organize documents, review tax law changes, and file early if possible.

Whether you expect a refund or anticipate a payment due, understanding deadlines and preparing ahead of time can save money and stress.

What are your plans for this tax season? Share your thoughts below and stay tuned for further updates as April approaches.