The landscape of different types of bankruptcies in the United States is shifting quickly as households, small businesses, and major corporations turn to the courts for financial protection. Recent filing patterns show a clear rise in both consumer and business bankruptcies, reflecting ongoing pressure from high debt levels, tighter credit conditions, and rising operating costs across the economy.

From individuals struggling with unsecured debt to well-known companies restructuring billions in obligations, bankruptcy has become a central topic in the national financial conversation. Understanding how these legal options work—and why filings are increasing—offers valuable insight into the current economic climate.

Bankruptcy in the United States: A Legal Overview

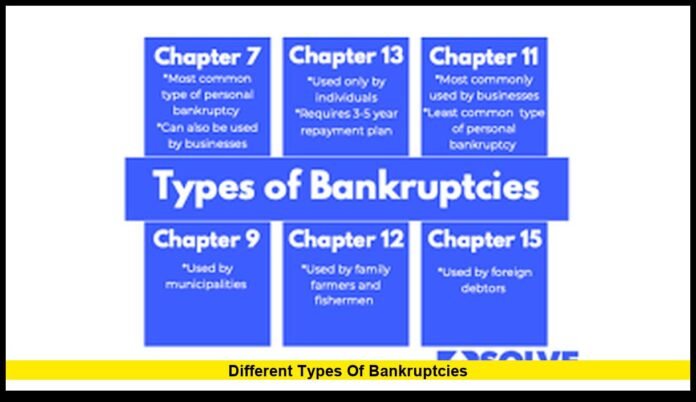

Bankruptcy in the U.S. operates under federal law and provides structured solutions for individuals, businesses, and organizations that can no longer meet their financial obligations. The system is divided into several chapters, each designed for specific circumstances.

These legal pathways do not exist to punish debtors. Instead, they aim to balance relief for those overwhelmed by debt with fair treatment for creditors.

Chapter 7 Bankruptcy: Liquidation for a Fresh Start

Chapter 7 bankruptcy remains the most common form filed by individuals. Often referred to as liquidation bankruptcy, it allows eligible debtors to discharge many unsecured debts after selling certain non-exempt assets.

Key characteristics of Chapter 7 include:

- Typically completed within a few months

- Medical bills, credit card balances, and personal loans may be discharged

- Some assets are protected under exemption laws

- Income limits determine eligibility

For many Americans facing sudden job loss, medical emergencies, or long-term debt accumulation, Chapter 7 offers a legal reset.

Chapter 13 Bankruptcy: Structured Repayment Over Time

Chapter 13 bankruptcy is designed for individuals with regular income who want to reorganize their debts rather than liquidate assets. This option allows filers to create a court-approved repayment plan, usually lasting three to five years.

Common reasons people choose Chapter 13 include:

- Preventing home foreclosure

- Catching up on missed mortgage or car payments

- Managing tax debt or child support arrears

- Protecting valuable property

Unlike Chapter 7, debts are repaid partially or fully over time, making this option attractive to wage earners with steady income.

Chapter 11 Bankruptcy: Corporate Restructuring and Survival

Chapter 11 bankruptcy is most often associated with large businesses, but it can also apply to small companies and high-income individuals. This chapter allows operations to continue while debts are renegotiated under court supervision.

Recent filings show that businesses are increasingly turning to Chapter 11 as they face:

- Rising interest expenses

- Increased labor and supply costs

- Reduced consumer spending

- Heavy debt from past expansions or acquisitions

In many cases, Chapter 11 helps companies preserve jobs, renegotiate leases, and emerge as leaner operations.

Other Bankruptcy Chapters You Should Know

While less common, additional bankruptcy chapters serve specific groups:

- Chapter 9 applies to municipalities such as cities or public districts

- Chapter 12 is reserved for family farmers and fishermen with seasonal income

These specialized chapters reflect how bankruptcy law adapts to unique financial structures across different sectors.

Bankruptcy Filings Are Rising Nationwide

Recent nationwide data shows a steady increase in bankruptcy filings compared to prior years. Consumer filings account for the majority of growth, driven largely by higher credit card balances, medical expenses, and cost-of-living pressures.

Business filings are also trending upward. Although fewer in number than consumer cases, they often involve larger financial stakes and broader economic impact.

This increase suggests that more Americans and businesses are reaching a breaking point after years of financial strain.

Why Are More Americans Filing for Bankruptcy?

Several factors are contributing to the rise in filings across different types of bankruptcies:

Rising Household Debt

Credit card balances and personal loan obligations have grown significantly. As interest rates remain elevated, minimum payments have become harder to manage for many households.

Medical and Emergency Expenses

Unexpected medical costs continue to be a major driver of personal bankruptcy, even for individuals with health insurance.

Business Cost Pressures

Small and mid-sized businesses face higher wages, rent, utilities, and borrowing costs. For some, restructuring through bankruptcy becomes the only path to survival.

Tightened Lending Standards

As lenders grow more cautious, refinancing options shrink. This leaves borrowers with fewer alternatives when cash flow tightens.

High-Profile Business Bankruptcies Draw Attention

Recent months have seen several well-known companies file for Chapter 11 protection. These cases highlight how even established brands can struggle under heavy debt loads and changing consumer behavior.

In many instances, companies continue operating during bankruptcy, paying employees and serving customers while restructuring obligations behind the scenes.

These filings also demonstrate how bankruptcy can function as a strategic financial tool rather than a signal of permanent closure.

How Bankruptcy Affects Credit and Financial Recovery

Filing for bankruptcy does impact credit reports, but it also stops collection actions, lawsuits, and wage garnishments. For many filers, bankruptcy becomes the first step toward rebuilding financial stability.

Key long-term considerations include:

- Credit scores can recover over time with responsible financial behavior

- Bankruptcy remains on credit reports for several years, depending on the chapter

- Many filers qualify for new credit sooner than expected

Financial recovery often begins once unmanageable debt is resolved.

Choosing the Right Bankruptcy Path

Selecting among the different types of bankruptcies depends on income, assets, debt structure, and long-term goals. While Chapter 7 focuses on quick relief, Chapter 13 emphasizes repayment, and Chapter 11 centers on reorganization.

Understanding these differences is critical for individuals and businesses evaluating their financial options in today’s economy.

What This Trend Signals for the U.S. Economy

The rise in bankruptcy filings reflects deeper economic stress but also shows that legal safeguards remain accessible. Bankruptcy courts continue to play a central role in stabilizing finances, preserving jobs, and allowing economic participants to reset and move forward.

As financial pressures evolve, bankruptcy remains a powerful legal mechanism—one that affects not just those who file, but communities, workers, and markets nationwide.

As bankruptcy trends continue to shape the financial landscape, staying informed can make all the difference—share your perspective or check back for the latest developments.