Bankruptcy is one of the most powerful legal tools available to Americans facing overwhelming debt. Yet many people still feel uncertain about what happens if you declare bankruptcy and how it may affect their finances, property, and future. In 2026, with household debt levels remaining high and borrowing costs elevated, bankruptcy continues to play a major role in helping individuals and families regain financial stability.

This article explains what bankruptcy really means today, what changes once you file, how different types of bankruptcy work, and what the long-term effects can be. Everything below reflects current, confirmed rules and practices in the United States.

What Bankruptcy Means Under U.S. Law

Bankruptcy is a legal process governed by federal law that allows people who cannot repay their debts to either eliminate or restructure those obligations. Cases are handled in federal bankruptcy courts, and once a case is filed, the court oversees how debts, assets, and payments are managed.

The moment a bankruptcy petition is filed, most collection activity must stop. This includes creditor phone calls, lawsuits, wage garnishments, and bank levies. This immediate protection is known as the automatic stay and provides breathing room for people under financial pressure.

The Most Common Types of Bankruptcy

Most personal bankruptcy cases fall under two chapters of the Bankruptcy Code.

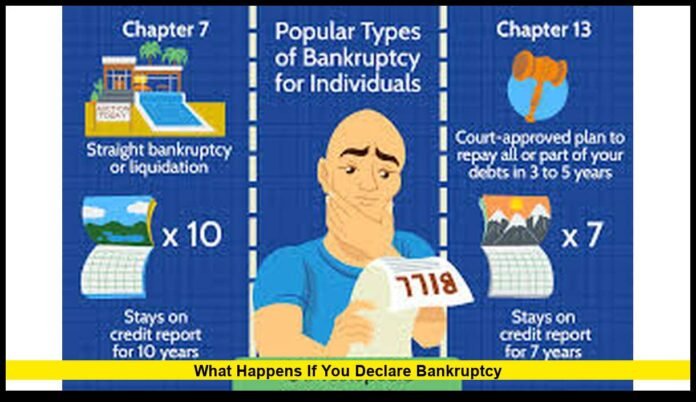

Chapter 7 bankruptcy is often called liquidation bankruptcy. It is designed for people with limited income who cannot realistically repay their debts. In many cases, eligible debts are wiped out within a few months.

Chapter 13 bankruptcy is a repayment-based option. Instead of eliminating debts immediately, the filer enters a court-approved payment plan lasting three to five years. This option is often used by people who have regular income and want to keep valuable assets like a home or car.

Businesses and high-debt individuals sometimes use Chapter 11, but it is far less common for everyday consumers.

What Happens to Your Debts

One of the main reasons people file bankruptcy is to deal with debt they can no longer manage.

Many unsecured debts can be discharged, meaning you are no longer legally required to pay them. These often include credit card balances, medical bills, personal loans, and past-due utility accounts.

Some debts generally survive bankruptcy. These include child support, alimony, most student loans, certain tax debts, and criminal fines. Bankruptcy can pause collection efforts on these obligations, but it does not usually eliminate them.

In Chapter 13 cases, debts are reorganized into a structured repayment plan. Some debts may be reduced, while others are paid in part over time.

What Happens to Your Property

A common fear is that filing bankruptcy means losing everything. In reality, the law includes protections that allow people to keep essential property.

In Chapter 7 cases, a trustee reviews your assets. Property that falls under exemption limits is protected and cannot be taken. These exemptions often cover basic household goods, clothing, tools of the trade, retirement accounts, and a portion of home and vehicle equity. Many Chapter 7 cases are classified as “no-asset” cases, meaning nothing is sold.

Chapter 13 works differently. Instead of selling assets, the filer keeps their property and repays creditors through monthly payments. This option is especially helpful for people who are behind on mortgage or car payments and want time to catch up.

How Bankruptcy Affects Your Credit

Bankruptcy has a significant impact on your credit history. A Chapter 7 filing can remain on your credit report for up to ten years, while a Chapter 13 filing typically stays for up to seven years.

Credit scores usually drop after filing, especially if they were high beforehand. However, many people begin rebuilding credit sooner than expected. Paying bills on time, limiting new debt, and using secured credit responsibly can lead to steady improvement over time.

While bankruptcy makes borrowing more difficult in the short term, it can also remove heavy debt burdens that were damaging credit month after month.

Income, Employment, and Daily Life

Filing bankruptcy does not mean losing your job. Employers generally cannot fire or discipline someone solely for filing bankruptcy. Income earned after filing is usually protected, especially in Chapter 7 cases.

Bankruptcy also does not prevent you from opening bank accounts or receiving income. Many filers continue normal financial activity while their case moves through the court.

Housing and loans may be harder to obtain immediately after bankruptcy, but many landlords and lenders consider applications once a person shows stable income and responsible behavior after filing.

Impact on Joint Debts and Co-Signers

Bankruptcy clears your responsibility for qualifying debts, but it does not automatically protect co-signers. If someone co-signed a loan or credit card with you, the lender can still pursue them for payment after your discharge.

Chapter 13 offers limited protection for co-signers during the repayment period, but once the case ends, any remaining balance may still fall on the co-signer.

Public Record and Privacy

Bankruptcy filings are public records. Basic case information can be accessed by those who know where to look. While this can concern some filers, the reality is that bankruptcy has become a common financial reset used by millions of Americans over time.

Personal safety information is protected, and sensitive identifiers are not displayed in full.

Mandatory Counseling and Legal Steps

Before filing, individuals must complete credit counseling from an approved provider. This requirement ensures filers understand alternatives and eligibility rules.

After filing, a second financial education course is required before debts can be discharged. These steps are mandatory and enforced by the court.

Many people choose to work with bankruptcy attorneys to ensure paperwork is accurate and deadlines are met, especially in cases involving property or complex debt.

How Often Bankruptcy Can Be Filed

The law limits how frequently a person can receive a bankruptcy discharge. For example, a Chapter 7 discharge generally cannot be granted again until several years have passed since a prior Chapter 7 case.

Filing too soon can result in dismissal or reduced protections, making timing an important factor when considering bankruptcy again.

Why Bankruptcy Still Matters in 2026

Economic conditions in 2026 continue to place pressure on households through high interest rates, rising costs, and tighter credit standards. Bankruptcy remains a lawful and structured way to address financial collapse, not a sign of failure.

For many Americans, it offers a chance to stop collection actions, regain control, and rebuild on a more stable foundation.

Understanding what happens if you declare bankruptcy can help you make informed decisions, and we invite you to share your thoughts or stay connected for more updates on this topic.