The federal tax brackets 2026 are officially in place, outlining how individual income will be taxed for the 2026 tax year. These brackets apply to income earned from January through December 2026 and will be used when Americans file their federal tax returns in 2027. Updated income thresholds reflect inflation adjustments under current federal tax law, giving taxpayers clearer expectations for planning, withholding, and year-round financial decisions.

Understanding How Federal Tax Brackets Work

The federal income tax system in the United States is progressive. That structure means income is divided into layers, with each portion taxed at a different rate. Higher earnings do not replace lower rates. Instead, additional income is taxed at higher percentages as it moves through the brackets.

For 2026, there are seven federal income tax brackets. Each one applies only to the income within its specific range. This approach ensures that all taxpayers benefit from lower rates on their initial earnings.

Federal Income Tax Brackets for 2026

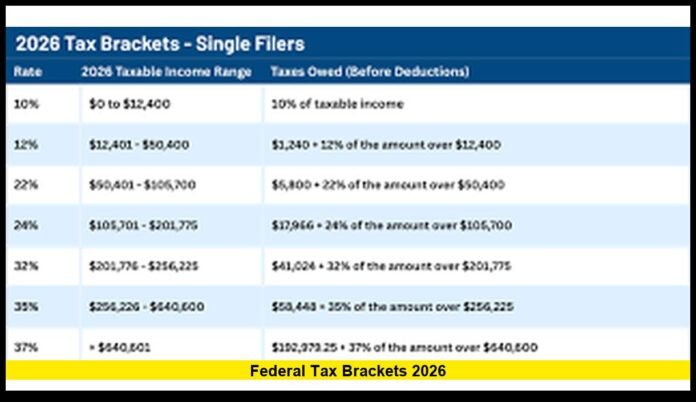

The following table shows the federal income tax brackets for 2026 based on filing status. These thresholds apply to taxable income after deductions are applied.

2026 Federal Income Tax Brackets

| Tax Rate | Single Filers | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 10% | $0 – $12,400 | $0 – $24,800 | $0 – $17,700 |

| 12% | $12,401 – $50,400 | $24,801 – $100,800 | $17,701 – $67,450 |

| 22% | $50,401 – $105,700 | $100,801 – $211,400 | $67,451 – $105,700 |

| 24% | $105,701 – $201,775 | $211,401 – $403,550 | $105,701 – $201,750 |

| 32% | $201,776 – $256,225 | $403,551 – $512,450 | $201,751 – $256,200 |

| 35% | $256,226 – $640,600 | $512,451 – $768,700 | $256,201 – $640,600 |

| 37% | Over $640,600 | Over $768,700 | Over $640,600 |

These limits were adjusted upward to reflect inflation. The goal is to prevent taxpayers from paying higher taxes simply because wages rise alongside living costs.

Why the Federal Tax Brackets 2026 Matter

Tax brackets influence how much of your income is taxed at each rate. Even small changes to income thresholds can affect overall tax liability, especially for households near the top of a bracket.

Several important points stand out for 2026:

- The highest federal income tax rate remains 37%.

- Bracket thresholds increased compared to prior years.

- Inflation adjustments protect real purchasing power.

- More income may stay taxed at lower rates for many filers.

These updates make it easier for taxpayers to estimate their federal taxes more accurately during the year.

Standard Deduction Amounts for the 2026 Tax Year

Tax brackets apply only after deductions are subtracted from gross income. Most taxpayers rely on the standard deduction to reduce taxable income before applying tax rates.

For 2026, standard deduction amounts are:

- $16,100 for single filers

- $32,200 for married couples filing jointly

- $24,150 for head of household filers

Additional standard deduction amounts apply for taxpayers who are age 65 or older or legally blind. These increases further lower taxable income and can shift taxpayers into lower brackets.

Taxable Income Versus Gross Income

Understanding the difference between gross income and taxable income is essential when reviewing federal tax brackets.

- Gross income includes wages, salaries, interest, business income, and other earnings.

- Taxable income is what remains after deductions and adjustments.

Federal tax brackets are applied only to taxable income. This distinction often surprises taxpayers who assume their entire paycheck is taxed at their highest rate.

Marginal Tax Rates Explained Clearly

A common misunderstanding is believing that moving into a higher tax bracket causes all income to be taxed at that higher rate. That is not how the system works.

Here is how it functions:

- Income is taxed in layers.

- Each layer has its own rate.

- Only the portion of income that falls into a higher bracket is taxed at that rate.

For example, a taxpayer whose income enters the 24% bracket still pays 10%, 12%, and 22% on earlier portions of income. This layered approach keeps the effective tax rate lower than the top marginal rate.

Effective Tax Rate and What It Tells You

The effective tax rate represents the average percentage of income paid in federal taxes. It is calculated by dividing total tax owed by taxable income.

Because income is spread across multiple brackets, the effective rate is always lower than the highest marginal rate reached. This measure provides a more accurate picture of a household’s real tax burden.

Filing Status and Its Impact on 2026 Tax Brackets

Filing status determines which income thresholds apply. Choosing the correct status is critical, as each one has different bracket limits and standard deductions.

Common filing statuses include:

- Single

- Married filing jointly

- Married filing separately

- Head of household

Head of household status often provides wider brackets and a higher standard deduction, but eligibility rules are strict. Filing incorrectly can result in delays or adjustments later.

How Inflation Adjustments Affect Tax Planning

Inflation adjustments are built into the federal tax system. They increase bracket thresholds and deductions each year to account for rising prices.

For taxpayers, this means:

- Raises may not automatically increase tax burden.

- More income can remain taxed at lower rates.

- Withholding calculations remain more accurate.

These adjustments play a key role in maintaining fairness across income levels.

Tax Withholding and the 2026 Brackets

Federal income tax is typically withheld from paychecks throughout the year. The amount withheld depends on income, filing status, and information provided on Form W-4.

Taxpayers should consider reviewing withholding if:

- Income has increased or decreased.

- Filing status has changed.

- A second job was added.

- Major life events occurred.

Accurate withholding helps avoid large balances due or unexpected refunds at tax time.

Additional Income and Bracket Awareness

Bonuses, overtime, freelance work, and investment income can affect which federal tax brackets apply. These earnings may push taxable income into a higher marginal range.

Being aware of how extra income fits into the federal tax brackets 2026 allows taxpayers to plan ahead and avoid surprises when filing.

Long-Term Stability in the Federal Tax Structure

Current federal law maintains the existing bracket structure and prevents sudden rate increases that were once scheduled to occur. This stability allows households and businesses to plan with more confidence.

Taxpayers benefit from:

- Predictable tax rates

- Consistent income thresholds

- Ongoing inflation adjustments

- Continued availability of standard deductions

These factors create a more stable tax environment for the 2026 tax year.

Key Points Every Taxpayer Should Remember

- Federal income tax uses seven progressive brackets.

- Income is taxed in layers, not at one flat rate.

- Standard deductions reduce taxable income first.

- Filing status significantly affects outcomes.

- Inflation adjustments protect real income value.

- Marginal and effective rates are not the same.

Understanding these fundamentals helps taxpayers make informed financial choices throughout the year.

Looking Ahead to Filing Season

While filing for the 2026 tax year will not happen until 2027, preparation begins much earlier. Reviewing income trends, deductions, and withholding now can reduce stress later.

Taxpayers who understand how the federal tax brackets apply to their situation are better positioned to manage cash flow, savings, and financial goals.

Staying informed about the federal tax brackets 2026 empowers smarter planning and fewer surprises, so keep checking back for updates and share your thoughts below.