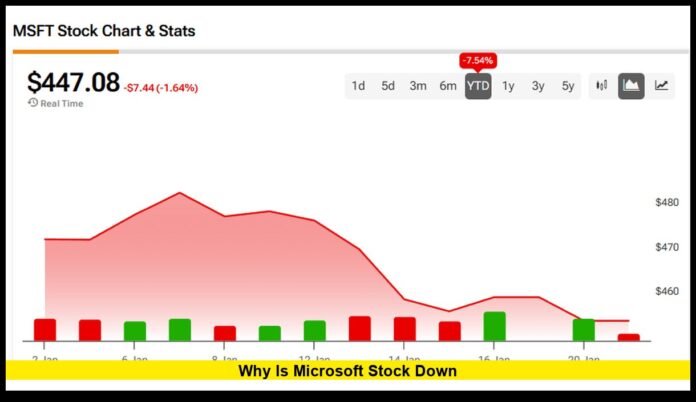

Why is Microsoft stock down today? The question is dominating search trends as U.S. investors react to a sharp pullback in one of the market’s most widely held technology stocks. Despite reporting strong revenue and profit growth, Microsoft shares moved lower after its latest earnings release as Wall Street reassessed cloud momentum, AI spending levels, valuation, and near-term margin trends.

The selloff did not stem from weak financial performance. Instead, it reflects how markets respond when expectations, future growth signals, and capital allocation plans collide. Below is a comprehensive look at the confirmed factors influencing Microsoft’s stock movement and why traders and long-term investors are interpreting the same data in different ways.

Strong Results, Unexpected Market Reaction

Microsoft delivered solid quarterly numbers across its major business segments. Revenue rose at a double-digit pace, earnings exceeded forecasts, and demand for enterprise software, cloud services, and AI tools remained resilient. Commercial bookings stayed healthy, and recurring subscription income continued to climb.

Yet the stock declined shortly after the report and remained under pressure during the following U.S. trading session. This type of reaction often confuses casual observers, but it is common in markets when expectations have already been priced in.

Stocks move on changes in outlook, not simply on whether a company posts good results. In Microsoft’s case, the focus shifted from what the company achieved last quarter to how fast its most important growth engines can expand in the quarters ahead.

Cloud Growth Under the Microscope

Azure, Microsoft’s cloud platform, sits at the center of the company’s valuation. Investors view it as the main driver of future earnings and long-term market leadership. While Azure continued to grow at a strong pace, the rate of expansion eased slightly compared with previous periods.

That small deceleration mattered.

For a business that has consistently posted rapid cloud growth, even a modest slowdown can trigger concern. Institutional investors watch cloud trends closely because:

- Enterprise migration to the cloud fuels long-term revenue visibility.

- Cloud margins support overall profitability.

- Market share gains signal competitive strength.

Although Azure’s growth remained robust, it did not accelerate. Some investors interpreted this as a sign that large corporate customers are becoming more cautious with spending or that competition is intensifying. This reassessment weighed on the stock.

Heavy Investment in Artificial Intelligence

Another major reason Microsoft stock is down involves the scale of its investment in artificial intelligence infrastructure.

Microsoft is committing vast resources to:

- Building and expanding data centers

- Acquiring advanced computing hardware

- Supporting large-scale AI model training

- Upgrading networking and power capacity

These investments position the company as a leader in enterprise AI and cloud-based intelligence services. However, they also require significant upfront capital.

Capital expenditures rose sharply compared with a year earlier. While this spending supports long-term strategy, it reduces near-term free cash flow and places pressure on operating margins. Markets tend to react cautiously when costs rise faster than revenue, even if the spending supports future growth.

Margin Sensitivity and Cost Structure

Microsoft’s operating margins remain among the strongest in the technology sector. Even so, investors are highly sensitive to any signal that profitability could be affected by rising infrastructure and energy costs.

Key cost factors include:

- Data center construction and maintenance

- Semiconductor supply and pricing

- Power consumption for AI workloads

- Depreciation of new equipment

When guidance suggests that expenses may climb in coming quarters, traders often reassess valuation models. This reassessment can lead to temporary share price weakness, particularly in stocks that trade at premium multiples.

Valuation and Market Expectations

Microsoft entered the earnings period near historic highs. The stock had benefited from optimism around AI integration, cloud leadership, and stable enterprise demand. That optimism was already reflected in the share price.

When expectations run high, even good news may not be enough to push a stock higher. Investors ask a simple question: Is the new information better than what was already priced in?

In this case, the answer for many traders was no. Growth remained strong, but it did not significantly exceed forecasts. At the same time, spending plans appeared aggressive. This combination led to a classic market response: profits were taken, and positions were reduced.

Broader Tech Sector Dynamics

Microsoft’s movement also occurred within a broader context. Large-cap technology stocks are sensitive to changes in:

- Interest rate outlook

- Inflation expectations

- Corporate IT budgets

- Investor risk appetite

When rates remain elevated, growth stocks face tighter valuation scrutiny. Future earnings are discounted more heavily, which can pressure share prices even when business fundamentals are solid.

As a bellwether for the technology sector, Microsoft often reflects shifts in sentiment across the entire market. A cautious tone in tech can amplify individual stock reactions.

Institutional Rebalancing and Portfolio Strategy

Large funds regularly adjust their holdings after earnings season. These adjustments are not always driven by negative views on a company. They can reflect:

- Rebalancing to maintain portfolio weightings

- Rotation between growth and value stocks

- Risk management ahead of macroeconomic events

Because Microsoft represents a significant portion of many major indexes and portfolios, even small allocation changes by large institutions can move the stock.

How Traders and Long-Term Investors See It Differently

Short-term traders focus on momentum, growth rates, and near-term margin signals. Long-term investors focus on competitive positioning, cash generation, and strategic leadership.

From a short-term perspective:

- Slower cloud growth can affect near-term sentiment.

- Higher spending can compress margins temporarily.

- Valuation can adjust quickly when expectations shift.

From a long-term perspective:

- Microsoft retains dominant positions in software and cloud.

- AI integration strengthens its ecosystem.

- Recurring revenue provides stability.

- Balance sheet strength supports continued investment.

These two viewpoints can coexist, creating volatility even when the underlying business remains healthy.

What the Price Action Is Signaling

The current pullback suggests that the market is recalibrating its assumptions rather than losing confidence in the company.

Investors are weighing:

- How fast cloud and AI services can grow in a maturing market

- Whether current spending will deliver strong returns

- How sustainable premium valuation levels are in a higher-rate environment

This reassessment explains why the stock can fall even as revenue and profits rise.

The Role of Expectations in Stock Performance

Understanding why is Microsoft stock down requires understanding how expectations shape price movement.

A stock can decline when:

- Results are strong but not strong enough to exceed forecasts

- Guidance suggests rising costs

- Growth rates stabilize after a period of acceleration

- The market shifts toward caution

In Microsoft’s case, none of the key business lines showed weakness. Instead, the growth trajectory and investment profile prompted a more measured outlook from investors.

Long-Term Outlook Versus Short-Term Volatility

Microsoft continues to benefit from:

- A vast installed base of enterprise customers

- Subscription-driven revenue stability

- Leadership in productivity software

- Expanding cloud and AI platforms

These strengths support its long-term prospects. However, the stock market often moves in cycles, reacting to quarterly developments even when the long-term story remains intact.

Short-term volatility does not necessarily reflect a change in competitive position. It reflects changing expectations and shifting risk assessments.

Key Factors Behind the Decline

To summarize, the main forces behind the recent weakness in Microsoft shares include:

- A slight moderation in cloud growth rates

- Elevated capital spending for AI and infrastructure

- Sensitivity to margin outlook

- High valuation levels entering the earnings release

- Profit-taking and portfolio rebalancing

- Broader caution across large-cap technology stocks

Each of these elements contributes to how investors interpret the company’s near-term trajectory.

What Investors Are Watching Next

Going forward, market participants will monitor:

- Trends in enterprise cloud demand

- Progress in monetizing AI services

- Capital spending efficiency

- Operating margin stability

- Overall conditions in the U.S. technology sector

Future earnings reports and guidance will help determine whether the recent pullback represents a temporary reset or the start of a longer consolidation phase.

Final Perspective

So, why is Microsoft stock down despite strong financial performance? Because markets are adjusting expectations around growth pace, investment intensity, and valuation after a period of optimism and rapid price appreciation.

The company remains financially strong and strategically positioned, but investors are reassessing how quickly new investments will translate into higher profits. This reassessment, rather than any fundamental weakness, is what has driven the recent decline.

Stay connected for further updates as market sentiment and corporate results continue to shape Microsoft’s next move.