The 2026 social security earnings limit plays a major role in how much income Americans can earn from work while collecting Social Security benefits before reaching full retirement age. This limit, updated by the Social Security Administration for 2026, sets the income thresholds that determine whether a portion of monthly benefits will be temporarily withheld.

For millions of older workers and early retirees, understanding how this rule works is essential for budgeting, tax planning, and deciding when to claim benefits. The earnings limit affects part-time workers, full-time employees, and self-employed individuals who draw Social Security while remaining in the labor force.

What the 2026 Social Security Earnings Limit Is

In 2026, the earnings test applies only to people who receive Social Security retirement benefits before reaching full retirement age. The limits are divided into three categories based on age and timing:

1. Under Full Retirement Age for the Entire Year

If you are younger than your full retirement age for all of 2026, you can earn up to $24,480 from wages or self-employment without any reduction in benefits.

If your earnings exceed this amount, Social Security withholds $1 in benefits for every $2 earned above the limit.

2. Reaching Full Retirement Age in 2026

If you reach full retirement age during 2026, a higher limit applies for the months before your birthday month. In that case, you may earn up to $65,160 in those months.

If your income goes above that level, Social Security withholds $1 in benefits for every $3 earned over the limit, but only until the month you reach full retirement age.

3. After Full Retirement Age

Once you reach full retirement age, the earnings limit no longer applies. You may earn any amount from work, and your Social Security benefits will not be reduced.

Who Is Affected by the Earnings Limit

The earnings limit mainly impacts:

- People who claimed Social Security at 62 or 63 and are still working

- Individuals between 64 and full retirement age who have part-time or full-time jobs

- Self-employed retirees with ongoing business income

- Workers who plan to transition gradually into retirement

Those who delay claiming benefits until full retirement age or later are not affected by the earnings test at all.

How Benefit Withholding Works

When your income exceeds the 2026 social security earnings limit, Social Security does not permanently take your money. Instead, it withholds part of your monthly checks until the required amount has been recovered.

For example:

- If you are under full retirement age and earn $10,000 over the annual limit, Social Security will withhold $5,000 in benefits during the year.

- If you reach full retirement age in 2026 and exceed the higher limit by $9,000, Social Security will withhold $3,000 before your birthday month.

The agency usually withholds entire monthly checks rather than reducing each payment slightly. Once the withheld amount equals what must be held back under the formula, regular payments resume.

What Happens to Withheld Benefits

A key point many people misunderstand is that withheld benefits are not lost forever.

When you reach full retirement age, Social Security recalculates your benefit and credits you for the months in which payments were withheld. This often results in a higher monthly benefit going forward. Over time, this adjustment helps offset what was held back earlier.

This feature makes the earnings limit a timing issue rather than a lifetime penalty.

Full Retirement Age and Why It Matters

Full retirement age depends on your year of birth:

- For people born in 1960 or later, full retirement age is 67.

- For those born in earlier years, it ranges from 66 to 66 and several months.

Reaching full retirement age is a turning point because:

- The earnings test ends.

- Your benefit is no longer reduced due to work income.

- Delayed retirement credits stop accumulating if you waited beyond full retirement age.

Knowing your exact full retirement age helps you plan when the higher earnings limit applies and when all limits disappear.

Annual vs. Monthly Earnings Rules

The earnings test is based on total annual income, not just monthly pay. This can create surprises for people with uneven earnings.

Examples:

- A person who works heavily in the first half of the year and stops later can still exceed the annual limit and face benefit withholding.

- A seasonal worker may cross the limit during a short high-income period.

- Self-employed individuals must count net earnings, not gross revenue.

In the year you reach full retirement age, only earnings before the month you reach that age count toward the higher limit. Income earned afterward is ignored for earnings-test purposes.

Types of Income That Count

Only income from work is counted toward the 2026 social security earnings limit, including:

- Wages from employment

- Net earnings from self-employment

- Bonuses and commissions tied to work

The following do not count:

- Pensions

- Social Security benefits themselves

- Investment income such as dividends or capital gains

- Withdrawals from retirement accounts

This distinction is important for retirees who rely on a mix of work income and investment income.

How the Earnings Limit Fits Into Broader 2026 Social Security Changes

In addition to the earnings limit, several other Social Security figures for 2026 affect financial planning:

- The taxable wage base for Social Security payroll taxes has risen to $184,500, meaning higher earners pay Social Security tax on a larger portion of income.

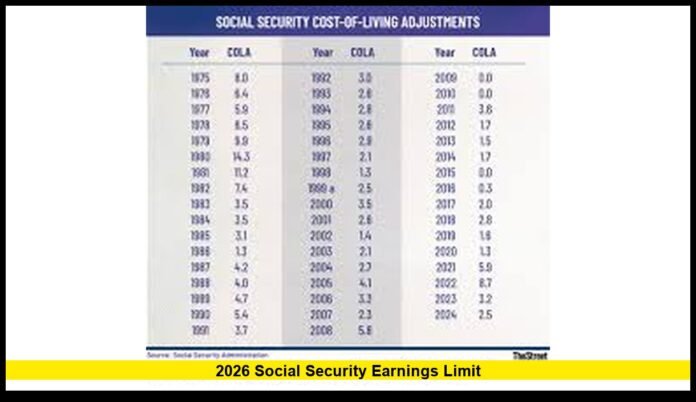

- Monthly benefits have increased due to the 2026 cost-of-living adjustment.

- Maximum retirement benefits at full retirement age are higher for those with long, high-earning work histories.

While these figures do not change the earnings test directly, they shape overall retirement income and tax exposure.

Planning Strategies for Workers Receiving Benefits

To manage the 2026 social security earnings limit effectively, many retirees use careful planning:

Track Income Closely

Keep a running total of wages and self-employment earnings. Even small amounts of overtime or a year-end bonus can push total income over the limit.

Coordinate Claiming Age and Work Plans

Some workers delay claiming benefits until full retirement age to avoid the earnings test entirely, especially if they plan to keep working full-time.

Adjust Work Hours

Reducing hours or shifting work to later in the year can help control annual income.

Report Changes Promptly

Inform Social Security when you expect your earnings to change. This can prevent large withholdings or underpayments that must be corrected later.

Common Misunderstandings

Several myths surround the earnings limit:

- “I lose my benefits forever.”

Withheld benefits are later credited through higher payments after full retirement age. - “All income counts.”

Only work income is included, not investment or retirement account income. - “The limit applies after full retirement age.”

Once full retirement age is reached, there is no earnings limit at all.

Clearing up these misunderstandings helps retirees make confident decisions.

Why the Earnings Limit Still Exists

The earnings test is designed to reflect Social Security’s original role as a replacement for wages after retirement. While the system now supports many people who continue working, the limit remains a way to coordinate early benefit payments with ongoing employment.

Over time, adjustments to the limit have allowed higher earnings before reductions, reflecting changes in wages and living costs.

Looking Ahead

For Americans balancing work and retirement in 2026, the 2026 social security earnings limit is one of the most important numbers to know. It determines whether benefits will be paid in full, partially withheld, or completely unaffected, depending on age and income.

Understanding the thresholds, how withholding works, and how benefits are later adjusted can help workers and retirees make informed choices about when to claim Social Security and how much to work.

Stay informed, plan carefully, and share your perspective on how the 2026 social security earnings limit affects your retirement strategy.