Yahoo Finance too many requests errors are becoming a major concern for traders, developers, analysts, and website operators across the United States. As of January 2026, a growing number of users are encountering access blocks when attempting to pull stock prices, charts, and historical market data from Yahoo Finance through automated tools or high-frequency queries. These blocks typically appear as HTTP 429 responses, signaling that Yahoo’s systems have temporarily restricted access due to request volume or activity patterns.

The issue now affects everything from personal trading dashboards and financial research scripts to commercial websites displaying live quotes. While Yahoo Finance remains one of the most popular free sources of U.S. market information, its infrastructure is enforcing stricter traffic controls to manage demand, protect servers, and regulate automated usage.

The Rise of Rate Limiting on Financial Data Platforms

Financial data consumption has changed dramatically over the past few years. Real-time investing apps, AI-driven trading models, and automated portfolio trackers generate a constant stream of requests to market data providers. Yahoo Finance, long known for its accessible web interface and widely used data endpoints, now faces sustained traffic from millions of users and countless automated systems.

To manage this load, the platform applies request throttling mechanisms. When the volume or frequency of incoming queries exceeds internal thresholds, the system returns a “Too Many Requests” response. This action is not an error in the traditional sense. It is a protective measure designed to ensure service stability and prevent abuse.

What Triggers a “Too Many Requests” Response

The Yahoo Finance too many requests message can appear under several conditions:

- Rapid polling for live prices

- Bulk downloads of historical data

- Multiple parallel requests from the same IP address

- Automated scripts running without delays

- Shared servers making collective high-volume queries

- Repeated page refreshes through bots or scrapers

Unlike formal APIs that publish usage limits, Yahoo Finance does not disclose its request thresholds. This makes it difficult for developers to predict when they will hit a limit. The system evaluates traffic behavior in real time, considering frequency, patterns, and server load.

Why Access Restrictions Are Tighter in 2026

Several structural changes explain the growing visibility of rate-limit blocks this year.

Explosion of Algorithmic Trading Tools

Retail traders increasingly rely on automated strategies. These systems request price updates far more often than human users, placing heavy demand on free data sources.

Growth of Data-Driven Content Platforms

News sites, comparison portals, and investment blogs frequently pull live quotes for tickers, indices, and commodities. Each page view can trigger multiple backend calls.

Security and Abuse Prevention

Modern infrastructure monitors traffic patterns to detect scraping, commercial data harvesting, and denial-of-service risks. Rate limiting acts as a first line of defense.

Infrastructure Cost Management

Delivering real-time financial data at scale is expensive. Limiting uncontrolled automated access helps control operational load and ensures fair distribution of resources.

How Long Do the Blocks Last

When the system issues a 429 response, access is not permanently revoked. The duration varies based on usage behavior:

- Light overuse may trigger short cooldown periods

- Repeated bursts can extend blocking windows

- Continuous high-frequency access can lead to longer temporary restrictions

- In extreme cases, entire IP ranges may be limited for extended periods

The absence of fixed public rules means users must rely on observation and adaptive throttling to maintain access.

Impact on Traders and Analysts

For active market participants, even brief data interruptions can cause problems:

- Delayed price updates during volatile sessions

- Incomplete intraday charts

- Failed technical indicator calculations

- Interrupted automated trade execution

- Gaps in historical backtesting datasets

When price feeds stall, decision-making quality suffers. This is particularly critical during earnings announcements, economic releases, and high-volatility trading hours in U.S. markets.

Challenges for Website Owners

Websites that embed Yahoo Finance data face their own risks:

- Broken quote widgets

- Empty stock tables

- Inaccurate market snapshots

- Slow page loading due to failed data calls

- Loss of user trust when numbers stop updating

The Yahoo Finance too many requests limitation can appear suddenly, even on sites with moderate traffic, if background scripts query multiple tickers at once.

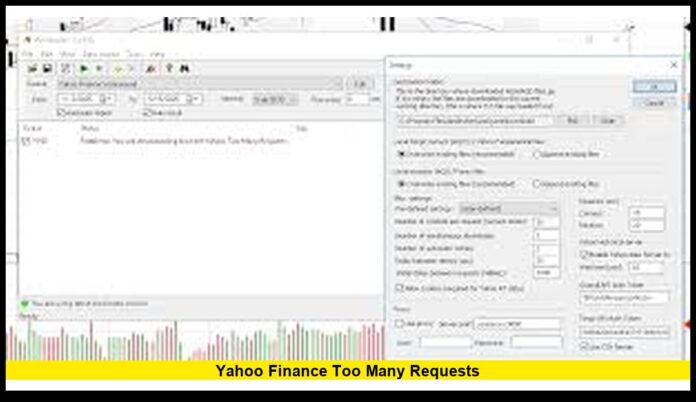

How Automated Tools Are Affected

Popular financial libraries and custom scripts often simulate browser requests to retrieve data. When these tools scale up, they can trigger detection systems that classify the traffic as excessive. Common problems include:

- Authentication tokens expiring after repeated use

- Session data being invalidated

- Request headers flagged as non-human

- Connection throttling during peak market hours

Without built-in throttling and caching, even well-designed tools can encounter frequent access blocks.

Managing Request Volume More Effectively

While Yahoo does not publish official limits, several practical strategies help reduce the likelihood of triggering rate controls.

Introduce Smart Delays

Spacing out requests by even a few seconds can significantly reduce detection risk.

Batch Data Intelligently

Request groups of symbols in structured intervals instead of all at once.

Cache Frequently Used Data

Store recent prices locally and refresh them only when necessary.

Reduce Refresh Frequency

Updating quotes every minute instead of every second dramatically lowers request volume.

Monitor Error Patterns

Tracking when 429 responses appear allows systems to automatically slow down and recover.

Real-Time Data vs. Reliability

Free market data platforms offer accessibility but not guaranteed uptime for automated workloads. The trade-off becomes clear in 2026:

| Feature | Free Web Access | Controlled Data Feeds |

|---|---|---|

| Cost | No direct fee | Subscription required |

| Rate Limits | Dynamic and undisclosed | Clearly defined |

| Stability | Variable | High |

| Commercial Use | Restricted | Licensed |

| Support | None | Professional |

For casual investors, brief interruptions may be tolerable. For trading platforms and financial publishers, predictable access is often essential.

Legal and Usage Policy Considerations

Yahoo Finance’s terms of use restrict large-scale automated extraction and commercial redistribution of its data. Rate limiting serves as a technical method of enforcing these policies. While manual browsing remains unrestricted, sustained programmatic access at scale can violate usage conditions and lead to throttling or temporary blocks.

The Yahoo Finance too many requests response is therefore not only a technical signal but also a policy boundary.

Effects on Historical Data Research

Researchers downloading years of price history can face interruptions mid-process. Large datasets require thousands of individual requests, increasing the chance of hitting traffic limits. Without adaptive pacing, long backfills often fail before completion.

This creates challenges for:

- Academic finance studies

- Quantitative strategy development

- Risk modeling

- Long-term volatility analysis

- Portfolio optimization research

Consistent access becomes harder as dataset size and query frequency increase.

The Role of IP Address and Network Environment

Rate limiting often operates at the network level. Shared environments are more vulnerable:

- Cloud servers hosting multiple applications

- University networks with many concurrent users

- Corporate VPNs routing traffic through common gateways

- Data centers running parallel scripts

In such cases, even moderate individual usage can collectively exceed thresholds.

Current Situation in Early 2026

As of January 2026, the following conditions are confirmed:

- HTTP 429 responses continue to appear during automated access attempts.

- Both real-time and historical data endpoints are affected.

- No public rate-limit documentation has been released.

- Restrictions vary by time of day, traffic load, and access pattern.

- The behavior is consistent across U.S. and international users.

There is no indication that these controls will be relaxed. On the contrary, traffic growth suggests enforcement may become even more sophisticated.

Preparing for a Tighter Data Environment

For anyone building tools, websites, or trading systems that rely on Yahoo Finance, preparation is essential:

- Design systems to handle temporary data gaps

- Implement retry logic with exponential backoff

- Add secondary data sources as fallbacks

- Log and analyze throttling events

- Avoid unnecessary background polling

Resilient architecture reduces the impact of unpredictable access limits.

Looking Forward

The Yahoo Finance too many requests issue reflects a broader shift in how large platforms manage public data access. As demand for real-time financial information continues to surge, infrastructure protection and policy enforcement will play a larger role in shaping what users can access freely.

For investors, developers, and publishers in the U.S., understanding and adapting to these limits is no longer optional. It is part of operating in a high-volume, data-driven financial ecosystem.

Have you encountered rate-limit blocks while accessing Yahoo Finance data? Share your experience and stay connected for future updates on this evolving situation.