What is the inheritance tax in California is a question many U.S. families ask when planning estates or receiving assets after the loss of a loved one. As of January 2026, California does not impose a state inheritance tax on property, money, or investments passed to heirs. This means beneficiaries are not required to pay a special California tax simply for receiving an inheritance, regardless of the size of the estate or their relationship to the person who passed away.

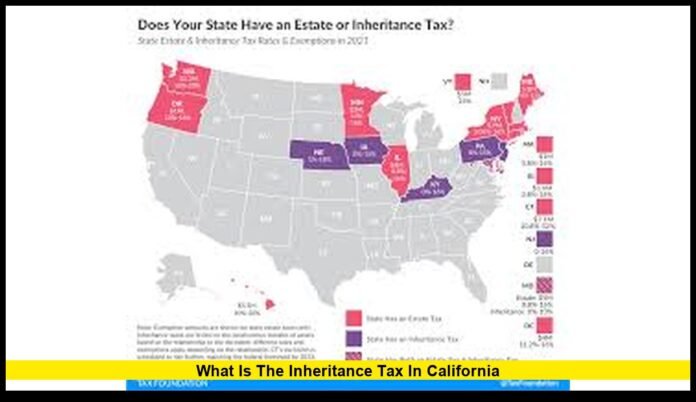

This clear position places California among the majority of states that no longer tax inheritances at the state level. While the absence of an inheritance tax simplifies many situations, it does not remove all tax responsibilities. Federal estate tax rules, income tax on certain inherited assets, and property tax reassessment laws can still affect what heirs ultimately receive and pay over time.

Understanding the current legal framework is essential for families who want accurate, up-to-date information and realistic expectations when managing estates or planning future wealth transfers.

No State Inheritance Tax in California

California continues to have no inheritance tax in 2026. An inheritance tax is a tax imposed on the person who receives assets from a deceased individual. Some states apply different tax rates depending on whether the heir is a spouse, child, or distant relative. California does not follow this model.

If you inherit cash, real estate, retirement accounts, stocks, or personal property from someone who lived in California, the state does not charge a tax based solely on the act of inheriting. This applies to both residents and non-residents who receive assets from a California estate.

The lack of a state inheritance tax means:

- Heirs do not file a California inheritance tax return.

- No state percentage is deducted from inherited assets.

- The relationship between the deceased and the beneficiary does not affect state tax liability.

This policy has remained stable for years and continues unchanged as of January 2026.

Difference Between Inheritance Tax and Estate Tax

Many people use the terms inheritance tax and estate tax interchangeably, but they refer to different types of taxation.

Inheritance tax is paid by the beneficiary after receiving assets. The amount often depends on the heir’s relationship to the deceased and the value of the inheritance.

Estate tax is paid by the estate itself before assets are distributed. The executor calculates the total value of the estate, applies exemptions and deductions, and pays any tax owed from estate funds.

California has neither a state inheritance tax nor a state estate tax. This means the state does not tax wealth transfers at death, either at the estate level or at the beneficiary level.

However, federal estate tax law still applies to very large estates, regardless of the state in which the person lived.

Federal Estate Tax Rules in 2026

While California does not tax inheritances, the federal government may tax large estates. As of January 2026, the federal estate tax exemption is set at $15 million per individual and $30 million for married couples who use portability.

If an estate’s total value is below these thresholds, no federal estate tax is owed. If the estate exceeds these limits, the portion above the exemption may be taxed at rates that can reach 40 percent.

Federal estate tax is paid by the estate, not by the heirs directly. The executor or personal representative files the necessary tax return and pays any tax due before distributing assets to beneficiaries.

For most families, the federal exemption is high enough that no estate tax applies. Still, high-value estates must plan carefully to account for potential federal tax liability, even though California itself imposes none.

Income Tax on Inherited Assets

Although inheriting assets is not taxable income under California or federal law, certain types of inherited property can generate taxable income after transfer.

Examples include:

- Rental income from inherited real estate

- Dividends from inherited stocks

- Interest from inherited savings or bonds

- Required distributions from inherited retirement accounts

This income is taxed under normal income tax rules. The inheritance itself is not taxed, but earnings produced by inherited assets are.

Beneficiaries should also understand cost basis rules. Many inherited assets receive a step-up in basis to their fair market value at the time of death. This can reduce capital gains tax if the asset is later sold, which is an important planning consideration.

Property Taxes and Inherited Real Estate

California does not impose an inheritance tax, but property tax laws can affect heirs who receive real estate.

Current rules allow certain transfers between parents and children or between spouses to avoid full reassessment under specific conditions. However, not all inherited property qualifies for these exclusions, and in some cases the assessed value may be adjusted to current market levels.

This can result in higher annual property tax bills for heirs, even though no inheritance tax is owed at the time of transfer. These property tax changes are separate from inheritance tax and should be considered when evaluating the long-term cost of keeping inherited real estate.

Inheriting Assets from Other States

California’s lack of inheritance tax does not override the laws of other states. If a person inherits property located in a state that does impose an inheritance tax, that state’s tax rules may apply.

For example, if a California resident inherits real estate or other assets from an estate based in a state with an inheritance tax, the beneficiary may be required to file tax forms and pay tax in that state.

This situation is most common when families own vacation homes, rental properties, or business interests in multiple states. Each state’s laws must be reviewed independently.

Why California Does Not Tax Inheritances

California eliminated its inheritance and estate taxes decades ago and has not reintroduced them. The state’s revenue system relies primarily on income taxes, sales taxes, and property taxes rather than transfer taxes at death.

The absence of an inheritance tax reflects policy decisions aimed at avoiding double taxation, encouraging investment, and simplifying estate administration. It also makes California more attractive to retirees and high-net-worth individuals who are sensitive to estate planning considerations.

As of January 2026, there are no enacted laws that would reintroduce a state inheritance tax, and no active statewide inheritance tax structure exists.

Estate Planning Without a State Inheritance Tax

Even without a California inheritance tax, proper estate planning remains essential. A well-designed plan ensures assets are transferred efficiently, legally, and according to the individual’s wishes.

Key planning considerations include:

Wills and Trusts

A valid will or trust controls how assets are distributed and can reduce delays and disputes. Trusts may also help avoid probate and provide ongoing management for beneficiaries.

Federal Tax Strategy

High-value estates should consider strategies to reduce potential federal estate tax exposure, including lifetime gifting, charitable planning, and trust structures.

Beneficiary Designations

Retirement accounts and life insurance policies pass by beneficiary designation, not by will. Keeping these updated is critical.

Property Ownership Structure

How property is titled can affect transfer speed, tax treatment, and creditor protection.

Family Circumstances

Blended families, minor children, special-needs beneficiaries, and business owners often require customized planning approaches.

Practical Example

Consider a California resident who passes away in 2026 with an estate valued at $4 million, including a primary residence, investment accounts, and retirement savings.

- No California inheritance tax applies.

- No California estate tax applies.

- No federal estate tax applies because the value is below the federal exemption.

- Heirs receive their shares without state tax on the transfer itself.

- Future income from inherited investments is taxable as normal income.

- If real estate is retained, property tax rules determine future tax assessments.

This example shows how the absence of a state inheritance tax simplifies the transfer process but does not eliminate all tax considerations.

Long-Term Outlook

The answer to what is the inheritance tax in California remains consistent and clear in 2026: there is none at the state level. Beneficiaries do not pay California tax on what they inherit, and estates do not owe a separate state estate tax.

However, federal estate tax law, income taxation of inherited assets, and property tax rules continue to shape the real financial outcome for heirs. Staying informed and planning ahead helps families protect wealth and avoid unexpected complications.

California’s approach offers simplicity, but thoughtful preparation is still the key to a smooth and efficient transfer of assets across generations.