Social Security work credits determine who qualifies for retirement, disability, survivors, and Medicare benefits, and in 2025 they remain one of the most important yet misunderstood parts of the U.S. Social Security system. Every worker who earns income covered by Social Security taxes accumulates these credits over time, and without enough of them, access to benefits is not possible, regardless of age, need, or income history.

For millions of Americans, Social Security benefits form a critical layer of long-term financial stability. Work credits act as the gateway to that protection. Understanding how they are earned, tracked, and applied is essential for workers at every stage of life, from first-time employees to those approaching retirement.

What Social Security Work Credits Really Represent

Social Security work credits are not a measure of wealth, success, or total earnings. Instead, they represent participation in the U.S. workforce under the Social Security system. Each credit reflects a portion of taxable work activity, showing that a worker has contributed to the system that later provides benefits.

Credits are recorded permanently on an individual’s Social Security record. Once earned, they do not disappear due to job changes, career breaks, economic downturns, or personal circumstances. This permanence is intentional. The system is designed to recognize long-term work effort rather than continuous employment without interruption.

Work credits are used solely to determine eligibility. They do not increase benefit amounts, influence retirement age, or affect cost-of-living adjustments. Their role is binary: either you qualify, or you do not.

How Social Security Work Credits Are Earned in 2025

In 2025, Social Security work credits are earned based on annual earnings from jobs or self-employment that are subject to Social Security taxes. The Social Security Administration sets a specific dollar amount required to earn one credit, and this amount is adjusted each year to reflect national wage trends.

For the current year:

- One work credit is earned for every $1,810 in covered earnings.

- Workers can earn a maximum of four credits per year.

- Earning $7,240 in a year results in the full four credits.

These credits can be earned at any point during the year. A worker could earn all four credits in a single month if their earnings meet the threshold, or gradually across the year through part-time or seasonal work.

Covered earnings include wages from employment and net income from self-employment. Income from investments, rental properties, gifts, or most benefits does not count toward work credits.

Why the Annual Limit Is Four Credits

The four-credit annual limit ensures that Social Security eligibility is based on time spent in the workforce rather than income level. This structure protects lower-income workers and ensures fairness across different types of employment.

Without this limit, high earners could qualify for lifetime benefits after only a short period of work. By capping credits annually, the system emphasizes consistency and long-term participation.

This design also supports workers with interrupted careers, including parents, caregivers, military members, and those affected by illness or economic disruption.

Retirement Benefits and Social Security Work Credits

To qualify for Social Security retirement benefits, most workers need 40 work credits. This typically equals about ten years of work at the annual maximum credit level.

Once a worker reaches 40 credits:

- Retirement eligibility is permanently secured.

- Credits never need to be re-earned.

- Benefits can be claimed as early as age 62.

While eligibility is fixed at 40 credits, benefit amounts vary widely. Monthly payments depend on lifetime earnings, adjusted for inflation, and the age at which benefits are claimed.

Workers who earn fewer than 40 credits cannot receive retirement benefits based on their own record, though they may still qualify through a spouse.

Social Security Work Credits and Disability Coverage

Disability benefits rely on work credits differently than retirement benefits. Eligibility is based on both the total number of credits earned and how recently they were earned before disability begins.

Disability Credit Requirements by Age

- Before age 24:

Workers may qualify with as few as six credits earned in the three years prior to disability. - Ages 24 to 31:

Eligibility usually requires credits equal to half the time between age 21 and the onset of disability. - Age 31 and older:

Most workers need at least 20 credits earned in the ten years immediately before disability, with total credit requirements increasing with age.

This structure balances protection for younger workers with the expectation that older workers maintain recent workforce participation.

Survivors Benefits and Work Credits

Work credits also determine whether surviving family members can receive benefits after a worker’s death. The number of required credits depends on the worker’s age at the time of death.

In many cases:

- Younger workers need fewer credits.

- A minimum level of work may still qualify survivors.

- Benefits may be available to spouses, children, or dependent parents.

Survivors benefits play a vital role in family financial stability, especially when a primary earner dies unexpectedly.

Medicare Eligibility and Social Security Work Credits

Work credits are closely tied to Medicare eligibility. To qualify for premium-free Medicare Part A, most people need 40 work credits by age 65.

If a worker has fewer than 40 credits:

- Medicare Part A is still available.

- Monthly premiums apply.

- Premiums decrease as more credits are earned.

Spouses can often qualify based on a partner’s work record, even if they have limited or no personal work history.

How Self-Employed Workers Earn Credits

Self-employed individuals earn Social Security work credits through net income, not gross revenue. After business expenses are deducted, net earnings are used to calculate credits.

Important considerations for self-employed workers include:

- Paying Social Security taxes is essential for credit eligibility.

- Accurate tax reporting ensures credits are recorded correctly.

- Even modest net income can earn credits if it meets annual thresholds.

Self-employment offers flexibility but requires careful financial planning to maintain eligibility.

Part-Time, Seasonal, and Gig Workers

Part-time and gig workers can earn the same number of credits as full-time employees. Earnings from multiple jobs can be combined to meet annual thresholds.

This applies to:

- Freelancers

- App-based drivers

- Contract workers

- Seasonal employees

As long as earnings are properly reported and taxed, credits accumulate normally.

Do Social Security Work Credits Ever Expire?

Work credits earned for retirement and Medicare never expire. Once earned, they remain on a worker’s record for life.

However, disability benefits include recent work requirements. Older credits may not count if too much time has passed since the worker last worked. This distinction is critical for workers with long employment gaps.

Common Misconceptions About Social Security Work Credits

More Credits Increase Monthly Benefits

Credits only determine eligibility. Benefit amounts depend on lifetime earnings.

Credits Reset Over Time

They do not reset. Credits accumulate permanently.

Only Full-Time Workers Qualify

Part-time and self-employed workers qualify if earnings meet thresholds.

Credits Equal Years Worked

Credits are based on earnings, not calendar years or hours worked.

How to Track Your Work Credits

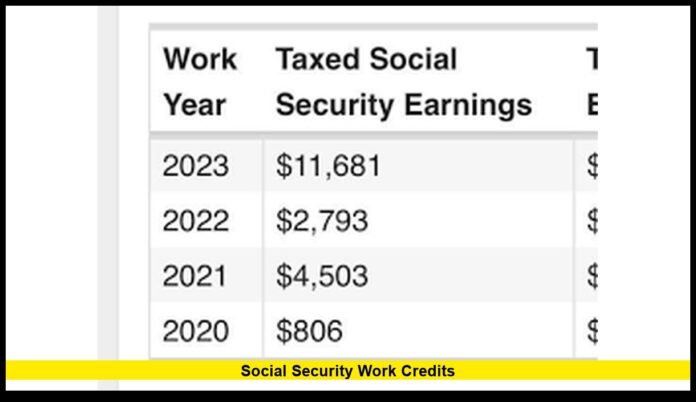

Workers can review their Social Security earnings record to see:

- Total credits earned

- Annual earnings history

- Estimated future benefits

Regular review helps identify errors early and ensures eligibility goals are met.

Why Work Credits Matter in Today’s Workforce

Modern careers are less linear than in the past. Job changes, remote work, and gig employment make tracking work credits more important than ever.

Credits protect access to:

- Retirement income

- Disability protection

- Family survivor benefits

- Health coverage through Medicare

Missing even a few credits can delay or prevent eligibility.

Planning Strategies Using Work Credits

Understanding your credit status allows you to:

- Decide when to retire

- Protect disability eligibility

- Plan spousal benefits

- Avoid gaps late in life

In some cases, working even one additional year can secure lifelong benefits.

What Changes Each Year and What Does Not

What remains constant:

- Maximum of four credits per year

- Credits never expire for retirement

- Eligibility thresholds remain fixed

What changes:

- Earnings required per credit

- Wage indexing formulas

- Cost-of-living adjustments

These updates keep the system aligned with economic conditions.

The Long-Term Importance of Social Security Work Credits

Work credits may seem simple, but they unlock benefits that provide income, healthcare, and family protection for decades. Without enough credits, even high earners may find themselves ineligible.

For younger workers, awareness prevents future gaps. For older workers, monitoring credits avoids last-minute surprises.

Final Thoughts on Social Security Work Credits

Social Security work credits are the foundation of benefit eligibility in the United States. They reflect participation, contribution, and commitment to the workforce. Understanding how they work empowers individuals to protect their financial future.

Knowing where you stand with your Social Security work credits today can shape your security tomorrow—share your perspective or questions below and stay engaged as policies continue to evolve.