A retirement plan specifically designed for self-employed individuals provides one of the most effective ways to grow wealth while preparing for the future. In 2025, this type of plan continues to be an essential tool for freelancers, consultants, and small business owners seeking to maximize their retirement savings. With flexible contribution options, higher annual limits, and a range of investment choices, it remains one of the most versatile retirement solutions available for independent professionals.

The structure of this plan allows participants to contribute both as an employee and as an employer, enabling aggressive retirement growth. It offers unique advantages for individuals without employees beyond themselves or a spouse, creating a framework where contributions can be substantial while maintaining tax efficiency. Over the past year, many self-employed professionals have taken steps to leverage these plans as part of a broader financial strategy, balancing business earnings with long-term wealth accumulation.

What This Retirement Plan Offers

This type of retirement account provides a combination of features that appeal to independent professionals. It allows dual contributions, where participants can make personal deferrals while also contributing as the business owner. The account can include traditional pre-tax contributions that reduce taxable income for the current year, as well as after-tax contributions that grow tax-free and may be withdrawn without tax liability in retirement.

The flexibility extends beyond contributions. Participants have access to a wide range of investment options, including stocks, mutual funds, bonds, and ETFs, allowing for diversified portfolio construction. Because these plans are tailored to individuals without employees, they offer simplified administration while still providing powerful tax and savings benefits.

Eligibility Requirements

Eligibility is straightforward. Independent professionals, sole proprietors, LLC owners, and small corporations without employees beyond the owner or the spouse can participate. The spouse may also be included if compensated by the business, enabling additional contributions to increase household retirement savings.

This structure ensures that self-employed professionals maintain control over the account while maximizing allowable contributions. Businesses with employees beyond the owner or spouse typically require other types of retirement plans, as this plan is specifically designed for owner-only situations. This limitation helps participants focus on savings without navigating the complexities of broader employer obligations.

Contribution Limits and Strategies

One of the most appealing aspects of this retirement option is the high contribution ceiling. Participants in 2025 can make personal deferrals up to $23,500, with an additional catch-up contribution of $7,500 for those aged 50 and above. These limits are higher than those found in many other retirement vehicles and provide an opportunity to significantly accelerate savings.

Employer contributions further enhance retirement potential. Participants can contribute up to 25% of compensation as a profit-sharing component. When combined with personal deferrals, total contributions can reach $70,000 in a single year. This dual structure enables participants to take full advantage of years with higher income, strategically increasing retirement savings while also optimizing tax benefits.

Tax Advantages and Considerations

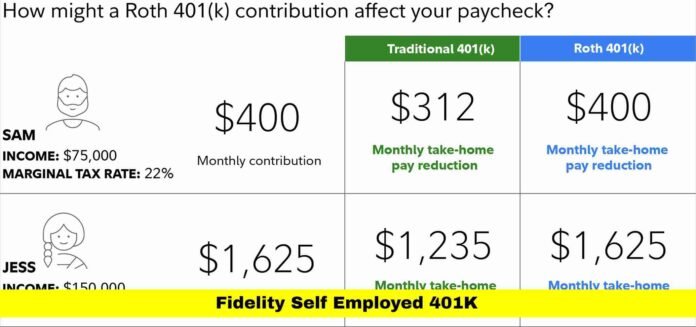

The tax advantages associated with this type of plan are substantial. Traditional contributions reduce taxable income, providing immediate tax relief and easing the burden during high-income years. Roth contributions, made after-tax, grow tax-free, allowing for tax-free withdrawals in retirement under qualified conditions.

Deciding the mix between traditional and Roth contributions depends on individual circumstances, including current income, anticipated retirement tax rates, and long-term goals. Proper planning allows independent professionals to balance immediate tax savings with future tax-free income, creating a versatile strategy to manage both current finances and future retirement needs effectively.

Setting Up the Plan

Establishing this retirement plan involves completing an adoption agreement and defining rules for participation, contributions, and administration. Many financial institutions provide tools to simplify the process, allowing participants to set up accounts online efficiently.

Once the plan is established, individuals can designate contribution types, select investments, and determine administrative procedures. Proper setup ensures compliance with tax rules and maximizes savings potential. Maintaining accurate records and adhering to plan guidelines is essential for smooth operation and avoiding administrative complications in the future.

Investment Options and Portfolio Management

After the plan is established, participants can choose from an array of investment options to build a diversified portfolio. Stocks, mutual funds, bonds, and ETFs offer flexibility to align with risk tolerance, financial goals, and retirement timeline.

Active management and periodic portfolio review are essential to ensure investments continue to meet long-term objectives. Rebalancing and monitoring market trends can help maintain desired allocation and growth potential. This control over investments allows participants to customize strategies to their unique financial situation while leveraging the advantages of a high-contribution retirement account.

Timing Contributions and Deadlines

Employee contributions typically must be made by the business tax filing deadline, including extensions. Employer profit-sharing contributions also follow this schedule, allowing participants to plan contributions based on income variability.

This flexibility is particularly valuable for self-employed individuals whose earnings may fluctuate from year to year. By timing contributions strategically, participants can maximize savings in profitable years and maintain compliance with contribution limits, ensuring optimal growth and tax efficiency.

Withdrawals and Retirement Distributions

Withdrawals generally follow standard retirement account rules. Early withdrawals before age 59½ may be subject to penalties and taxation. Required minimum distributions typically begin at age 73, though Roth contributions may qualify for tax-free withdrawals if holding requirements are met.

Understanding these rules is essential for effective retirement planning. Roth contributions, in particular, provide an opportunity to access tax-free funds during retirement, creating flexibility in managing income and expenses later in life. Planning withdrawals in advance ensures that participants can minimize penalties and tax exposure while maintaining financial security.

Record-Keeping and Compliance

Maintaining accurate documentation is critical. Plan administrators must retain adoption agreements, contribution records, investment selections, and any amendments. Proper record-keeping supports compliance with tax regulations and ensures readiness for potential audits or reporting requirements.

As plan assets grow, additional IRS filings may become necessary, including forms reporting contributions and plan activity. Attention to record-keeping details ensures smooth operation and protects participants from potential penalties or administrative challenges.

Comparison with Other Retirement Options

Compared to other retirement plans like SEP IRAs or SIMPLE IRAs, this account offers higher contribution limits and greater flexibility. Participants can maximize savings through dual contributions while maintaining control over investment selection and timing.

Roth options further enhance versatility, allowing for both tax-deferred and tax-free growth within a single plan. The ability to integrate this account with other retirement savings vehicles makes it a key component of a comprehensive financial strategy for independent professionals.

Maximizing the Benefits

To make the most of this retirement plan, participants should assess income, tax situation, and retirement goals annually. Strategic contributions, combined with thoughtful investment management, can significantly enhance long-term growth.

Regular reviews of contribution levels, investment performance, and plan rules help ensure that participants are on track to meet retirement objectives. Careful planning allows self-employed individuals to optimize savings while minimizing taxes and creating financial security for the future.

Strategic Planning for Long-Term Growth

Integrating this retirement account into a broader financial plan enhances its effectiveness. Independent professionals should consider potential income fluctuations, expected expenses in retirement, and additional savings vehicles.

By aligning contributions with long-term goals and market opportunities, participants can build a diversified and resilient retirement strategy. Combining this account with other investments, IRAs, and personal savings ensures a balanced approach to financial security and wealth accumulation.

Common Mistakes to Avoid

Many participants overlook critical aspects such as timely contributions, accurate record-keeping, and periodic portfolio adjustments. Failing to monitor investments or exceeding contribution limits can result in penalties or lost growth opportunities.

Being proactive in managing the account, reviewing annual limits, and updating investments ensures that the retirement plan remains effective. Understanding rules for withdrawals, catch-up contributions, and Roth options also helps prevent mistakes that could negatively impact long-term savings.

Future Outlook and Trends

In 2025, self-employed retirement accounts continue to evolve. New legislation and plan enhancements provide additional options for contributions, tax strategies, and investment flexibility. Independent professionals increasingly recognize the importance of leveraging these plans to build wealth and achieve retirement security.

By staying informed about regulatory changes and financial planning strategies, participants can maximize benefits and adapt to changing circumstances. The ongoing popularity of this plan reflects its effectiveness and versatility for self-employed Americans seeking a reliable path to retirement.

Independent professionals can take control of their retirement by leveraging high-contribution accounts and strategic investments. How are you planning your savings to achieve long-term security? Share your experiences and strategies below.