In today’s credit-driven world, a good credit score unlocks a treasure trove of financial benefits. Lower interest rates, easier loan approvals, and even better rental agreements all hinge on a strong credit history. But what if your credit score isn’t quite where you’d like it to be? You might be scouring the internet for ways to improve it quickly, and chances are you’ve stumbled upon Experian Boost reviews.

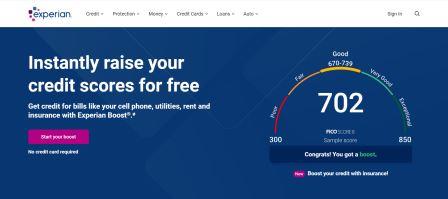

Experian Boost, a free service offered by the credit bureau Experian, has generated a lot of buzz. It promises to potentially raise your FICO® Score 8 by considering your on-time utility, phone, and certain streaming service bill payments. This has sparked a wave of online discussions, with users seeking Experian Boost reviews to understand its effectiveness.

This comprehensive blog delves into the world of Experian Boost in 2024. We’ll explore its features, user experiences gleaned from reviews, and its potential impact on your credit score. Additionally, we’ll address some frequently asked questions (FAQs) you might encounter on platforms like Google, Quora, and Reddit.

What is Experian Boost?

Experian Boost is a free tool that allows you to add your on-time payments for utilities, phone services, and some streaming subscriptions to your Experian credit report. Traditionally, these bills haven’t been factored into your credit score, even though paying them on time demonstrates responsible financial behavior. Experian Boost aims to bridge this gap by considering your positive payment history for these bills, potentially giving your credit score a boost.

Experian Boost Reviews: A Spectrum of User Experiences

Experian boost reviews paint a diverse picture. Let’s explore some common themes users share:

Positive Experiences: Many users have positive experiences with Experian Boost, reporting significant credit score increases ranging from 10 to 30 points. These users often had limited credit history or were actively rebuilding their credit score. Experian Boost helped them add valuable positive payment information to their reports, leading to a noticeable improvement.

Limited Impact: Some users report no change or a minimal increase in their score. This could be due to factors like already having a good credit history with a high score or having late payments on the linked accounts (Experian Boost only considers on-time payments).

Experian Boost Reviews: Complaints and Concerns

While positive reviews exist, some users express concerns in Experian Boost reviews. Here are some common complaints:

- Limited Reach: A frequent concern is that the score increase only reflects on your Experian report. Many lenders use FICO scores from different bureaus (Experian, Equifax, and TransUnion) to make credit decisions.

- Uncertain Long-Term Impact: Some users are unsure if the score increase from Experian Boost is temporary or long-lasting.

Does Experian Boost Work? Evaluating its Potential

Experian Boost can be a valuable tool in specific situations:

- Limited Credit History: If you’re new to credit or have a thin credit file with little information, Experian Boost can be extremely helpful. By adding positive payment data for utilities and phone bills, it can significantly strengthen your credit report and potentially boost your score.

- Quick Score Boost: If you’re aiming for a quick credit score increase before a loan application, Experian Boost might provide a temporary bump, especially if your on-time payments for linked accounts are consistent. However, it’s important to remember that this might not be reflected in your overall FICO score used by all lenders (discussed later).

Some key considerations when evaluating Experian Boost’s effectiveness

- Not Guaranteed: Experian Boost doesn’t guarantee a credit score increase. The impact depends on your individual credit profile. Factors like your existing credit history, credit utilization ratio, and outstanding debt all play a role in determining the potential score change.

- Limited Reach: While Experian Boost can improve your Experian credit report, it might not be reflected in your overall FICO score. Many lenders use FICO scores from different bureaus (Experian, Equifax, and TransUnion) to make credit decisions. While Experian might consider the information added by Boost, other bureaus might not.

Bottom Line

Experian Boost offers a potential avenue for improving your credit score, especially if you have a limited credit history or are seeking a quick score increase. Users report varied experiences, with some seeing significant boosts while others notice minimal changes. However, it’s essential to recognize that the impact of Experian Boost may be limited as it only affects your Experian credit report and not necessarily your overall FICO score used by all lenders. While it can be a helpful tool in certain situations, it’s not a guaranteed solution, and its long-term impact remains uncertain.

Some Important Point/ Frequently Asked Questions on Various Online Platforms Like Google, Quora, Reddit and others

To provide a more comprehensive understanding of Experian Boost, we’ve compiled a list of important points and frequently asked questions (FAQs) from various online platforms, along with concise answers.

Q: Is Experian Boost really free to use?

A: Yes, Experian Boost is completely free to use and does not require any paid membership or subscription.

Q: How long does it take for the boost to reflect on my credit report?

A: The boost is applied instantly to your Experian credit report and score once you’ve connected your accounts and selected eligible payments.

Q: Will Experian Boost impact my credit scores from TransUnion and Equifax?

A: No, Experian Boost only affects your Experian credit report and score, not the reports from the other two major bureaus.

Q: Can I remove the boost from my Experian credit report if I change my mind?

A: Yes, you can remove the boost at any time by disconnecting your bank accounts from the Experian Boost tool.

Q: Is it safe to share my bank account information with Experian?

A: Experian claims to use read-only access and adhere to strict security protocols, but some users remain concerned about data privacy.

Q: Will using Experian Boost result in hard inquiries on my credit report?

A: No, using Experian Boost does not result in any hard inquiries or negatively impact your credit score.

Q: Is Experian Boost beneficial for those with already good credit scores?

A: Users with already good or excellent credit scores may not see much benefit from using Experian Boost.