Why filing for bankruptcy is bad is a question more Americans are asking as debt levels rise and financial decisions carry lasting consequences. While bankruptcy can provide legal relief from certain obligations, its impact reaches far beyond the courtroom. Credit damage, limited opportunities, asset risks, and public disclosure often follow individuals for years, making recovery slower and more difficult than many expect.

Bankruptcy and How It Works in the United States

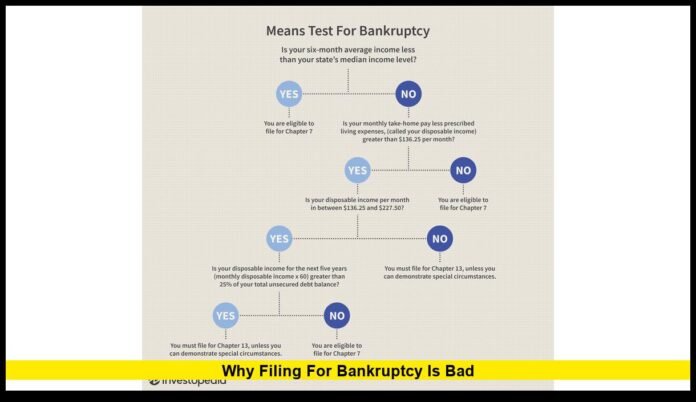

Bankruptcy is a federal legal process created to help individuals who cannot repay their debts. Most personal filings fall under Chapter 7 or Chapter 13.

Chapter 7 allows for the discharge of qualifying unsecured debts but may require selling non-exempt assets. Chapter 13 places the filer under a court-supervised repayment plan that typically lasts three to five years. Both options involve strict rules, ongoing oversight, and permanent records.

Once filed, bankruptcy becomes part of the public court system. This status does not disappear when the case ends.

Credit Damage That Lasts for Years

One of the most significant reasons why filing for bankruptcy is bad is the impact on credit history. Bankruptcy is among the most harmful entries that can appear on a U.S. credit report.

A Chapter 7 filing can remain visible for up to ten years. A Chapter 13 filing can remain for up to seven years. Credit scores often drop sharply and recover slowly, even with responsible financial behavior afterward.

During this period, many individuals face:

- Reduced access to credit

- Higher interest rates

- Lower borrowing limits

These factors increase the cost of borrowing and reduce financial flexibility.

Limited Loan and Financing Options

After bankruptcy, lenders often treat applicants as high risk. Many traditional banks decline applications automatically.

Those who do qualify for loans may encounter:

- Higher down payment requirements

- Shorter repayment terms

- Increased fees

Auto loans and credit cards are often offered only with elevated interest rates. Mortgage approvals usually require long waiting periods and strict conditions, delaying major life goals.

Housing Barriers for Renters and Buyers

Housing access frequently becomes more challenging after bankruptcy. Many landlords review credit reports as part of tenant screening.

A bankruptcy record can lead to:

- Rental application denials

- Higher security deposits

- Requests for co-signers

In competitive rental markets, applicants with bankruptcy histories are often passed over.

For homebuyers, approval standards are tighter. Even when eligible, borrowers may pay higher rates, increasing the total cost of ownership.

Employment and Career Setbacks

While federal law restricts some forms of discrimination, bankruptcy can still influence hiring and promotion decisions. Many employers conduct credit checks, particularly for roles involving finances or sensitive responsibilities.

A bankruptcy filing may raise concerns about financial judgment. This can affect:

- Hiring decisions

- Career advancement

- Professional credibility

Certain professional licenses and government positions also require financial disclosures, which may result in additional review.

Asset Loss Risks

Asset protection depends on state exemption laws, but Chapter 7 bankruptcy often involves liquidation. While essential property is usually protected, limits apply.

Assets commonly at risk include:

- Vehicles with high equity

- Savings above exemption thresholds

- Investment accounts not legally shielded

Once sold, these assets cannot be recovered. Losing savings or property can weaken long-term financial stability.

Chapter 13 avoids liquidation but requires consistent payments. Failure to meet payment terms can cause the case to be dismissed, leaving debts unresolved.

Bankruptcy Does Not Clear All Debts

Many people assume bankruptcy eliminates all financial obligations. This is incorrect.

Debts that usually remain include:

- Most student loans

- Recent tax obligations

- Child support and alimony

- Court-ordered fines

As a result, some filers exit bankruptcy still facing significant payments.

Increased Everyday Expenses

After bankruptcy, basic living costs often rise. Many service providers use credit-based evaluations to determine pricing.

Common effects include:

- Higher auto and renter insurance premiums

- Utility deposits for new service

- Prepaid or limited mobile phone plans

These increased expenses strain monthly budgets during financial recovery.

Public Records and Loss of Privacy

Bankruptcy filings are public court records. Anyone can legally access them.

This visibility affects:

- Personal privacy

- Business relationships

- Financial reputation

Even after credit reports no longer show the filing, court records remain accessible.

Emotional and Psychological Effects

The financial impact of bankruptcy is often accompanied by emotional strain. Many individuals report:

- Persistent stress

- Feelings of embarrassment

- Family tension

Court appearances, trustee meetings, and strict reporting rules can increase anxiety. Recovery involves emotional resilience as well as financial discipline.

Restrictions on Future Filings

Bankruptcy is not a reusable solution. Federal law limits how often individuals can receive discharges.

A Chapter 7 discharge prevents another Chapter 7 discharge for eight years. Filing too early can eliminate a safety option later in life.

This restriction makes timing a critical factor.

Long-Term Financial Opportunity Loss

The effects of bankruptcy extend beyond immediate debt relief. A filing can influence decisions made by lenders, insurers, and business partners for years.

Entrepreneurs may struggle to secure funding. Investors may hesitate to collaborate. These barriers slow wealth-building and long-term planning.

Alternatives That Cause Less Damage

Many Americans manage debt without filing bankruptcy. These approaches depend on income, debt type, and personal discipline.

Common alternatives include:

- Structured repayment plans

- Direct negotiations with creditors

- Credit counseling programs

- Temporary hardship solutions

These options avoid public records and long-term credit harm while preserving greater control over assets.

Why Filing for Bankruptcy Is Bad as an Early Decision

Bankruptcy exists to provide legal relief, but it is intended as a last resort. The combined impact on credit, housing, employment, assets, and privacy creates lasting consequences.

For many households, these outcomes outweigh the short-term relief. Exploring all other options first can prevent irreversible setbacks.

Final Takeaway for American Consumers

Debt relief should support long-term stability, not undermine it. Bankruptcy can stop collection actions, but the financial and personal costs often follow for years.

Understanding these realities allows consumers to make informed decisions during difficult times.

Have you experienced these challenges or found other ways to regain financial control? Share your perspective below and stay connected for more practical money guidance.