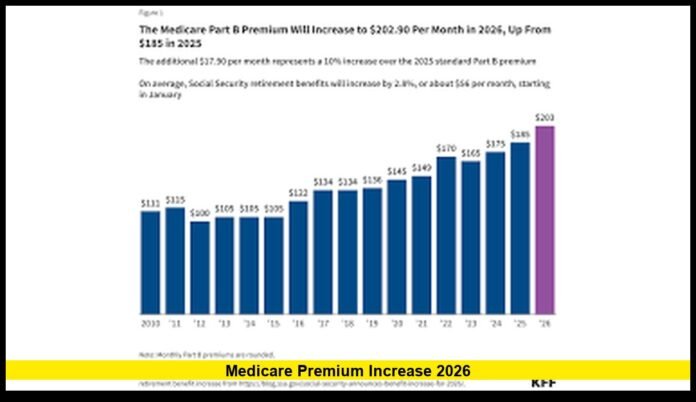

The Medicare premium increase 2026 has become one of the most significant financial updates affecting older Americans, as the confirmed Part B premium will rise to $202.90 per month. This shift represents an important turning point for millions who rely on Medicare for their healthcare needs, and it comes at a time when everyday expenses are already stretching household budgets. With healthcare costs rising across the country, the new premium amount is shaping how seniors plan for the upcoming year.

This article explores the reasons behind the increase, the exact financial changes for 2026, and how these adjustments may influence retirement planning, healthcare decisions, and income management for U.S. beneficiaries.

Why the 2026 Premium Increase Matters

A premium change might appear small for those viewing it only in monthly terms. Yet the increase pushes Medicare Part B above the $200 mark for the first time, establishing a new cost baseline for future years. For many seniors, especially those on fixed incomes, any rise in medical expenses can disrupt their monthly budgeting.

Healthcare inflation, medical labor shortages, and rising outpatient service use all contribute to higher Medicare costs. With Americans living longer and relying more heavily on medical care, Medicare’s financial demands continue to grow. The 2026 premium reflects that reality.

How the Part B Premium Will Change

The confirmed premium of $202.90 is a $17.90 increase over the previous year. While this amount may not seem overwhelming at first glance, many seniors feel increases more strongly because premiums are deducted directly from Social Security benefits. When a premium rises, the take-home amount shrinks.

Part B covers services such as:

- Doctor visits

- Outpatient procedures

- Preventive screenings

- Lab testing

- Medical equipment

- Select therapies

Because these services are among the most commonly used by Medicare beneficiaries, even a modest premium increase affects most enrollees.

The Deductible Increase and Its Impact

The 2026 annual Part B deductible will rise to $283, which is $26 higher than the year before. This means beneficiaries must pay more out of pocket before Medicare covers Part B services.

For seniors with chronic conditions requiring frequent care, an increased deductible can influence how they schedule appointments, manage treatments, or budget for early-year medical costs. While some individuals meet the deductible quickly, others may spread those costs over several months.

Part A Cost Adjustments for 2026

Medicare Part A, which covers inpatient hospital stays, skilled nursing care, and some home health services, also sees annual updates. The 2026 inpatient hospital deductible will rise to $1,736, which is $60 higher than the previous year.

Because hospital stays can be costly, even a small deductible change matters. Seniors who undergo planned surgeries, extended inpatient care, or unexpected hospitalizations must prepare for higher out-of-pocket totals.

Financial Pressure on Social Security Recipients

Most Medicare beneficiaries have their Part B premiums automatically deducted from their monthly Social Security payments. This direct link between the two programs means that any premium increase reduces the net income that retirees receive.

Even when Social Security increases through cost-of-living adjustments, higher Medicare premiums can absorb much of that gain. For people who depend heavily on Social Security—often those without pensions or sizable retirement savings—the reduction in take-home funds can influence daily spending decisions.

This pressure is especially noticeable among older Americans who already face rising costs for groceries, rent, medications, and utilities.

Higher-Income Beneficiaries and IRMAA

The Income-Related Monthly Adjustment Amount, known as IRMAA, adds an additional charge for those whose incomes exceed certain thresholds. In 2026, these adjustments will rise as well, meaning higher-income beneficiaries will pay more for their Medicare coverage.

IRMAA uses tax returns from two years prior, so income reported in 2024 determines the surcharge for 2026. This structure means:

- Extra withdrawals from retirement accounts

- Capital gains

- Large one-time income events

- Investment income

can all affect future Medicare costs.

For those in the higher tiers, combined premiums can exceed $600 per month. Managing income strategically becomes essential for individuals who want to avoid moving into a higher IRMAA bracket.

Why Healthcare Inflation Is Driving Costs Up

Healthcare in the United States continues to grow more expensive. Factors influencing this trend include:

- Rising wages for medical professionals

- Increased use of advanced medical technology

- Growth in outpatient procedures

- Higher demand from an aging population

- Increased costs for medical supplies and equipment

Medicare reflects these broader trends. When system-wide costs rise, premiums, deductibles, and coinsurance amounts must rise as well.

The Medicare premium increase 2026 highlights a larger national issue: medical expenses are escalating faster than many seniors’ incomes.

The Growing Demand for Outpatient Care

Part B covers outpatient care, and its rising usage is one of the primary forces behind the premium update. As technology improves, many procedures that once required inpatient care now take place in outpatient centers. These settings often provide less expensive and more efficient care, but they also increase the volume of services billed under Part B.

Older adults are also receiving more preventive screenings and ongoing treatments than previous generations. While these services improve long-term health outcomes, they also increase Medicare spending.

Long-Term Planning for Rising Healthcare Expenses

Seniors and their families are adjusting to an environment in which healthcare costs rise each year. The 2026 premium increase presents an opportunity to reassess financial strategies.

Ways beneficiaries can plan ahead include:

Reviewing Medicare Advantage and Medigap options:

Different plans offer different premiums, deductibles, and supplemental benefits. Some may reduce out-of-pocket costs for certain individuals.

Evaluating prescription drug coverage:

Although Part D is separate from Part B, changes in one area can influence decisions in another.

Adjusting household budgets:

Understanding early in the year how the new premium affects income can help seniors plan for routine and unexpected expenses.

Tracking healthcare usage:

Some beneficiaries evaluate whether all recurring appointments are necessary or whether certain services can be combined to save on transportation or time.

How the Increase Affects Family Caregivers

Many American families play a major role in the daily lives of aging parents or relatives. The increase in Medicare premiums and deductibles not only impacts seniors but also places additional responsibility on caregivers who often help with:

- Budgeting

- Medical appointments

- Insurance decisions

- Prescription management

Higher costs may lead some families to explore community resources, supplemental coverage, or home-based care options to better manage their loved one’s needs.

Looking Ahead: What This Means for the Future

The rising premium marks a clear trend in the Medicare landscape. As the baby boomer population continues entering retirement, the financial demands on Medicare grow. With more than 10,000 Americans turning 65 each day, enrollment increases place long-term pressure on the program.

Many healthcare analysts expect ongoing adjustments to premiums and deductibles in the years ahead. While the exact numbers cannot be predicted, the overall direction is clear: beneficiaries must prepare for continued changes in the cost structure of Medicare.

Understanding these shifts early helps seniors make informed decisions about retirement planning, savings strategies, and insurance coverage.

A New Reality for American Seniors

Crossing the $200 premium threshold is more than a financial update—it represents a new era in how seniors must approach Medicare. The costs tied to healthcare will likely remain a core part of retirement planning, influencing everything from investment decisions to housing choices.

For many, the Medicare premium increase 2026 is a reminder of the importance of staying informed and adapting to new financial conditions. With thoughtful planning, beneficiaries can navigate these changes while maintaining financial stability and access to care.

How will the Medicare premium increase 2026 influence your financial plans or daily budget? Share your thoughts below and contribute to the discussion.