The conversation around home financing has intensified as mortgage interest rates today reflect new market reactions to the latest economic developments, shaping how Americans approach buying homes, refinancing existing loans, and planning long-term financial strategies. With shifting indicators, evolving demand, and a central bank focused on balancing stability and growth, borrowers now face a housing landscape that requires more awareness, preparation, and timing than ever.

A New Phase in the Economic Cycle

The national economy is moving through a complex phase marked by cooling inflation, measured job growth, and policy decisions aimed at preventing either runaway inflation or unnecessary economic slowdown. These transitions have created a borrowing environment that is neither restrictive nor historically low. Instead, it sits in a middle zone where rates react quickly to economic data, market sentiment, and bond movements.

The current period stands out from past cycles because of multiple competing forces. Inflation has decelerated but remains a concern. Employment remains strong yet shows signs of gradual softening. Consumer demand is steady, though more sensitive to rate changes than in previous years. Taken together, these elements make rate fluctuations more dynamic than predictable.

As a result, mortgage applicants are operating in conditions shaped by both opportunity and uncertainty, requiring a deeper understanding of what drives the cost of borrowing today.

Why Mortgage Rates Look the Way They Do Right Now

Mortgage rates are influenced by a blend of economic factors, each pushing or pulling rates in different directions. While many people assume that rate decisions by the central bank dictate mortgage pricing, long-term home loans are more closely tied to broader financial markets.

The primary forces shaping rates include:

1. Long-Term Treasury Yields

The 10-year Treasury yield remains the most influential benchmark for mortgage pricing. When investors anticipate slower economic growth or express caution, they often seek the relative safety of long-term government bonds. This increased demand lowers yields, often driving mortgage rates down. Conversely, optimistic economic sentiment tends to push yields — and mortgage rates — higher.

2. Inflation Progress and Expectations

Inflation continues to be a major variable. When inflation trends downward, lenders face less risk that the value of long-term repayments will erode, allowing them to offer lower interest rates. If inflation shows signs of heating up again, lenders tend to raise rates quickly to protect themselves from future uncertainty.

3. Housing Market Conditions

Demand for homes remains steady, but buyers today are far more sensitive to rate changes. Even a small fluctuation can determine whether a household qualifies for a loan or meets monthly budget targets. This sensitivity adds volatility to the market because lenders adjust their rates to stay competitive in an environment where consumers react immediately.

4. Investor Confidence and Global Factors

Global economic shifts, geopolitical developments, and fluctuations in financial markets all influence the mortgage rate environment. A global slowdown, for example, often pulls U.S. yields lower as investors seek reliable U.S. government debt, indirectly affecting mortgage pricing.

Together, these forces have made today’s mortgage environment more fluid than in many prior years, requiring borrowers to stay attentive to rate movements and market indicators.

Current Mortgage Rate Levels and What They Mean for Borrowers

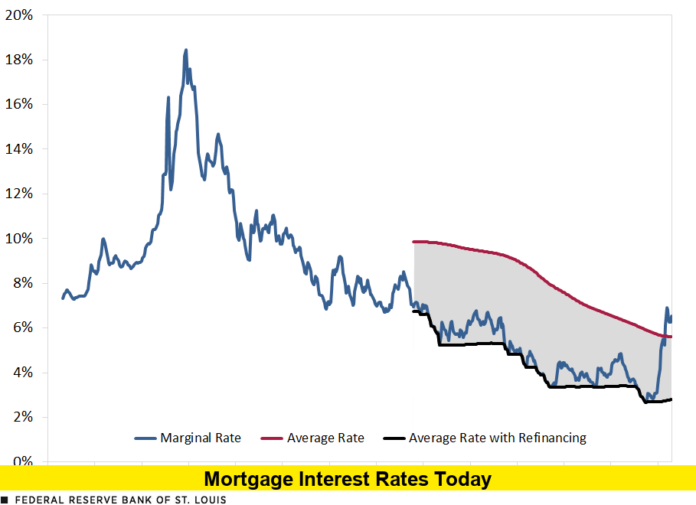

Recent averages show 30-year fixed mortgage rates hovering slightly above 6%, while 15-year fixed loans remain below that threshold. Although these rates are notably higher than the historic lows seen earlier in the decade, they are also lower than the peaks reached when inflation surged and borrowing costs spiked in response.

For buyers, this creates a mixed environment:

- Rates are not at crisis levels, keeping homeownership within reach for many households.

- Monthly payments remain meaningful, requiring thoughtful budgeting and realistic expectations.

- Market competition has cooled from its peak, offering more negotiating room on home prices and contingencies.

For homeowners considering refinancing, today’s rates are most appealing to those who locked in loans during a period of higher volatility. Even a small rate reduction can translate into substantial long-term savings if the borrower plans to remain in the home.

The key is assessing the break-even timeline — the point at which savings exceed the cost of refinancing — and ensuring it aligns with future plans.

How Lender Practices Are Evolving in the Current Climate

Lenders are adapting to a market where borrowing activity has cooled from record highs. With fewer applicants, competition among lenders has intensified, driving changes that borrowers should notice:

More Customized Offers

Rather than offering generic terms, lenders are increasingly tailoring products to individual financial profiles. Strong credit scores, robust employment histories, and moderate debt loads often result in noticeably better rates.

More Flexibility With Points and Fees

Borrowers may find more options for buying points, adjusting closing costs, or negotiating promotional incentives. These opportunities can help borrowers secure a lower long-term payment or reduce initial expenses.

Enhanced Preapproval Value

A strong preapproval now carries more weight in the housing market, as sellers favor buyers who demonstrate financial readiness. This also positions borrowers to lock favorable terms more quickly when the right home appears.

Understanding these trends allows borrowers to approach lenders with greater confidence and clearer expectations.

What Buyers Should Prioritize in Today’s Market

Buying a home in the current climate requires a balance of patience, preparation, and strategic timing. Key priorities include:

1. Strengthening Credit Quality

A higher credit score consistently yields better mortgage terms. Borrowers with strong credit often see lower rates, reduced fees, and more flexible loan options.

2. Building a Strong Down Payment

Increasing the down payment can reduce monthly costs, eliminate private mortgage insurance, and improve lender confidence. Even a small increase can shift loan terms significantly.

3. Monitoring Rate Swings Daily

Mortgage rates can change quickly. Borrowers who track daily movements have a distinct advantage, which could help them lock a rate during a temporary dip.

4. Exploring Multiple Lenders

No two lenders price loans the same way. Comparing offers often reveals savings that are not obvious at first glance.

5. Considering Loan Type Flexibility

While the 30-year fixed loan remains the most popular option, today’s environment has made adjustable-rate mortgages and shorter-term loans more appealing to certain borrowers. Each offers unique advantages depending on financial goals and timeline.

How Sellers Are Adjusting Their Strategies

The shift in mortgage rates has also changed seller behavior. Sellers are increasingly willing to offer concessions, including:

- Closing cost assistance

- Price reductions

- Temporary rate buydowns

- Repair credits

- Flexible closing schedules

These incentives help counterbalance the effect of higher borrowing costs, making homebuying more accessible and giving buyers opportunities they may not have had when the market was more competitive.

Future Outlook: What Could Influence Rates in the Months Ahead

Predicting mortgage rates is inherently complex, but several influential threads will guide the path ahead.

Economic Data Releases

Employment numbers, consumer spending, and wage growth will all shape rate expectations. Slower economic momentum tends to place downward pressure on rates.

Trends in Inflation

Continued progress on inflation is essential for lower borrowing costs. If inflation drifts back toward the central bank’s preferred range, lenders gain confidence in offering lower long-term rates.

Movements in Treasury Yields

Since yields mirror investor sentiment about economic health, any shift in confidence — positive or negative — will likely move mortgage rates in tandem.

Consumer Demand in the Housing Market

Seasonal trends, affordability concerns, and shifts in migration patterns will help determine how aggressively lenders compete for new business.

Lender Capacity and Competition

When application volumes decline, lenders often adjust pricing to attract more clients. This dynamic can put downward pressure on rates even when broader economic indicators remain steady.

Through these factors, the market could see gradual softening in borrowing costs or continued moderate fluctuations depending on how economic conditions evolve.

Why This Moment Matters for Borrowers

Borrowers are navigating a housing market that is transitioning from rapid swings to steadier patterns. This environment rewards preparation, patience, and informed decision-making.

The keyword mortgage interest rates today is more than a search term; it reflects the reality of a market defined by nuance and opportunity. Those who understand the forces at play — and who plan their finances with intention — are positioned to make more confident decisions about buying, refinancing, or waiting for the right moment.

Final Thoughts: A Market Built on Awareness and Timing

Today’s mortgage environment is neither restrictive nor especially forgiving. It demands attention, strategic planning, and an understanding of how broader economic forces influence personal financial decisions. Mortgage rates may not shift dramatically overnight, but informed borrowers who adapt to the current landscape can still secure favorable outcomes.

Share your perspective below and tell us how today’s rate environment is shaping your plans for buying or refinancing a home.