The student loans save plan is undergoing one of the most significant transitions in modern federal loan policy after officials confirmed that new enrollments have stopped and millions of current users will soon be moved into different repayment programs. The change has drawn nationwide attention because the plan had become a central tool for borrowers seeking lower monthly payments, predictable interest handling, and more accessible forgiveness timelines. With this new direction, borrowers face a period of adjustment that will shape repayment strategies for years to come.

The announcement immediately halted incoming applications, closed the door for pending submissions, and set in motion a step-by-step transition process for the millions already using the program. This shift signals a clear departure from recent years, when the federal government expanded repayment flexibility and introduced new tools designed to stabilize loan balances and protect low-income borrowers. Now, the focus has turned toward restructuring and guiding borrowers into earlier repayment models.

A Sudden Halt to New Enrollment

One of the most defining parts of this update is the complete stop to new registrations. Borrowers who attempted to apply shortly before the change, but whose forms had not yet been processed, will not be added to the program. Those who were still researching whether SAVE was the right fit no longer have the option to choose it.

Officials have stated that the pause is not temporary. Instead, the plan is entering a wind-down phase in which all activity is aimed at redirecting users elsewhere. The result is a sweeping operational shift that loan servicers and borrowers must navigate at the same time.

Millions who previously viewed SAVE as a long-term repayment anchor now face uncertainty about their payment levels, interest management, and eligibility for eventual forgiveness. These changes require borrowers to actively review their financial situations rather than assuming their current settings will continue unchanged.

How Current Borrowers Will Be Transitioned

Transitioning out of a program used by millions is a complex undertaking. Federal agencies are preparing a structured timeline to move borrowers into other repayment models, primarily existing income-driven plans or standard repayment schedules.

Borrowers should expect:

- Notifications outlining their next available repayment options

- Details on when their accounts will officially switch

- Information comparing estimated payments under new structures

- Updated timelines for loan payoff or forgiveness

- At least one opportunity to choose an alternate plan before an automatic assignment

Current users will be guided through online account messages, mailed letters, and servicer outreach. Although these updates may roll out at different times depending on the servicer and borrower status, federal officials have emphasized that every borrower will receive direct instructions.

This transition will not happen instantly; it will unfold in stages as systems update repayment categories and recalibrate each borrower’s income details. However, the effect will eventually reach every SAVE participant.

Why the Change Matters for Monthly Bills

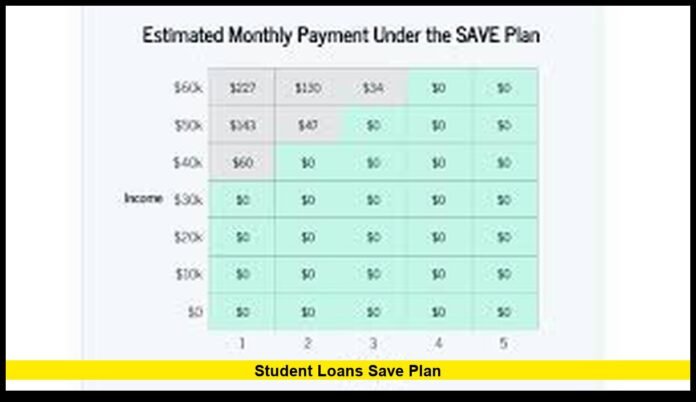

For many borrowers, the most pressing question is how the end of SAVE will affect monthly payments. SAVE was designed to provide a lower payment structure for people with modest incomes, using an income-driven formula that shielded a larger portion of earnings from calculation. It also reduced or eliminated unpaid interest buildup, one of the biggest drivers of growing student loan balances.

Without those protections, some borrowers may see noticeable increases in their bills once moved into older repayment structures. These earlier options typically:

- Use less flexible income exemption rules

- Require a higher monthly contribution compared to SAVE

- Offer fewer forgiveness categories

- Allow unpaid interest to grow more rapidly

- Take longer before balancing out toward possible forgiveness

Not every borrower will face higher payments, but many who benefited from SAVE’s unique structure should prepare for the possibility.

Long-Term Consequences for Forgiveness Timelines

Another major concern involves the timeline to loan forgiveness. Under SAVE, some borrowers qualified for faster cancellation of remaining balances if all payments were made on time. The duration depended on the original loan amount and other factors, but many individuals saw a shorter pathway than was available under older repayment plans.

With the plan winding down, borrowers will return to the previous forgiveness structures, which often require a longer payment history. This means that someone who believed they were only a few years away from cancellation under SAVE may now have additional years added to their timeline once shifted into another program.

For borrowers pursuing Public Service Loan Forgiveness, payment counts remain important. Because the transition will involve changes in repayment plan categories, borrowers in public service sectors should monitor their payment tallies closely to ensure no gaps or errors occur during servicer updates.

Interest Handling and Balance Growth

Interest management was one of SAVE’s most popular features. Many borrowers appreciated that unpaid interest did not pile onto their principal balance as long as they made their required payments. This structure prevented loan amounts from ballooning, a problem that has historically discouraged borrowers and raised concerns about long-term affordability.

As borrowers exit SAVE, interest accumulation rules will shift. Under traditional income-driven plans:

- Unpaid interest may accumulate

- Balances can grow even when payments are made on time

- Capitalization may occur under certain conditions

This change could significantly alter the trajectory of loan balances for many borrowers, particularly those with lower incomes or high principal amounts.

A Closer Look at the Student Base Affected

While SAVE had millions of users, they were not a monolithic group. The transition will affect:

- Recent graduates who selected SAVE immediately after the end of the payment pause

- Middle-income professionals who relied on SAVE’s stable monthly formula

- Parents who used Parent PLUS loans and sought relief under income-driven options

- Public-sector workers pursuing long-term forgiveness

- Borrowers with older loans who consolidated to qualify for enhanced repayment benefits

Each group faces different financial pressures and long-term repayment expectations. Experts anticipate that many borrowers will begin reassessing their budgets, adjusting saving strategies, and modifying long-term financial planning as new payment levels take effect.

The Legal and Administrative Background Behind the Transition

The end of the program arises from a legal settlement that requires federal officials to halt SAVE operations and move users back to preexisting repayment structures. The settlement directs the government to deny new enrollments, discontinue the program’s unique features, and restore a more traditional repayment system.

This represents one of the most substantial shifts since major federal student loan reforms were introduced in the past decade. Although the settlement will continue to move through formal procedures, the operational instructions have already been issued, meaning the change is not theoretical—institutions have begun implementing required updates.

Practical Guidance for Borrowers During the Transition

Borrowers should take a proactive approach during the transition period. The following steps can help ensure that repayment remains manageable and that no important updates are missed:

1. Review account notifications regularly

Official messages will appear in borrower dashboards. These notices provide important dates, next steps, and repayment comparisons.

2. Compare repayment plan options

The available plans vary in payment structure, forgiveness timelines, and income calculations. Borrowers should evaluate each option before being moved automatically.

3. Verify income information

Because repayment plans rely heavily on annual income, ensuring that income data is accurate will help prevent miscalculations during the transition.

4. Monitor payment counts

Especially for those pursuing Public Service Loan Forgiveness or long-term income-driven forgiveness, every payment matters. Payment counts should be checked after the transition to ensure they remained intact.

5. Keep copies of all communications

Having a personal record makes it easier to resolve discrepancies, especially when large-scale administrative changes take place.

Impact on Broader Student Debt Trends

The end of SAVE comes at a time when the national conversation about student debt remains active. Borrowers are adjusting to resumed payments, higher living costs, and evolving job markets. SAVE had provided stability during this period, especially for borrowers managing tight budgets or trying to build financial momentum after the multi-year payment pause.

With SAVE ending, some analysts believe the transition may influence:

- Household budgeting in low- and middle-income families

- Borrowers’ ability to qualify for mortgages and other credit

- The pace at which borrowers reduce existing debt

- Public discussions about long-term student loan reform

The transition will ripple across many sectors as borrowers adapt to higher or differently structured monthly payments.

Key Term Mention Requirement

As part of reporting clarity, the program is referenced again here: the student loans save plan is ending its operational role, and this change will reshape the repayment landscape for millions of Americans moving forward.

Looking Ahead as Borrowers Await Updated Repayment Assignments

The shift brings a new chapter for borrowers navigating the federal loan system. As the wind-down continues, the most important action borrowers can take is to remain informed. The coming months will include new instructions, timeline updates, and repayment plan details issued directly to affected users.

By staying alert and reviewing account information regularly, borrowers can adapt more easily and choose the most suitable repayment path for their financial goals. Although the transition brings uncertainty, active engagement and careful planning can help borrowers regain a sense of control over their loan journey.

Share your thoughts below and let others know how these changes are shaping your repayment plans.