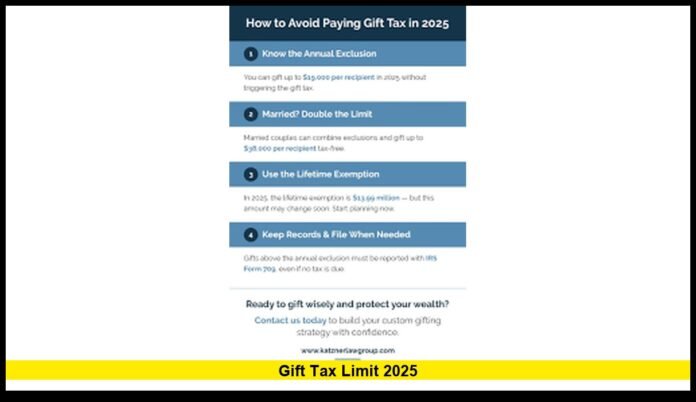

The gift tax limit 2025 marks an important update for anyone planning to transfer money or assets in the coming year. The Internal Revenue Service increased the annual exclusion to $19,000 per recipient, creating new opportunities for strategic gifting while keeping financial decisions aligned with federal regulations. As Americans review their financial goals, estate plans, and family obligations, this new limit shapes how much can be shared without triggering additional reporting requirements or affecting long-term tax strategies.

Why the 2025 Gift Tax Limit Matters More Than Ever

The United States tax system allows individuals to give a specific amount each year to as many people as they choose without facing gift tax concerns. The rise to $19,000 for 2025 gives families greater flexibility. Many Americans use gifting as a tool for supporting children, helping aging parents, contributing to education expenses, or transferring wealth during their lifetime.

The yearly adjustment plays a direct role in how people budget, invest, and plan ahead. With inflation affecting household finances nationwide, even small increases in allowable gifting can help families maintain stability while keeping long-term estate plans intact. For individuals with significant assets, the annual gift limit is also a key part of managing estate size before future inheritance decisions come into play.

How the New $19,000 Limit Works

The core rule is simple: in 2025, you may give up to $19,000 to any number of individuals without filing a federal gift tax return. This amount applies per recipient, which means every gift is evaluated separately. A taxpayer could give $19,000 to each child, each grandchild, or any combination of relatives and friends, and the gifts stay within the exclusion.

This limit only applies when the total given to one person during a calendar year stays within the allowed amount. Once a donor surpasses the threshold, the additional amount counts against the lifetime exemption.

Short, clear examples help illustrate how the system works:

- Giving $19,000 to one child and $19,000 to another remains fully within the exclusion.

- Giving $25,000 to one recipient exceeds the limit by $6,000, and only that excess is reportable.

- You may give smaller amounts throughout the year, and the IRS calculates the total across the full twelve months.

These rules allow straightforward planning while still giving donors room to support loved ones during important life moments.

The Role of the Lifetime Exemption

While the annual exclusion draws the most attention, the lifetime gift and estate tax exemption is equally important. This amount remains at $13.99 million per individual for 2025. Only gifts that exceed the annual exclusion chip away at this larger exemption.

For many Americans, this long-term exemption prevents any tax from being due even when larger gifts are made. A donor would only owe gift tax after surpassing the lifetime amount, something most individuals never reach.

The connection between the annual limit and the lifetime exemption gives taxpayers flexibility. People can choose smaller yearly gifts that avoid paperwork entirely or make larger transfers with proper documentation. Both approaches support financial planning, buying property for family members, helping with home purchases, or passing down businesses and investments.

How Married Couples Benefit From the 2025 Rules

Married couples have even more flexibility due to gift-splitting rules. If both spouses agree to share the annual exclusion, they can give $38,000 to a single recipient without exceeding the limit. This joint approach supports major financial moves such as assisting a child with a down payment or contributing to college tuition.

Another important guideline applies to gifts between spouses. When both are U.S. citizens, these transfers are generally unlimited. This rule prevents unnecessary complications for couples who share finances and manage assets jointly.

For spouses who are not U.S. citizens, the IRS sets a separate, higher annual exclusion to prevent tax complications. In 2025, the gift limit to a non-citizen spouse rises to $190,000, allowing couples in international households to manage their finances with fewer restrictions.

These distinctions show how the tax system adjusts for varying family situations. Whether a household is U.S.-based or includes a spouse from another country, the rules provide avenues for responsible and fair financial management.

Gifts That Do Not Count Toward the Limit

Not all gifts apply to the annual exclusion. Several categories remain fully exempt because they support essential needs and public benefits. These include:

- Direct tuition payments made to schools or universities

- Direct medical payments to doctors, hospitals, or other providers

- Charitable donations

- Political contributions

The key detail is that medical and tuition payments must go straight to the institution. If you give money to someone so they can pay a bill, it counts as a gift. But if you pay the school or medical provider directly, the payment does not affect your gift limit at all.

This rule is especially helpful for grandparents helping with college costs and families assisting older relatives with healthcare expenses.

How the 2025 Limit Supports Long-Term Estate Planning

Estate planning is not only for wealthy households. Many Americans use gifting to reduce the size of their taxable estate and support loved ones while they are still alive. The updated limit gives donors more room to plan in thoughtful and tax-efficient ways.

Key benefits include:

- Gradual transfer of wealth: Smaller annual gifts can shift assets over time, reducing future estate burden.

- Support without tax pressure: Families can share financial support without hitting administrative hurdles.

- Easier record-keeping: Staying within the exclusion keeps paperwork minimal.

- Predictable planning: The gift tax limit adjusts with inflation, giving households a reliable framework.

These practices help families plan for future generations, handle financial responsibilities, and maintain stability even during unpredictable economic shifts.

2025 vs. 2024 Gift Rules: A Clear Comparison

A simple comparison highlights the changes:

| Category | 2024 Limit | 2025 Limit |

|---|---|---|

| Annual exclusion per recipient | $18,000 | $19,000 |

| Annual married-couple exclusion per recipient | $36,000 | $38,000 |

| Lifetime exemption | $13.99 million | $13.99 million |

| Exclusion for gifts to a non-citizen spouse | Higher than standard limit | $190,000 |

The increase gives taxpayers additional flexibility in how they move money or assets without triggering federal reporting requirements.

Best Practices for Using the New Gift Limit

Here are simple steps to make the most of the updated rules:

- Track gifts throughout the year to make sure totals stay within the allowed amount.

- Consider gift-splitting when giving larger amounts as a couple.

- Use direct payments for education or healthcare to avoid affecting the exclusion.

- Keep documentation for gifts that exceed the limit.

- Plan early in the year to avoid rushed decisions near tax deadlines.

- Explore gifting assets such as stocks or property when trying to reduce future estate size.

These steps make gifting easier and help avoid unnecessary complications.

A Deeper Look at How Americans Use Gifting

Gifting is more than a tax strategy. It reflects personal goals, family values, and long-term planning. Many Americans use gifting to support their children’s financial independence, encourage education, or ensure aging parents receive proper care. Others use gifting to transfer family businesses, help relatives buy their first homes, or strengthen generational wealth.

The 2025 limit supports these efforts by offering:

- Clear rules

- Predictable annual adjustments

- Flexibility across various financial situations

- Room for both modest and significant transfers

Every household uses gifting differently, but the annual exclusion ensures that families remain empowered to support one another responsibly and efficiently.

Final Thoughts

The gift tax limit 2025 provides important clarity for anyone planning financial transfers in the coming year. With the annual exclusion set at $19,000 per recipient, Americans can give more freely, support loved ones, and manage long-term financial goals with confidence. Whether you are assisting a family member, planning your estate, or simply sharing resources, understanding this limit helps you make informed and effective decisions.

Share your thoughts or experiences with gifting in 2025 below — your insight may help others navigating the same decisions.