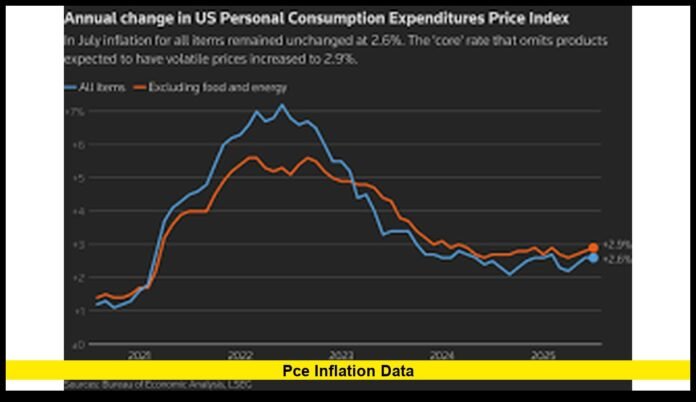

The latest PCE inflation data indicates that inflation in the United States remains elevated. In September 2025, the headline Personal Consumption Expenditures (PCE) index rose 0.3% from the prior month and shows a 2.8% increase compared with one year ago. The core PCE — which excludes volatile food and energy costs — rose 0.2% in the month and also recorded a 2.8% year-over-year increase.

These fresh numbers arrive after a delay caused by a federal government shutdown. Now that the data is published, it offers a clear snapshot of current inflation trends, influencing decisions among policymakers, markets, and everyday households alike.

Understanding PCE — Why It Matters More Than Ever

The PCE price index measures what households across the United States pay for goods and services. It includes everything from groceries and rent to medical care and entertainment costs. Because it adjusts for changing consumption patterns and covers a broad basket of expenditures, it is viewed as a more comprehensive gauge of inflation than many other indexes.

The core PCE removes food and energy prices — two categories that often swing dramatically. This helps highlight underlying inflation pressures that are less about raw commodity volatility and more about persistent price changes across housing, services, and other essentials. When core PCE remains high, it suggests inflation is embedded deeply in the economy rather than being driven only by temporary spikes in volatile sectors.

Policymakers at the central bank watch PCE closely because it influences interest rate decisions, cost-of-living expectations, and broader economic policy. When PCE inflation stays elevated, it often complicates efforts to balance growth and stability.

What the September 2025 Report Shows

Here’s a breakdown of the latest numbers from the PCE report:

- Headline PCE (month-over-month): +0.3%

- Headline PCE (year-over-year): +2.8%

- Core PCE (month-over-month): +0.2%

- Core PCE (year-over-year): +2.8%

The 0.3% monthly increase matches the pace seen in August. On an annual basis, 2.8% remains significantly above the 2% inflation target often cited as a benchmark for economic stability. The fact that both headline and core PCE are rising at the same rate suggests inflation is broad-based and affecting multiple sectors — not just volatile categories like fuel or food.

Moreover, because this report was delayed, it represents a catch-up in economic data reporting, offering a consolidated look at pricing trends without the usual monthly rhythm. That makes these numbers especially critical for economic planners, businesses, and consumers trying to gauge where prices are headed next.

How the Markets Are Reacting to the New Data

The release of this PCE inflation data is influencing both investor sentiment and expectations for monetary policy. Ahead of the publication, markets were already leaning toward the idea that the central bank may reduce interest rates soon. The data’s release puts that conversation into sharper focus.

Some of the key reactions include:

- Heightened probability of a rate cut: With inflation remaining sticky but not surging, many investors now expect a 25-basis-point rate cut at the upcoming central bank meeting in December.

- Stocks and risk assets gaining traction: Moderate inflation keeps open the possibility of easier borrowing costs, which tends to support equities and risk-on investments.

- Cautious optimism: While prices remain elevated, the stable monthly increases suggest inflation pressures might be plateauing — enough to prompt relief among consumers and businesses alike.

That said, the central bank must balance between easing policy to support growth and ensuring inflation does not stay entrenched. Persistent core inflation signals caution remains necessary.

Impact on American Households — Inflation You Feel

For many families, these numbers are more than abstract economic indicators — they translate directly into daily financial pressures. Elevated PCE affects everything from grocery bills to housing costs, and these pressures can influence spending, savings, and overall financial security.

Here’s how current inflation trends are likely to impact households:

- Higher costs for essentials: Food, utilities, rent, medical expenses, and services remain pricier than just a few years ago.

- Eroding purchasing power: If wages don’t keep up with inflation, many families may struggle to maintain their standard of living.

- Increased cost of credit: Even if interest rates are cut, inflation may keep borrowing costs relatively high, especially for loans tied to long-term rates.

- Reduced discretionary spending: With more income going to necessities, fewer households may feel comfortable spending on non-essential items or major purchases.

- Budget stress for lower- and middle-income families: Those with less financial cushion feel the pinch more sharply as price increases eat into disposable income.

These effects underscore why the PCE reading matters not just to investors or policymakers — but to everyday Americans across the socioeconomic spectrum.

What’s Next — Key Things to Monitor in Coming Months

As we move toward the end of 2025, several developments could shape how inflation and the broader economy evolve:

Upcoming Monthly PCE Reports

Future PCE releases — for October, November, and beyond — will be closely watched. If monthly increases remain modest, it may cement a view that inflation is stabilizing. If they rise, it could reignite concerns.

Labor Market Developments

Job growth, wage trends, and labor participation will influence both consumer spending and inflation. A slowing labor market might ease inflation, but weak wages could prolong economic strain for many households.

Consumer Spending Trends

As prices remain elevated, spending patterns may shift. Americans could prioritize essentials, cut back on discretionary purchases, or rely more on credit — all of which impact economic growth.

Central Bank Moves

The central bank’s December policy meeting will be critical. Officials must weigh current inflation against economic growth and labor data. Their decision — to cut rates or hold steady — could shape borrowing costs and economic momentum for months ahead.

Broad Economic Sentiment

Consumer confidence, business investment, mortgage rates, and global economic pressures will all play a role. Inflation does not exist in a vacuum. External factors — trade dynamics, energy prices, global demand — can sway how the U.S. economy performs.

Why PCE Inflation Data Matters More Than Ever

The PCE price index remains the gold standard for measuring inflation in the U.S. Unlike other measures that capture narrower baskets or use fixed weighting, PCE adapts to real-world spending habits. It reflects how people actually spend — on everything from groceries to streaming services.

Because of this adaptability, PCE tends to show softer inflation compared with older indexes. But when PCE remains elevated for months, it signals broad-based inflation that touches many aspects of everyday life.

That is exactly the situation the United States finds itself in today. The 2.8% annual inflation rate and 0.3% monthly increase reflect a persistent upward trend. Even though monthly rises are modest, the cumulative impact over months and years adds up — influencing household budgets, corporate costs, and interest-rate expectations.

The Broader Economic Picture — A Balancing Act

The economy faces a complex balancing act. On one side, inflation remains too high for comfort. On the other, consumer spending and job growth are showing signs of softening. For policymakers, the challenge is clear: ease monetary policy enough to support growth without undermining progress on inflation.

For consumers and businesses alike, this balancing act creates uncertainty. Decisions about saving, spending, borrowing, and investing all hinge on what happens next — and that depends heavily on upcoming data and central bank actions.

The current PCE inflation data serves as a pivotal benchmark. It offers insight into underlying price trends, but it also highlights how sensitive the outlook remains.

What Americans Should Keep in Mind

- Adjust monthly budgets carefully. Rising costs may not shock every month, but steady increases add up over time. Monitor household spending and prioritize essentials.

- Plan for borrowing costs that may fluctuate. Even if interest rates drop, inflation can keep long-term borrowing expensive.

- Track inflation and wage growth together. When wages lag behind inflation, real purchasing power shrinks — especially for lower- and middle-income families.

- Watch upcoming economic data closely. Future PCE reports, labor market signals, and central bank moves will shape the economic context heading into 2026.

- Avoid long-term commitments when possible. Uncertainty around rates and inflation suggests flexibility may prove valuable, particularly for large purchases or investments.

Conclusion

The latest PCE inflation data underscores a reality many Americans already feel: prices remain high, and inflation hasn’t eased to comfortable levels. A 2.8% annual increase and consistent monthly gains signal a persistent inflation environment affecting everyday costs.

At the same time, signs of economic strain — from slower spending to weaker labor trends — suggest the economy is at a critical juncture. With the central bank’s December meeting just around the corner, markets, businesses, and households are paying close attention. What happens next could shape borrowing costs, spending behavior, and financial stability across the country.

Share your thoughts below and keep an eye on the next reports — because inflation isn’t just a statistic. It’s a force that impacts budgets, decisions, and lives across America.