The social security wage base 2025 sets the new taxable earnings limit for Social Security contributions and plays a major role in how workers, employers, and self-employed Americans calculate their federal payroll taxes this year. With the updated limit now established at $176,100, millions of people will see changes in their paychecks, tax planning, and retirement benefit calculations.

This report breaks down every important detail about the new taxable maximum, why the limit increased, and what it means for Americans across different income levels. All information reflects the most accurate, confirmed updates available as of today.

What the Social Security Wage Base Represents

The taxable maximum for Social Security is the highest amount of annual wage income subject to the 6.2% Social Security tax paid by employees and matched by employers. The system uses this cap because benefits themselves are tied to a structured formula that considers earnings only up to the annual limit.

This limit exists to:

- Keep contributions aligned with eventual benefits

- Prevent excessive tax collection from high earners

- Adjust taxes in line with national wage trends

Every year, the limit is recalculated based on changes in the country’s average wages. When earnings grow nationwide, the wage base increases as well.

Official 2025 Social Security Wage Base: $176,100

The federal government has finalized the wage base for 2025 at $176,100, which marks an increase of $7,500 from the previous year’s cap. This rise reflects wage growth across various industries and aligns the Social Security system with current economic conditions.

What Workers Should Know

- Social Security taxes apply only to wages up to $176,100.

- Any income earned above that amount is not taxed for Social Security purposes.

- The cap resets every January 1, meaning the 2025 limit applies to all wages earned this calendar year.

What Employers Should Know

- Employers must match the employee’s 6.2% contribution.

- The higher limit increases employer tax responsibility for workers earning above last year’s threshold.

What Self-Employed Workers Should Know

- Self-employed Americans pay both halves of the Social Security tax, totaling 12.4%.

- The income subject to this tax is now capped at $176,100 for 2025.

How Social Security Payroll Taxes Apply in 2025

The structure of payroll taxes remains consistent this year. Only the wage base has changed.

For Employees

- 6.2% Social Security tax on wages up to $176,100

- 1.45% Medicare tax on all wages

- Additional 0.9% Medicare surtax for high earners above established thresholds

For Employers

- 6.2% Social Security match on wages up to the same limit

- 1.45% Medicare tax on all wages

For Self-Employed Individuals

- 12.4% Social Security tax on net earnings up to $176,100

- 2.9% Medicare tax on all net earnings

- Additional 0.9% Medicare surtax above the income threshold

Because self-employed workers pay both shares of the Social Security tax, the wage base plays a significant role in their total annual tax liability.

Maximum Social Security Tax Amounts for 2025

With the new limit set, the maximum contributions are:

- Employee maximum: $10,918.20

- Employer maximum: $10,918.20

- Self-employed maximum: $21,836.40

Once an employee reaches the taxable maximum during the year, the Social Security portion of payroll withholding stops. Medicare taxes continue because they have no income limit.

Why the Wage Base Increased for 2025

Every year, the wage base is recalculated using the national average wage index. When overall earnings rise across the country, the taxable maximum increases to match those economic changes.

The increase for 2025 reflects:

- Nationwide wage growth

- Inflation adjustments

- Broader income trends across industries

The Social Security system relies on these adjustments to maintain financial balance between contributions and future benefits.

Workers Who Will Notice the Biggest Impact

Workers Below $176,100

Most workers fall under the wage base, meaning:

- They continue paying Social Security tax on all their wages

- They do not experience a change in when or how Social Security withholding stops

- Their paycheck changes will be minimal beyond regular payroll adjustments

Workers Above $176,100

Higher-income earners will experience:

- More Social Security withholding before they hit the cap

- A slightly lower take-home pay early in the year

- A noticeable increase in net pay later in the year after reaching the limit

For these workers, the wage base increase means a higher taxable amount compared with 2024.

Employees With Multiple Jobs

Workers with more than one employer could have too much Social Security tax withheld if both employers withhold to the full cap. In that case, they can claim a refund when filing their federal tax return. Employers are not responsible for tracking wages at other companies.

Impact on Employers Across the United States

The new limit influences employer tax planning in several ways:

1. Higher Payroll Tax Responsibility

Employers with high-earning employees will pay more in matched Social Security contributions due to the increased taxable maximum.

2. Year-End Planning

Budgeting for payroll costs becomes more important, especially for companies in industries with large executive or high-salary workforces.

3. Payroll System Updates

Most modern payroll platforms automatically adjust to new federal limits.

Small businesses handling payroll manually must ensure they update:

- The taxable maximum

- Withholding tables

- Employer contribution tracking

4. Recordkeeping and Compliance

Failure to withhold based on the current wage base can lead to:

- Payroll errors

- Penalties

- The need to correct annual wage reports

Ensuring compliance at the start of each year reduces financial risk later on.

How the Wage Base Affects Self-Employed Americans

Self-employed individuals often feel wage base adjustments more directly. Because they pay both the employee and employer portions of Social Security taxes, changes in the taxable maximum directly impact their estimated taxes.

Self-employed taxpayers should:

- Recalculate quarterly estimated tax payments

- Review retirement plan deductions

- Keep detailed records of net earnings

Proper planning helps avoid underpayment penalties and ensures accurate filings.

How the Wage Base Influences Social Security Benefits

Only income up to the taxable maximum counts toward the calculation of future retirement, disability, or survivor benefits. This means that for 2025, a maximum of $176,100 in annual earnings contributes to the benefit formula.

The Benefit Calculation Process

The Social Security Administration calculates future retirement benefits using:

- A worker’s highest 35 years of indexed earnings

- The average indexed monthly earnings (AIME)

- A formula applied at full retirement age

Earnings above the taxable maximum do not increase benefits, so the wage base defines the upper limit of retirement credit for each year.

The rise in the wage base helps future earners potentially qualify for higher benefits, assuming they consistently earn near or above the limit over many years.

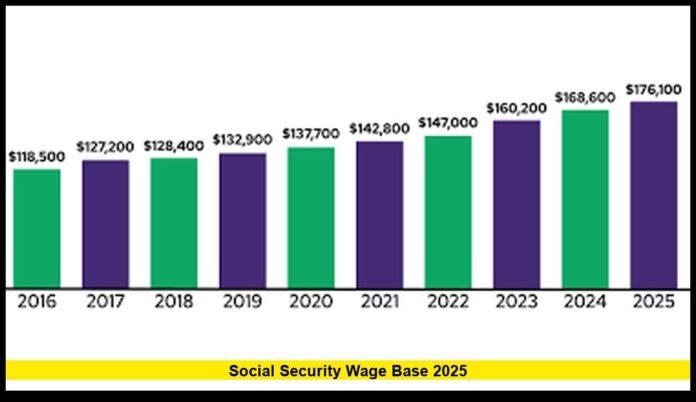

A Look at Wage Base Increases Over Time

Recent increases illustrate how changes in the national wage index influence the annual taxable maximum.

| Year | Wage Base |

|---|---|

| 2023 | $160,200 |

| 2024 | $168,600 |

| 2025 | $176,100 |

This steady rise demonstrates how wage growth continues to influence Social Security taxation and long-term retirement calculations.

Financial Planning Considerations for 2025

The updated wage base touches several areas of financial life.

1. Retirement Contribution Strategies

High earners may reconsider how they structure contributions to:

- 401(k)s

- Traditional IRAs

- Roth IRAs

- SEP IRA or Solo 401(k) accounts for the self-employed

Understanding how the Social Security limit interacts with income planning helps optimize long-term retirement strategies.

2. Adjusted Paycheck Expectations

Workers whose income exceeds the cap often notice a shift in take-home pay late in the year once Social Security withholding stops. Accounting for this helps with budgeting and financial planning.

3. Business Planning

Business owners and payroll directors must:

- Anticipate higher employer tax responsibilities

- Update compensation models if necessary

- Prepare for future increases

4. Tax Season Preparation

Taxpayers who earn from multiple sources or combine W-2 and self-employment income must carefully calculate their total contributions.

Why the Wage Base Matters for the Future of Social Security

The taxable maximum is one of the many levers affecting Social Security’s overall financial health. While the program remains a central part of retirement security in the United States, wage base increases help maintain stability by aligning contributions with wage trends.

The future of Social Security often sparks discussion about long-term funding, benefit formulas, and the role of wage indexing. While no new structural changes are active for 2025, wage base updates remain one of the most important annual adjustments that keep the program functioning.

Final Thoughts

The increase to the social security wage base 2025 brings meaningful changes for workers across the country, especially high earners and self-employed individuals. Understanding the new limit helps Americans plan paychecks, taxes, and long-term financial decisions with confidence. As wage trends continue to rise, annual updates like this will remain an essential part of the Social Security system.

Share your thoughts below and let others know how the new taxable maximum is affecting your planning this year.