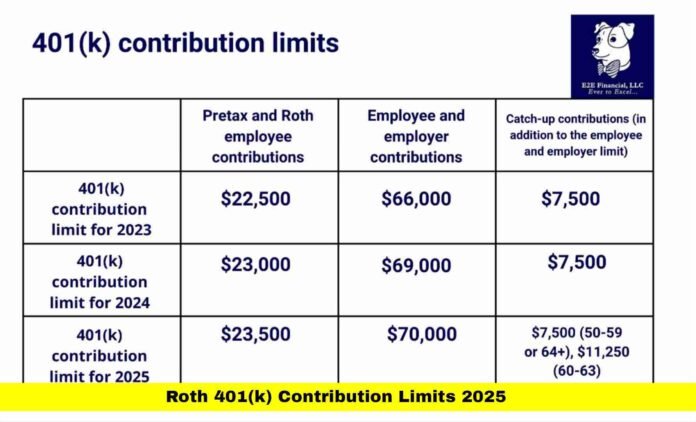

The Roth 401(k) contribution limits 2025 have officially been increased, giving American workers more room to save for retirement. The IRS announced that employees can now contribute up to $23,500 in 2025, compared to $23,000 in 2024. The overall limit, which includes both employee and employer contributions, has also gone up to $70,000. These new thresholds are designed to help workers protect their retirement savings from inflation and build long-term wealth more efficiently.

Roth 401(k) Contribution Limits for 2025

The IRS adjusts contribution limits each year to reflect the cost-of-living index. For 2025, the employee elective deferral limit—the maximum amount you can personally contribute—has been raised to $23,500. This limit applies whether your plan is a traditional 401(k), a Roth 401(k), or a mix of both.

Those aged 50 and older can also take advantage of catch-up contributions, which remain capped at $7,500. This means older savers can contribute a total of $31,000 in 2025.

In addition, the overall contribution limit—which includes employee and employer contributions—has risen to $70,000, up from $69,000 in 2024. This provides more flexibility for those whose employers offer generous matching or profit-sharing plans.

Catch-Up Contributions and the Super Catch-Up Rule

Catch-up contributions are a valuable way for older workers to make up for lost time in saving for retirement. For 2025, the catch-up limit remains $7,500, keeping the total employee contribution at $31,000 for individuals aged 50 and above.

A new feature under the SECURE 2.0 Act, called the “super catch-up,” will soon apply to those aged 60 to 63. It allows an additional contribution of $11,250, making it possible for near-retirees to contribute significantly more before retirement.

This rule helps those in their peak earning years maximize their savings potential and take advantage of tax-free Roth growth.

Combined Contribution Limits Including Employer Match

The combined contribution limit—which includes both your own contributions and those made by your employer—has increased to $70,000 for 2025.

This figure includes:

- Employee elective deferrals (Roth or traditional)

- Employer matching contributions

- Non-elective contributions

- Profit-sharing contributions

For employees aged 50 and older, the combined total including the catch-up allowance can reach $77,500.

Employer matches remain one of the best benefits of any 401(k) plan. For example, if your employer offers a 100% match on up to 5% of your salary, contributing at least that amount ensures you’re not leaving free money on the table.

Why the 2025 Increase Is Important

The 2025 contribution increase is particularly significant because it allows savers to keep pace with inflation and rising living costs. As healthcare, housing, and daily expenses continue to rise, being able to save an extra $500 in your Roth 401(k) can make a long-term difference.

The Roth 401(k) is especially attractive because contributions are made after taxes, and qualified withdrawals in retirement are completely tax-free. For those expecting higher taxes in the future, this provides a powerful hedge against potential tax hikes.

This year’s increase also encourages employees to think more strategically about how they split their contributions between Roth and traditional 401(k) accounts to optimize both immediate and future tax benefits.

How Roth 401(k) Contributions Work

A Roth 401(k) functions much like a traditional 401(k) but with one major difference—tax treatment. With a Roth 401(k), your contributions are made with after-tax dollars. This means you won’t pay taxes when you withdraw your money during retirement, provided you meet the requirements.

On the other hand, a traditional 401(k) uses pre-tax dollars, reducing your taxable income now but leading to taxable withdrawals later. Many workers choose to contribute to both accounts to balance short-term tax savings with long-term tax-free growth.

You can change your contribution ratio at any time, depending on your financial goals and expected tax rate in retirement.

Tax Benefits of Roth 401(k) Contributions

Roth 401(k)s offer a number of tax advantages that make them appealing to a wide range of investors.

- Tax-free withdrawals: Once you reach age 59½ and have held the account for at least five years, withdrawals are completely tax-free.

- No income limits: Unlike Roth IRAs, Roth 401(k)s have no income restrictions, so even high earners can participate.

- Employer match flexibility: Under the SECURE 2.0 Act, employers can now make their matching contributions directly to a Roth account if they choose.

These benefits make the Roth 401(k) a versatile option for workers at all income levels, especially those who expect to be in a higher tax bracket in retirement.

New Roth Rules for High Earners

Starting in 2026, employees earning more than $145,000 annually will be required to make their catch-up contributions to a Roth 401(k) instead of a traditional one. This change, introduced by the SECURE 2.0 Act, is designed to ensure that high-income workers pay taxes on their catch-up contributions upfront rather than deferring them until retirement.

Although this rule is not mandatory for 2025, many employers are already preparing their systems for the shift. For high earners, this change could ultimately be beneficial since their future withdrawals will be tax-free.

How to Maximize the 2025 Roth 401(k) Limits

Taking full advantage of the higher contribution limits requires thoughtful planning. Here are some strategies to get the most out of your 401(k):

- Contribute early and consistently. The sooner you contribute, the more time your money has to grow.

- Ensure you receive the full employer match. This is essentially free money and a guaranteed return on your contributions.

- Split contributions wisely. Combining Roth and traditional 401(k) contributions can balance your tax exposure over time.

- Use catch-up contributions. If you’re 50 or older, contribute the full additional $7,500 to make the most of your peak earning years.

- Review your investment mix annually. Ensure your portfolio aligns with your risk tolerance and long-term goals.

These practices not only help you reach the new limit but also improve your overall financial preparedness for retirement.

Impact of Inflation and Market Conditions on Retirement Savings

The decision to raise contribution limits every year is closely tied to inflation and the economy. In 2025, the IRS’s adjustment aims to help savers maintain their purchasing power.

As prices rise, so does the cost of living in retirement. By increasing how much you can save in tax-advantaged accounts, the government helps workers combat the effects of inflation on future income.

Roth accounts, in particular, offer a unique safeguard since their withdrawals are tax-free, ensuring that retirees can enjoy predictable income even if tax rates or inflation fluctuate.

Who Benefits the Most from Roth 401(k) Contributions

A Roth 401(k) can benefit various types of savers, but it’s especially valuable for:

- Younger employees who expect to earn more in the future and want to lock in today’s lower tax rates.

- High-income earners who want to diversify their tax exposure and ensure some retirement income is tax-free.

- Workers planning early retirement, since Roth accounts allow for more flexible withdrawal options.

- Older workers maximizing their savings through catch-up contributions before retirement.

By knowing which group you fall into, you can tailor your contribution strategy accordingly.

Planning Ahead: Why You Should Revisit Your Retirement Goals in 2025

With the new 2025 contribution limits, now is the perfect time to review your financial plan. If you haven’t updated your contribution rate recently, consider increasing it slightly to align with the new maximum. Even a small bump can have a big impact over time, thanks to compound growth.

Discussing your strategy with a financial advisor can help you decide the right mix between Roth and traditional contributions. Additionally, review your employer’s 401(k) match program to ensure you’re making the most of the benefits offered.

Conclusion

The updated Roth 401(k) contribution limits 2025 bring a welcome opportunity for American workers to save more for their futures. With employee limits rising to $23,500 and total combined limits reaching $70,000, this year’s adjustments reflect the growing importance of retirement readiness.

By planning ahead, making consistent contributions, and taking full advantage of catch-up and employer match options, you can build a tax-free retirement nest egg that supports long-term financial freedom.

Stay aware, stay consistent, and make 2025 the year you strengthen your retirement foundation for good.