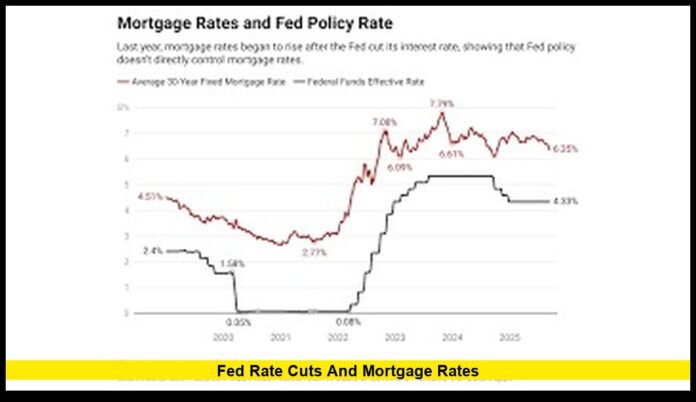

The link between fed rate cuts and mortgage rates has taken center stage in 2025 as the Federal Reserve begins easing its monetary policy after a prolonged period of high interest rates. For millions of Americans, these moves could influence one of the biggest financial decisions of their lives — buying or refinancing a home.

While many expected mortgage rates to fall sharply following the Fed’s latest actions, the actual story is far more nuanced. Mortgage rates have indeed eased from their recent highs, but the pace and scale of decline remain gradual. Understanding why — and what’s likely ahead — can help borrowers make smarter choices in this shifting environment.

The Current Situation: How the Fed’s Cuts Are Shaping the Market

The Federal Reserve made its first rate cut in over a year in September 2025, reducing the federal funds rate by 0.25% to a target range of 4.00% to 4.25%. Then, in October 2025, the Fed followed up with another 0.25% cut, bringing the benchmark range to 3.75%–4.00%.

These moves mark the first easing steps since the Fed paused its tightening cycle in late 2024. They reflect growing confidence that inflation is cooling — though still above the Fed’s 2% target — and acknowledgment that the U.S. economy is slowing in key areas like consumer spending and job growth.

For consumers, the most visible impact of these cuts is on borrowing costs. Mortgage rates, which surged above 7% earlier this year, have finally started to ease.

Mortgage Rates Are Falling — But Not as Much as Expected

The most recent average for a 30-year fixed mortgage rate in the United States stands around 6.2%, down from 7% in mid-2024. That’s the lowest level in over a year, offering some relief to buyers struggling with affordability.

However, the decline has not been dramatic. Many borrowers hoping for rates in the low 5% range may need to temper expectations. The reality is that while the Fed controls short-term rates, mortgage rates depend on long-term bond yields, which remain elevated due to investor caution, inflation risk, and government debt levels.

Current U.S. Mortgage Rate Averages (as of November 2025):

| Loan Type | Average Rate | Change from Mid-2024 |

|---|---|---|

| 30-Year Fixed | ~6.20% | ▼ 0.9% |

| 15-Year Fixed | ~5.55% | ▼ 0.8% |

| 5/1 ARM | ~5.80% | ▼ 0.6% |

Even modest declines make a difference. A drop from 7% to 6.2% on a $400,000 home loan can lower a buyer’s monthly payment by about $200 — a meaningful boost to affordability.

Why Fed Rate Cuts Don’t Automatically Translate to Lower Mortgage Rates

It’s a common misconception that mortgage rates move in perfect sync with the Federal Reserve. In truth, Fed rate cuts and mortgage rates are connected but not directly tied. Here’s why:

- Different Market Influences: The Fed funds rate affects short-term loans (like credit cards and auto loans), while mortgage rates are tied to long-term bonds — particularly the 10-year U.S. Treasury yield.

- Investor Expectations: Mortgage rates reflect what investors expect inflation and the economy to do in the coming years, not just what the Fed does today.

- Market Spreads: Lenders add a “spread” — or risk buffer — to Treasury yields when setting mortgage rates. Even if bond yields fall, wide spreads can keep rates higher.

- Global Economic Factors: Geopolitical tensions, foreign demand for U.S. debt, and fiscal deficits can all influence bond yields and mortgage costs.

In short, while Fed cuts make it cheaper for banks to borrow money, they don’t guarantee an equal drop in mortgage rates. The impact often unfolds gradually.

What Homebuyers Should Know Right Now

Slightly Better Affordability

After two years of punishing rate increases, the recent cuts bring some relief. A 1% drop in mortgage rates can translate to thousands of dollars in lifetime interest savings. For buyers, this opens the door to slightly more purchasing power — but not enough to fully offset high home prices.

Still a Tight Market

Even with lower rates, the U.S. housing market remains undersupplied. Many current homeowners are “locked in” at pandemic-era rates of 3% or lower, making them reluctant to sell. This keeps inventory low, sustaining price pressures even as borrowing costs ease.

Timing Is Everything

Buyers should focus less on predicting future rate movements and more on their personal readiness. Locking in a 6.2% rate today could still make sense if inflation flares up again and rates rebound.

What Homeowners Should Know: Refinancing Opportunities

For existing homeowners, the combination of fed rate cuts and mortgage rates trending down opens the door for refinancing — but only for certain borrowers.

If you took out a loan at 7% or higher, refinancing now could save you hundreds per month. However, those already in the 5%–6% range might find the benefit too small to justify the costs of closing and fees.

Refinance Example:

| Current Loan Amount | Current Rate | New Rate | Monthly Savings | Annual Savings |

|---|---|---|---|---|

| $400,000 | 7.00% | 6.20% | $200 | $2,400 |

Before refinancing, calculate your break-even point — the number of months it takes for savings to exceed upfront costs. If you plan to stay in your home long term, even modest rate drops can pay off significantly.

How the Fed’s Actions Affect the Broader Housing Market

The effect of fed rate cuts ripples beyond individual loans. Lower borrowing costs can boost housing demand, construction activity, and related industries such as home improvement, insurance, and retail.

Key Impacts of the Recent Rate Cuts:

- Rising Mortgage Applications: Refinancing and new loan applications have increased modestly, signaling growing buyer confidence.

- Improved Builder Sentiment: Homebuilders report stronger optimism, especially for entry-level housing.

- Refinancing Uptick: Mortgage refinancing applications have risen by nearly 10% in the weeks following the second Fed cut.

- Persistent Supply Constraints: Inventory remains tight, preventing large price corrections even as rates ease.

The result? A housing market that’s stabilizing — not booming, but healthier than it was in early 2024.

Mortgage Rate Outlook: What Experts Expect Through 2026

The future path of mortgage rates depends on how inflation, economic growth, and bond yields evolve. Economists expect only gradual declines from here.

Forecast for 30-Year Fixed Mortgage Rates

| Period | Projected Range | Notes |

|---|---|---|

| Q4 2025 | 6.0% – 6.3% | Fed cuts priced in |

| Q1 2026 | 5.8% – 6.1% | Inflation likely cooling further |

| Q2 2026 | 5.6% – 5.9% | Possible further Fed easing |

| Q4 2026 | 5.5% (optimistic case) | Dependent on labor and inflation data |

While some forecasters believe a sub-6% average is achievable by late 2026, others caution that higher government debt and lingering inflation could keep rates higher than many expect.

The Economic Balancing Act

The Fed faces a delicate challenge: cutting rates enough to support the economy without reigniting inflation. If rate cuts prove too aggressive, inflation could rebound, forcing the Fed to reverse course.

For mortgage borrowers, this creates both opportunity and uncertainty. Acting now — while rates hover near one-year lows — could protect against future fluctuations.

How Borrowers Can Make the Most of the Current Market

1. Monitor Mortgage Offers

Lenders adjust pricing daily. Compare quotes from multiple institutions and consider both fixed and adjustable options to find the best fit.

2. Strengthen Your Credit Profile

A higher credit score can lower your rate by 0.25% or more, saving thousands over the life of a loan. Pay down balances and avoid new debt before applying.

3. Lock When You’re Ready

If a rate works for your budget, don’t hesitate to lock it in. Waiting for “the perfect rate” can backfire if market conditions change suddenly.

4. Consider a Shorter-Term Loan

A 15-year mortgage can significantly reduce total interest costs, and rates on shorter terms are typically 0.5% lower than 30-year loans.

5. Stay Flexible

If you plan to move or refinance within five to seven years, a 5/1 adjustable-rate mortgage (ARM) might offer lower payments upfront.

The Bigger Picture: Fed Rate Cuts, Inflation, and the American Dream

At the heart of this discussion lies a larger question: can the Fed’s actions restore affordability and stability to the housing market?

For now, the answer is mixed. Lower rates are helping more buyers reenter the market, but they’re also reigniting demand faster than supply is improving. Unless housing inventory grows substantially, affordability challenges will persist.

Still, the direction of change is positive. The era of rising mortgage rates appears to have peaked, and the Fed’s cautious cuts signal a gradual return to balance between growth and price stability.

Final Thoughts

The relationship between fed rate cuts and mortgage rates is often misunderstood but critically important. While recent Fed actions have nudged borrowing costs lower, the path to affordable mortgages will be slow and uneven.

Homebuyers should see these developments as a window of opportunity, not a countdown to ultra-low rates. For homeowners, refinancing could make sense now rather than waiting for uncertain future cuts.

As we move into 2026, one thing is clear: the era of rapid rate hikes is over — but patience, preparation, and perspective remain the keys to navigating the modern mortgage market.

FAQs

Q1: Do Fed rate cuts directly reduce mortgage rates?

Not directly. Fed rate cuts lower short-term borrowing costs, but mortgage rates are influenced by long-term bond yields and investor expectations about inflation.

Q2: Could mortgage rates fall below 5% in 2026?

It’s possible, but unlikely unless inflation falls faster than expected. Most forecasts predict rates between 5.6% and 6% through next year.

Q3: Is now a good time to refinance?

If your current rate is 6.75% or higher, refinancing could be worthwhile. Always calculate your break-even point before deciding.

Disclaimer:

This article is for informational purposes only and should not be considered financial, tax, or legal advice. Readers should consult qualified mortgage or financial professionals before making decisions related to home loans or refinancing.