Understanding how much can you put in a 401k per year is crucial for anyone planning a secure retirement. 401k plans offer one of the most powerful ways to save for retirement, especially when employers provide matching contributions. Knowing contribution limits, catch-up rules, and strategic planning options helps you maximize your savings and minimize taxes.

As of 2025, the IRS has updated the contribution limits for 401k accounts, giving employees more room to save for the future. This article breaks down all the details, strategies, and nuances to help you make the most of your retirement plan.

KEY POINTS SUMMARY

For fast readers:

- 2025 Contribution Limit: $23,000 for employees under 50.

- Catch-Up Contributions: Additional $7,500 for those aged 50 or older.

- Employer Matching: Can significantly boost retirement savings.

- Roth vs Traditional 401k: Affects tax treatment of contributions and withdrawals.

- Contribution Strategies: Maximize employer match first, then consider additional investments in Roth or IRA accounts.

These key points provide a quick overview of how much you can save each year and the strategies to optimize your 401k.

2025 401K CONTRIBUTION LIMITS

Understanding the annual contribution limits is the foundation of maximizing your 401k savings:

- Under Age 50: Employees can contribute up to $23,000 in 2025.

- Age 50 and Older: Eligible for catch-up contributions of $7,500, totaling $30,500 annually.

- Significance: These limits allow employees to take full advantage of tax-deferred growth and compound interest over time.

Maxing out contributions, especially early in your career, can dramatically increase your retirement nest egg over decades.

CATCH-UP CONTRIBUTIONS: BOOSTING RETIREMENT SAVINGS

For employees approaching retirement age, catch-up contributions are critical:

- Eligibility: Age 50 and above can contribute extra $7,500 on top of standard 401k limits.

- Benefit: This provides an opportunity to accelerate savings if you started contributing later in your career.

- Strategy: Focus on maximizing catch-up contributions while also maintaining consistent investment growth through diversified portfolio choices.

Catch-up contributions are particularly valuable for late starters or those who receive windfalls like bonuses.

EMPLOYER MATCHING CONTRIBUTIONS

One of the most impactful features of a 401k is employer matching:

- Common Matching Structures: 50% match up to 6% of salary, or dollar-for-dollar match up to a set percentage.

- Impact on Savings: Employer matches are essentially free money, increasing the total annual contribution beyond your personal limit.

- Maximization Tip: Always contribute at least enough to get the full employer match before considering other investments.

Employer matching can add thousands of dollars per year, significantly enhancing long-term growth.

TRADITIONAL VS ROTH 401K CONTRIBUTIONS

Your choice of account type influences taxes and withdrawals:

- Traditional 401k: Contributions are pre-tax, reducing taxable income in the current year. Taxes are owed upon withdrawal in retirement.

- Roth 401k: Contributions are made with after-tax dollars, allowing for tax-free withdrawals if certain conditions are met.

- Strategy: Younger employees may benefit from Roth contributions due to potential lower taxes later, while higher earners may prioritize traditional contributions for immediate tax relief.

A mixed approach using both types can help manage taxes and maximize flexibility in retirement.

INVESTMENT OPTIONS WITHIN A 401K

Investment selection within a 401k is generally determined by the employer:

- Typical Choices: Mutual funds, index funds, target-date funds, and sometimes company stock.

- Diversification Importance: Spreading investments across asset classes reduces risk and optimizes returns.

- Rebalancing: Regularly adjusting your portfolio ensures alignment with risk tolerance and retirement goals.

Even within limited options, a strategic allocation can maximize the growth potential of your 401k contributions.

TAX BENEFITS OF MAXIMIZING CONTRIBUTIONS

Maxing out your contributions offers substantial tax advantages:

- Tax Deferral: Traditional 401k contributions reduce taxable income, lowering your current tax bill.

- Compounded Growth: Contributions grow tax-deferred, which amplifies the power of compounding over decades.

- Roth Advantages: Roth contributions grow tax-free, offering a tax-efficient income source in retirement.

Understanding these tax implications can help you create a retirement plan that minimizes future liabilities.

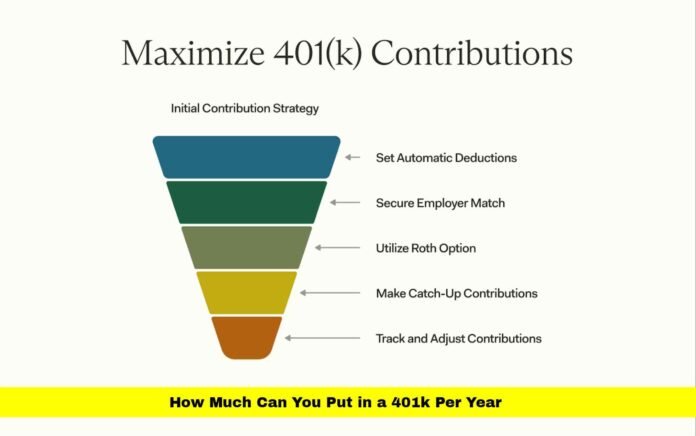

STRATEGIES TO MAXIMIZE ANNUAL 401K CONTRIBUTIONS

To get the most from your 401k:

- Start Early: Contribute as much as possible from your first paycheck to benefit from compounding.

- Incremental Increases: Gradually increase contributions annually, especially after raises or bonuses.

- Combine with Catch-Up Contributions: If eligible, add the catch-up contribution to accelerate growth.

- Diversify Investment Choices: Use available funds to match your risk tolerance and retirement timeline.

Implementing these strategies ensures your annual 401k contributions reach their full potential.

HOW 401K CONTRIBUTIONS AFFECT RETIREMENT TIMELINES

Contribution levels directly influence your retirement readiness:

- Early Career: Even modest contributions grow significantly over decades.

- Mid-Career: Maximizing contributions during peak earning years has the greatest impact.

- Late Career: Use catch-up contributions to fill any retirement savings gaps.

Consistent contributions over time, combined with employer matches, provide the best pathway to a secure retirement.

PORTABILITY AND ROLLOVERS

Changing jobs does not mean losing your contributions:

- Rollover Options: 401k balances can roll into a new employer’s plan or into an IRA.

- Avoiding Penalties: Properly executed rollovers maintain tax benefits and avoid early withdrawal penalties.

- Strategy: Consolidating accounts can simplify management and reduce fees.

Portability ensures your 401k contributions remain protected and continue to grow, even through job transitions.

FEES AND EXPENSE CONSIDERATIONS

401k fees can significantly impact long-term growth:

- Types of Fees: Administrative fees, investment fund expense ratios, and third-party management fees.

- Impact: Even small fees can reduce total retirement savings over decades due to compounding.

- Minimization Tip: Compare fund options within your 401k and choose low-cost index funds when available.

Managing fees is an often-overlooked aspect of maximizing annual contributions effectively.

FREQUENTLY ASKED QUESTIONS

1. Can I contribute more than the IRS limit with employer matching?

Yes, employer contributions do not count toward your personal limit, allowing total contributions above the employee limit.

2. What happens if I exceed the annual contribution limit?

Excess contributions must be corrected by the tax-filing deadline to avoid penalties and double taxation.

3. Can I split my 401k contributions between Roth and Traditional accounts?

Yes, most plans allow a mix, letting you balance current tax benefits with future tax-free withdrawals.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Consult a qualified professional before making decisions about 401k contributions.