The US inflation picked up to 3% in September 2025, marking a small but significant rise that is once again drawing attention to price stability and the Federal Reserve’s next move. While this level is far below the 9% peak seen in 2022, it shows that the economy is not yet fully in the “post-inflation” era many Americans hoped for.

The new report from the Bureau of Labor Statistics showed both headline and core inflation hovering around 3%, suggesting that while most categories are stabilizing, certain sectors — including energy, housing, and services — continue to push overall prices higher.

Breaking Down the 3% Inflation Increase

The 3% figure means that the Consumer Price Index (CPI) — a measure of average prices across a basket of goods and services — has risen 3% compared to the same month a year earlier. On a monthly basis, inflation ticked up 0.3%, reflecting a steady climb in costs for fuel, food, and shelter.

Key details include:

- Gasoline prices rose by over 4% in September, reversing earlier summer declines and contributing heavily to the overall increase.

- Food prices edged higher by 0.2%, particularly in categories like dairy, grains, and restaurant meals.

- Shelter costs—which make up nearly one-third of the CPI—remained stubborn, rising 0.4% month-to-month.

- Medical and insurance services also saw an uptick, as healthcare inflation continues to exceed the overall average.

Despite cooling prices in electronics, apparel, and used cars, these gains were not enough to offset inflationary pressure in essential categories.

Why Inflation Picked Up Again

The fact that US inflation picked up to 3% after months of apparent stability reflects both domestic and global influences.

1. Higher energy costs

Oil and gas prices have surged in recent months as global supply tightens, pushing transportation and utility bills higher for U.S. households. These costs ripple through industries, affecting everything from groceries to manufacturing.

2. Persistent housing inflation

While home sales have slowed due to high interest rates, rental inflation remains strong. Rent increases in major cities continue to outpace income growth, and shelter costs remain one of the biggest contributors to the inflation index.

3. Rising labor costs

A tight labor market means employers continue raising wages to attract workers, particularly in service sectors such as healthcare, hospitality, and logistics. Businesses then pass part of those increased labor costs to consumers through higher prices.

4. Global trade pressures

Tariffs and disruptions in global shipping have increased costs for imported goods, particularly electronics, appliances, and home furnishings. These price pressures are feeding back into U.S. consumer markets.

5. Strong consumer spending

American consumers have continued to spend despite high interest rates, supported by wage growth and a resilient job market. That steady demand has made it easier for businesses to maintain higher prices.

What the 3% Rate Means for Households

When inflation climbs to 3%, its effects can be felt across nearly every aspect of daily life.

- Groceries: Prices remain about 25% higher than pre-pandemic levels. Even small increases in staple goods like bread, eggs, and milk add up for families.

- Fuel and transportation: Gas prices have edged closer to $4 per gallon in some regions, impacting commuting costs and freight prices.

- Housing: Rent inflation continues to weigh heavily on middle- and lower-income families. Mortgage rates above 6% have also cooled the housing market but not yet brought relief to renters.

- Healthcare: Medical services and insurance premiums continue to climb faster than other categories, putting pressure on household budgets.

In real terms, a 3% inflation rate means that consumers are paying about $3 more for every $100 of goods compared to last year. While that may seem modest, it compounds over time — especially when wage growth begins to slow.

Impact on the Federal Reserve’s Policy Decisions

The Federal Reserve now faces a complex balancing act. After aggressively raising interest rates between 2022 and 2024 to curb runaway inflation, the Fed had begun signaling potential rate cuts later this year. However, with inflation picking back up to 3%, officials may proceed more cautiously.

- If inflation remains near 3%, the Fed could delay cuts to avoid reigniting price growth.

- If core inflation starts to fall below 2.5%, modest rate cuts could still occur by early 2026.

- If energy and housing costs remain high, policymakers may keep borrowing costs steady well into next year.

A key risk is that maintaining higher interest rates for too long could slow consumer spending and weaken job growth. The central bank’s challenge is to keep inflation anchored without triggering a recession.

Comparison with Previous Years

| Year | Annual Inflation Rate | Key Drivers |

|---|---|---|

| 2022 | 9.1% (peak) | Energy, food, global supply chain crisis |

| 2023 | 4.0% | Wage growth, lingering supply issues |

| 2024 | 2.9% | Cooling housing, easing supply chains |

| 2025 (current) | 3.0% | Fuel, housing, and service costs |

This trend suggests the U.S. has successfully escaped the high-inflation crisis but is still grappling with a “sticky” 3% rate that refuses to fall back to the Federal Reserve’s 2% target.

Sectors Most Affected by Rising Prices

Housing and Shelter: Rents are now 25–30% higher than pre-pandemic averages. Limited new housing construction and persistent demand have kept prices from easing meaningfully.

Energy: Gasoline, natural gas, and electricity bills have all risen, with seasonal fuel adjustments expected through winter.

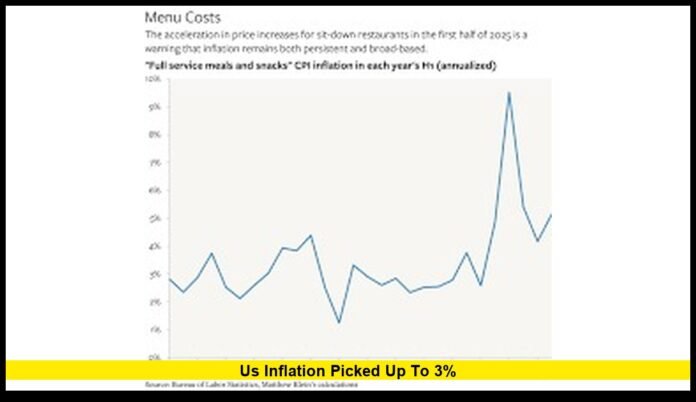

Food and Dining: Restaurants continue to raise menu prices due to higher wages and supply costs. While grocery inflation has eased, food overall is still about 3.5% higher than last year.

Healthcare: Hospital services and insurance premiums have climbed, with medical inflation remaining above 4%.

Travel and Recreation: Airline tickets and hospitality prices have increased slightly, reflecting strong consumer demand and limited supply.

Economic Outlook for Late 2025

Economists expect inflation to stay near the 3% level through the final quarter of 2025 before gradually declining in early 2026. Several trends support this projection:

- Energy prices could ease as global production stabilizes.

- Supply chains continue to normalize, helping control imported goods costs.

- Consumer spending may slow slightly as higher interest rates take full effect.

- Wage growth may cool, reducing cost-push inflation pressures.

However, risks remain. If global oil prices spike or wage growth accelerates faster than productivity, inflation could stay above target longer than expected.

How Businesses Are Adjusting

For American companies, the persistence of 3% inflation is forcing strategic adjustments:

- Retailers are offering smaller package sizes (known as “shrinkflation”) to maintain margins without outright price hikes.

- Manufacturers are investing in automation and logistics to reduce labor dependency and production costs.

- Small businesses are focusing on loyalty programs and digital sales to manage thinner profit margins.

Large corporations have largely adapted, but smaller enterprises face ongoing challenges as supply costs and wages continue to climb.

What Consumers Can Do

For households, navigating a 3% inflation environment requires planning and flexibility:

- Review household budgets: Identify non-essential expenses that can be reduced.

- Shop strategically: Use store loyalty programs and digital coupons to offset grocery costs.

- Lock in fixed-rate loans: With interest rates still high, securing fixed-rate financing helps protect against future increases.

- Invest in inflation-protected assets: Consider Treasury Inflation-Protected Securities (TIPS) or real estate investments that rise with inflation.

- Negotiate bills and subscriptions: Many service providers offer lower rates upon request — especially in telecom, insurance, and streaming services.

A Cautious Optimism Moving Forward

While inflation has risen slightly, economists emphasize that the U.S. remains in a far better position than during the price surge of 2022. Wage gains, job growth, and strong consumer spending continue to support overall economic stability.

The challenge for policymakers now is ensuring inflation remains manageable without stalling economic progress. For most Americans, that means balancing optimism about wage growth with realistic expectations for continued cost pressure in essentials like housing, healthcare, and fuel.

In summary, the fact that US inflation picked up to 3% is both a reminder of the economy’s resilience and a warning about lingering price pressures. While the days of record inflation are behind us, achieving full price stability remains a work in progress.

How are rising costs affecting your household or business? Share your thoughts below and stay informed about the next key economic updates.