How much does property management cost is a question every landlord, investor, and property owner asks before hiring a management company. In 2025, the answer is more complex than ever. The traditional percentage-of-rent model still dominates, but with rising repair costs, new regulations, and technology-driven tools, the real picture includes a range of fees and hidden charges that many owners overlook.

This in-depth guide explores every angle of property management costs today—monthly fees, leasing charges, regional variations, and negotiation strategies—so you know exactly what to expect.

Why Property Management Costs Matter More in 2025

Property managers aren’t just rent collectors. They handle compliance with strict housing laws, respond to tenant requests, coordinate repairs, and reduce vacancy rates. But these services come at a price, and with inflation and tenant advocacy on the rise, fees have shifted.

In 2025, landlords face:

- Higher labor and maintenance costs for repairs

- Tenant protections requiring faster response times

- Transparency rules demanding disclosure of all charges

- Technology adoption costs as managers implement AI tools, portals, and predictive maintenance

Understanding these factors is crucial to estimating how much property management really costs today.

The Core Question: How Much Does Property Management Cost on Average?

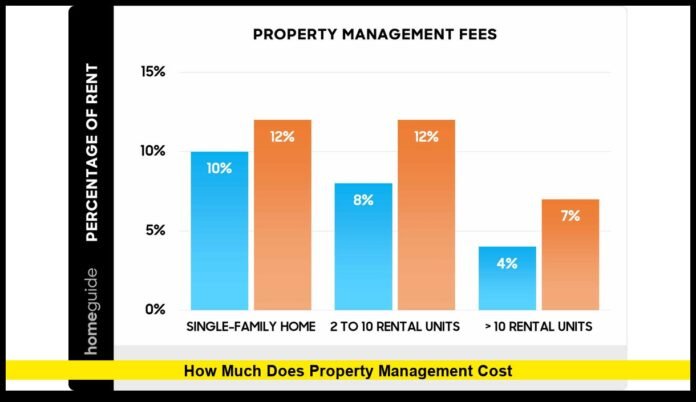

The average cost of property management depends on property type, region, and service level.

- Residential properties: 8–12% of monthly rent

- Commercial properties: 4–12% depending on size and complexity

- Flat fee models: $100–$500 per property per month

- Luxury rentals: Lower percentage (6–8%) but higher flat fees

On top of these base numbers, owners should budget for additional charges like leasing fees, renewals, and maintenance markups.

Breakdown of Common Property Management Fees

To fully answer “How much does property management cost,” let’s detail every possible fee you may encounter.

1. Monthly Management Fee

This is the main recurring cost. It covers rent collection, tenant communication, and routine management.

- Percentage model: 8–12% of rent collected

- Flat fee: $100–$300 per month

- Hybrid model: Smaller percentage plus flat base

2. Leasing or Tenant Placement Fee

Charged each time a new tenant is signed. This fee covers advertising, showings, applications, and screening.

- Typically 50–100% of one month’s rent

- Some companies discount it to stay competitive

3. Lease Renewal Fee

When a tenant extends their lease, managers often charge a smaller fee.

- Usually $150–$500

- Some companies waive it to attract business

4. Maintenance and Repair Markups

Management companies often add a fee to contractor invoices.

- Average markup: 5–15%

- Applies to routine and emergency repairs

- Justified as covering scheduling, liability, and oversight

5. Inspection Fees

- $50–$150 per inspection

- Covers move-in, move-out, and periodic property checks

6. Setup or Onboarding Fee

One-time charge for new clients.

- $200–$500

- Covers account setup, initial inspection, and document transfers

7. Eviction Fees

If eviction is necessary, managers charge coordination fees plus legal costs.

- $200–$500 for admin

- Court and attorney costs extra

8. Vacancy or Holding Fees

Some firms charge to manage empty units.

- Often a small percentage of projected rent

- Covers security checks and advertising

9. Termination Fees

Charged if an owner cancels the management agreement early.

- Equal to one month’s fee or a pre-set penalty

Cost Comparisons: Flat Fee vs. Percentage Model vs. Hybrid

| Model | How It Works | Pros | Cons | Best For |

|---|---|---|---|---|

| Percentage | Manager takes % of rent collected (8–12%) | Aligns incentives, flexible | Higher cost on luxury units | Standard rentals |

| Flat Fee | Fixed $100–$500 per property | Predictable, simple | May overpay on smaller rentals | Small units, low-rent areas |

| Hybrid | Combination of flat + % | Balanced cost structure | Complex contracts | Larger portfolios |

For owners with multiple units or higher-value rentals, negotiating a hybrid or flat-fee model often saves money.

Regional Differences in Property Management Costs

Urban vs. Suburban Areas

- Cities: More competition leads to slightly lower percentages, but higher flat fees.

- Suburbs: Fewer firms, so fees can be higher overall.

High-Cost States

- States like California and New York often see 6–10% management fees but higher leasing charges.

Smaller Markets

- In rural or low-rent areas, percentage fees may be 10–12% because flat models don’t generate enough income for managers.

Real-Life Cost Scenarios in 2025

Example 1: Single-Family Rental

- Rent: $2,000/month

- Management fee (10%): $200

- Leasing fee (75% of rent): $1,500

- Renewal: $250

- Maintenance markup: $150

Annual cost: $4,150 (~17% of rent income)

Example 2: Four-Unit Multifamily

- Rent per unit: $1,400 → $5,600 total

- Management fee (8%): $448/month

- Leasing (2 units turnover): $2,100

- Renewals: $600

- Maintenance markup: $500

Annual cost: $9,476 (~14% of rent income)

Example 3: Commercial Retail Property

- Rent: $12,000/month

- Management fee (6%): $720/month

- Leasing fee: Negotiated, often lower percentage

- Maintenance markup: $1,000 on $10,000 repairs

Annual cost: ~ $10,640 plus extras

Hidden Fees Owners Should Watch For

Some property management companies add less obvious charges:

- Advertising surcharges beyond placement fees

- Technology fees for using portals or apps

- Annual admin fees for account maintenance

- Late fee splits where managers keep part of tenant late payments

Transparency is key. Always request a full fee schedule before signing a contract.

How Rising Trends Are Shaping Costs in 2025

1. Technology Integration

AI-driven tenant screening, digital portals, and predictive maintenance reduce delays but may come with subscription or system fees passed to owners.

2. Regulatory Oversight

Regulators are cracking down on hidden or “junk” fees. This could reduce surprise charges but raise base percentages to offset lost revenue.

3. Inflation and Labor Shortages

Rising contractor rates mean higher maintenance costs, which often come with markups by management firms.

4. Tenant Pressure

Tenant unions demand faster repairs and stricter compliance, which means managers must spend more time and resources on responsiveness.

How to Negotiate and Save on Management Costs

Smart landlords can reduce costs by:

- Requesting multiple bids from management companies

- Negotiating lower placement fees for repeat tenants

- Bundling services like inspections and renewals into the base fee

- Asking for bulk discounts when managing multiple units

- Setting caps on maintenance markups

Is Property Management Worth the Cost?

While costs can seem high, property management offers significant value:

- Saves owners time and stress

- Reduces legal risk by ensuring compliance

- Minimizes vacancies through professional marketing

- Provides access to vetted contractors

- Improves tenant satisfaction and retention

For many landlords, the benefits outweigh the fees—especially for those managing multiple units or out-of-state properties.

Future Outlook for Property Management Fees

Looking ahead, we may see:

- More flat-fee and hybrid models replacing pure percentage-based contracts

- Performance-based fees, tying management pay to occupancy rates

- Greater fee disclosure requirements under consumer protection laws

- Technology-driven efficiencies that reduce certain costs but increase tech-related fees

Overall, while costs may rise due to inflation and compliance, owners will gain more transparency and choice in fee structures.

Conclusion

So, How Much Does Property Management Cost? The average sits around 8–12% of monthly rent, plus leasing, renewal, and maintenance fees. But the exact figure depends on property type, location, and contract details. In 2025, costs are shaped not just by market norms, but also by legal changes, technology, and tenant expectations.

The key is simple: always demand transparency, compare multiple firms, and negotiate terms that align with your property goals.

Have you had experience with property management costs? Share your thoughts in the comments below and let others learn from your journey.

FAQs

1. Can property management fees be negotiated?

Yes. Owners with multiple properties or long-term contracts often get reduced rates or waived fees.

2. Are property management fees tax deductible?

Yes. In most cases, management fees are considered deductible business expenses for rental income.

3. Do property managers charge when rent isn’t collected?

Some do. Always confirm whether the fee is based on “rent due” or “rent collected” before signing.