For students planning higher education, deciding between a subsidized vs unsubsidized loan can be one of the most important financial steps. With tuition costs continuing to rise in 2025, many families are relying on federal student aid to cover gaps left after scholarships or grants. While both subsidized and unsubsidized loans fall under the federal Direct Loan Program, their terms, benefits, and long-term costs differ significantly. Knowing the fine print can save students thousands of dollars over the life of a loan.

Why the Subsidized vs Unsubsidized Loan Choice Matters

Choosing between these two loans isn’t just about immediate affordability. It shapes how much debt will accumulate by the time a student graduates, how quickly repayment becomes overwhelming, and even whether certain forgiveness programs can be maximized.

Key Points Summary ✨ (For Readers Who Want It Fast)

- 📌 Subsidized loans save money by pausing interest while you’re in school.

- 📌 Unsubsidized loans are easier to access but cost more due to nonstop interest.

- 📌 Loan limits vary by academic year and dependency status.

- 📌 Federal interest rates in 2025 remain fixed but differ by borrower type.

- 📌 Strategic borrowing (subsidized first, unsubsidized later) reduces long-term debt.

Understanding Subsidized Loans in 2025

A Direct Subsidized Loan is awarded only to undergraduate students who can demonstrate financial need through the FAFSA process. Its defining feature is that the government covers the interest cost while the student is:

- Enrolled at least half-time,

- In the six-month grace period post-graduation,

- In approved deferment periods.

This effectively keeps the loan balance frozen until repayment starts, which is a huge relief for students worried about debt ballooning before they’ve earned their first paycheck.

Understanding Unsubsidized Loans in 2025

Unlike subsidized loans, a Direct Unsubsidized Loan does not depend on financial need and is available to both undergraduate and graduate students. However, the cost is heavier: interest accrues immediately after disbursement.

Borrowers have two options:

- Pay the interest while in school (keeping balances lower).

- Let interest accumulate and be capitalized, which increases total debt at repayment.

This makes unsubsidized loans flexible but also potentially burdensome if not managed carefully.

Direct Comparison: Subsidized vs Unsubsidized Loan

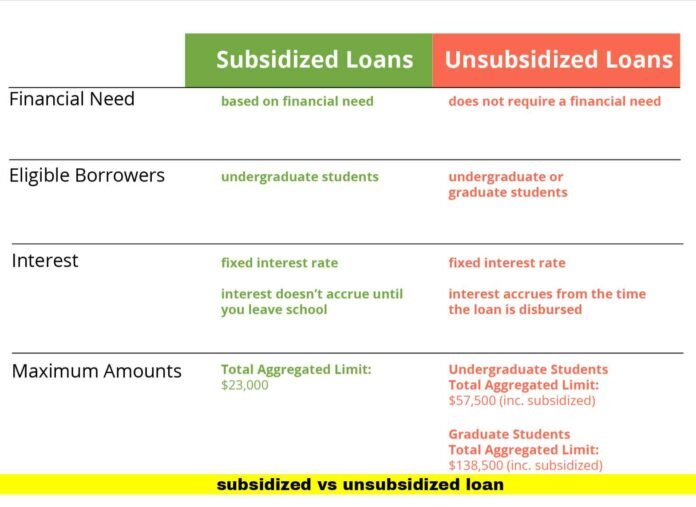

| Category | Subsidized Loan | Unsubsidized Loan |

|---|---|---|

| Eligibility | Must show financial need (FAFSA required) | Available to all students (no need required) |

| Who Qualifies | Undergraduates only | Undergraduates and graduates |

| Interest While in School | Paid by the government | Accrues immediately |

| Grace Period Interest | Paid by the government | Accrues and adds to balance |

| Borrowing Limits | Lower | Higher |

| Long-Term Cost | Less expensive | More expensive |

The table highlights why subsidized loans are always the first recommendation when available.

Loan Limits in 2025: How Much You Can Borrow

The Department of Education sets annual and lifetime borrowing limits.

- Dependent Undergraduates:

- 1st year: $5,500 (max $3,500 subsidized)

- 2nd year: $6,500 (max $4,500 subsidized)

- 3rd year and beyond: $7,500 (max $5,500 subsidized)

- Independent Undergraduates:

- 1st year: $9,500 (max $3,500 subsidized)

- 2nd year: $10,500 (max $4,500 subsidized)

- Later years: $12,500 (max $5,500 subsidized)

- Graduate Students:

- $20,500 unsubsidized annually (no subsidized eligibility).

This means even students who qualify for subsidized loans often need unsubsidized loans to fully cover tuition, housing, and other academic costs.

Interest Rates for 2025–2026

The Department of Education announces rates each summer. For the 2025–2026 academic year:

- Subsidized (Undergraduates): 5.2% fixed

- Unsubsidized (Undergraduates): 5.2% fixed

- Unsubsidized (Graduates): 7.1% fixed

Even though rates are similar for undergraduates, the timing of interest makes the difference. Subsidized borrowers avoid thousands in interest costs by graduation.

Repayment Structure Explained

Both loans enter repayment after the six-month grace period, but balances look different depending on loan type.

- Subsidized Loan Example: Borrowing $10,000 leads to a repayment balance of $10,000 upon graduation.

- Unsubsidized Loan Example: Borrowing $10,000 at 5.2% interest results in nearly $11,100 owed after four years, if no interest was paid in school.

This gap widens the longer repayment is delayed.

The Real Cost: Case Studies

Example 1: Undergraduate Borrower

Sarah borrows $15,000 subsidized and $10,000 unsubsidized. Upon graduation:

- Subsidized portion = $15,000.

- Unsubsidized portion (with accrued interest) ≈ $11,200.

Total balance = $26,200. Without subsidized loans, Sarah’s debt could have been closer to $30,000.

Example 2: Graduate Borrower

Daniel, a graduate student, borrows $40,000 unsubsidized. By the end of a two-year program, his balance is nearly $43,000. Since graduate students are ineligible for subsidized loans, his repayment burden is higher from the start.

Long-Term Benefits of Subsidized Loans

- Keeps debt manageable during college years.

- Encourages responsible borrowing through capped amounts.

- Reduces psychological stress by freezing balance until repayment.

Long-Term Risks of Unsubsidized Loans

- Larger balance after graduation.

- Interest compounding can trap borrowers in long-term repayment.

- Easy access makes it tempting to borrow more than necessary.

Strategic Borrowing Tips for Students

- Always accept subsidized loans first. They’re the cheapest option.

- Borrow unsubsidized loans cautiously. Cover essentials, not lifestyle extras.

- Consider paying interest while in school. Small payments can save thousands later.

- Track borrowing annually. Avoid surprises at graduation.

- Pair loans with scholarships, grants, and part-time work.

Policy Updates in 2025 That Affect Loans

- SAVE Repayment Plan Expansion: Offers income-based repayment with payments as low as 5% of discretionary income.

- Streamlined PSLF (Public Service Loan Forgiveness): Faster certification process benefits teachers, nurses, and government employees.

- Digital FAFSA Improvements: Easier application increases student access to subsidized loans.

These changes make understanding the subsidized vs unsubsidized loan structure even more important, as repayment flexibility now ties directly to total borrowed balances.

Common Myths About Subsidized vs Unsubsidized Loans

- Myth 1: “Unsubsidized loans are bad loans.”

- Reality: They’re not bad; they just cost more. For many, they’re the only option.

- Myth 2: “Graduate students can qualify for subsidized loans.”

- Reality: Only undergraduates are eligible.

- Myth 3: “You can’t pay interest on unsubsidized loans while in school.”

- Reality: You can—and should, if possible.

How Families Can Support Borrowers

Parents and guardians can play a role by:

- Helping with FAFSA completion early each year.

- Explaining repayment responsibilities to teens.

- Encouraging part-time work to cover unsubsidized loan interest.

- Discussing realistic post-college salary expectations.

Practical Borrowing Scenarios

- Scenario A: A freshman with full Pell Grant still needs $5,000. Taking it as subsidized ensures no growth until repayment.

- Scenario B: A graduate student must borrow $15,000 annually. Knowing it’s all unsubsidized, making $50 monthly interest payments in school prevents capitalization.

Final Thoughts

The subsidized vs unsubsidized loan debate isn’t about which loan is “good” or “bad.” It’s about making informed decisions. Subsidized loans provide unmatched affordability for undergraduates, while unsubsidized loans widen access but with higher long-term costs.

For 2025 borrowers, the smartest strategy is clear: borrow subsidized first, then carefully weigh unsubsidized amounts based on career goals, repayment options, and expected income. A thoughtful approach ensures education remains an investment rather than a financial burden.

FAQs

Q1: Can I switch my unsubsidized loan into a subsidized loan later?

No, once issued, loan type cannot be converted. Eligibility depends on FAFSA at the time of application.

Q2: Do unsubsidized loans qualify for forgiveness programs?

Yes, both subsidized and unsubsidized loans qualify for PSLF and income-driven repayment programs.

Q3: What happens if I pay only the minimum on unsubsidized loans?

Your repayment term will extend, and total interest paid will be much higher compared to subsidized loans.

Disclaimer

This content is for educational purposes only. It should not be taken as financial or legal advice. Students should consult official Federal Student Aid resources or a certified financial advisor before making borrowing decisions.