If you’ve ever wondered what is a backdoor Roth IRA, the answer is straightforward: it’s a retirement savings strategy designed specifically for high-income earners who are locked out of making direct Roth IRA contributions. Normally, Roth IRAs have strict income limits that prevent individuals above a certain threshold from contributing. But the backdoor Roth IRA provides a legal way around this restriction by using a two-step process.

First, you make a nondeductible contribution to a Traditional IRA with after-tax dollars. Then, you convert that contribution into a Roth IRA. Once the money is in the Roth, it enjoys all the same benefits as a direct Roth contribution: tax-free growth, tax-free withdrawals in retirement if conditions are met, and no required minimum distributions during the account owner’s lifetime. This makes it one of the most attractive options for building long-term wealth that won’t be eroded by taxes in retirement.

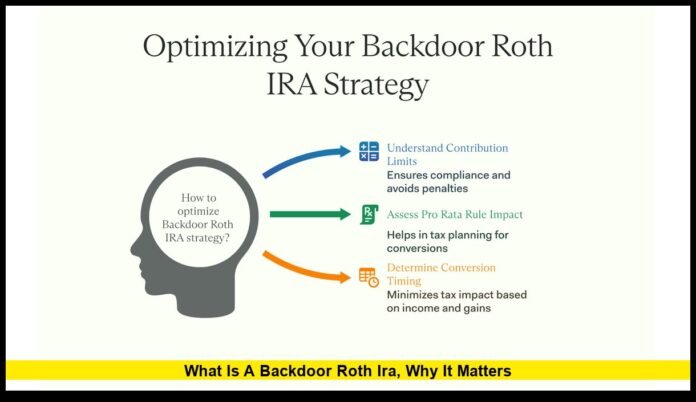

As of 2025, the backdoor Roth IRA remains a fully legal and effective tool for retirement savers. Despite occasional discussions in Congress about limiting or eliminating it for high earners, the rules are unchanged this year. Contribution limits are the same as other IRAs—$7,000 annually for individuals under age 50, and $8,000 for those 50 or older thanks to the catch-up provision. Income thresholds for direct Roth contributions, however, are still restrictive, which is why many professionals, executives, and entrepreneurs rely on the backdoor method to access Roth advantages.

In short, the backdoor Roth IRA remains one of the most powerful strategies in 2025 for individuals seeking to maximize their tax-free retirement income while working around income limits.

The Latest on Backdoor Roth IRAs in 2025

As of 2025, backdoor Roth IRAs are still allowed under IRS rules. Despite ongoing discussions in Washington about limiting or phasing them out for high earners, no legislation has passed to restrict the strategy. This makes 2025 another year where individuals with income above Roth IRA thresholds can still benefit from Roth accounts.

The IRA contribution limit for 2025 is $7,000 for people under age 50 and $8,000 for those 50 and older thanks to the $1,000 catch-up provision. These limits apply whether you are contributing directly to a Roth IRA or using the backdoor method.

Income eligibility thresholds for direct Roth IRA contributions have risen slightly in 2025 due to inflation adjustments, but many households will still be phased out of eligibility. That’s where the backdoor Roth IRA continues to be so valuable.

What Is a Backdoor Roth IRA?

A backdoor Roth IRA isn’t a special type of account. Instead, it’s a workaround strategy. Here’s how it works:

- Contribute to a Traditional IRA using after-tax dollars. Since there are no income limits on making nondeductible contributions to a Traditional IRA, this step is always available.

- Convert that contribution into a Roth IRA. Because Roth conversions don’t have income restrictions, this step allows the money to move into a Roth account where it can grow tax-free.

Once the money is in the Roth IRA, it enjoys all the same benefits as a direct contribution: tax-free growth, tax-free qualified withdrawals, and no required minimum distributions during the account owner’s lifetime.

Why High-Income Earners Use the Strategy

The Roth IRA offers benefits that Traditional IRAs cannot match. By using a backdoor Roth IRA, high-income households secure:

- Tax-free withdrawals in retirement (if rules are followed).

- Freedom from required minimum distributions (RMDs).

- Estate planning advantages, since heirs can inherit Roth accounts with tax-free growth potential.

- Diversification of tax exposure, balancing pre-tax savings in 401(k)s or Traditional IRAs with tax-free Roth savings.

In short, the backdoor Roth IRA creates an opportunity for wealthy savers who would otherwise be locked out of Roth contributions to enjoy its long-term benefits.

Contribution and Income Limits in 2025

Here’s how the numbers look in 2025:

- Contribution Limits: $7,000 if under age 50; $8,000 if age 50 or older.

- Direct Roth Contribution Phase-Outs:

- Single filers: phase-out begins at $150,000 of income and ends at $165,000.

- Married filing jointly: phase-out begins at $236,000 and ends at $246,000.

- Married filing separately: not eligible once income reaches $10,000.

Anyone earning above these levels cannot contribute directly to a Roth IRA—but they can still do so indirectly via a backdoor Roth IRA.

Step-by-Step: How to Do a Backdoor Roth IRA

Here’s a clear process to follow in 2025:

- Open a Traditional IRA (if you don’t already have one).

- Make a nondeductible contribution with after-tax dollars, up to the annual limit.

- Convert the money to a Roth IRA. This is usually done soon after the contribution to avoid taxable earnings building up.

- Report the transaction on IRS Form 8606 when filing taxes, documenting the nondeductible contribution and the conversion.

Done correctly, this allows the contribution to flow into a Roth IRA without creating excess tax burdens.

Understanding the Pro Rata Rule

One of the most important parts of knowing what is a backdoor Roth IRA is understanding the pro rata rule. This IRS rule states that if you hold other pre-tax IRA balances—like Traditional, SEP, or SIMPLE IRAs—any conversion will be treated as a mix of pre-tax and after-tax money.

For example:

- If you have $93,000 in pre-tax IRA funds and add a $7,000 nondeductible contribution, your after-tax portion is just 7%.

- If you then convert $7,000, only 7% would be tax-free. The rest would be taxed.

This is why many savers clear out pre-tax IRA balances by rolling them into a 401(k), leaving only the nondeductible contribution in the IRA to convert.

Common Mistakes to Avoid

- Forgetting Form 8606: Without this, the IRS may treat your entire conversion as taxable.

- Delaying the conversion: Waiting too long can create taxable earnings before conversion.

- Ignoring other IRA balances: The pro rata rule applies to all your IRAs combined.

- Believing it’s a loophole that could be undone anytime: Conversions cannot be recharacterized under current rules.

The Mega Backdoor Roth IRA

Alongside the standard backdoor Roth IRA, there’s also the mega backdoor Roth IRA, which uses a 401(k) plan. This strategy involves making after-tax contributions to a 401(k) beyond the normal deferral limit and then converting or rolling them into a Roth account.

In 2025, the total 401(k) contribution limit (employer plus employee) is higher than $70,000 for some savers, depending on age and catch-up eligibility. Not all plans allow this feature, but for those that do, it can supercharge Roth savings well beyond the standard IRA limits.

Legislative Watch in 2025

Backdoor Roth IRAs remain on policymakers’ radar. In recent years, proposals have surfaced to eliminate or limit Roth conversions for very high earners. However, no law has yet been passed to close the backdoor Roth IRA. For now, the strategy is alive and well, but it’s wise to stay alert as new budget debates or retirement reforms emerge in Congress.

Who Should Consider a Backdoor Roth IRA?

Good candidates include:

- High-income earners above Roth IRA limits.

- Savers with little or no pre-tax IRA balances.

- People expecting higher tax rates in the future.

- Investors seeking tax diversification in retirement.

It may not be ideal if:

- You hold large pre-tax IRA balances subject to the pro rata rule.

- You anticipate lower tax rates in retirement.

- You need liquidity soon and cannot wait for Roth withdrawal rules.

Tax Considerations

Taxes owed on a backdoor Roth IRA depend on timing and existing IRA balances:

- If you convert a clean after-tax contribution quickly, taxes may be minimal.

- If the money earns income before conversion, that portion is taxable.

- If you have large pre-tax IRA balances, most of the conversion could be taxed under the pro rata rule.

This is why planning and accurate reporting are essential.

Practical Tips for 2025

- Act quickly after contributing to avoid taxable earnings before conversion.

- Check all IRA balances before starting—don’t overlook SEP or SIMPLE IRAs.

- Keep clear records and file Form 8606 accurately.

- Stay informed about legislation, as rules may evolve in coming years.

- Consult a professional if your situation involves large balances or complex tax planning.

Conclusion

So, what is a backdoor Roth IRA? It’s not a loophole, but a legitimate method to fund a Roth IRA when your income is too high for direct contributions. In 2025, it remains an effective way for high-income earners to access the powerful tax-free growth and retirement flexibility Roth IRAs provide.

Used correctly, it can be a cornerstone of long-term financial planning. But it requires awareness of the pro rata rule, tax reporting, and ongoing legislative developments. For many, the backdoor Roth IRA is a smart way to secure tax-free retirement income well into the future.

Have questions or experiences with this strategy? Share your thoughts in the comments below—your perspective might help others navigating the same decision.

FAQs

Q1: Can I do a backdoor Roth IRA if I’m under the income limit?

Yes, but if you’re eligible to contribute directly, that’s usually simpler. The backdoor method is designed for high earners.

Q2: What happens if I have other Traditional IRA balances?

The pro rata rule applies, making part of your conversion taxable. Rolling old IRAs into a 401(k) can sometimes solve this.

Q3: Is the backdoor Roth IRA going away soon?

While there are proposals to limit it, no changes have been enacted. For now, it’s fully available in 2025.

Disclaimer

This article is for informational purposes only. Tax laws can change, and individual circumstances vary. Consult a qualified tax or financial professional before making decisions about Roth IRA strategies.