Roth 401 k contribution limits 2025 will rise to a maximum of $23,500, offering savers a clearer path toward tax-free retirement savings.

2025 Roth 401(k) Contribution Updates

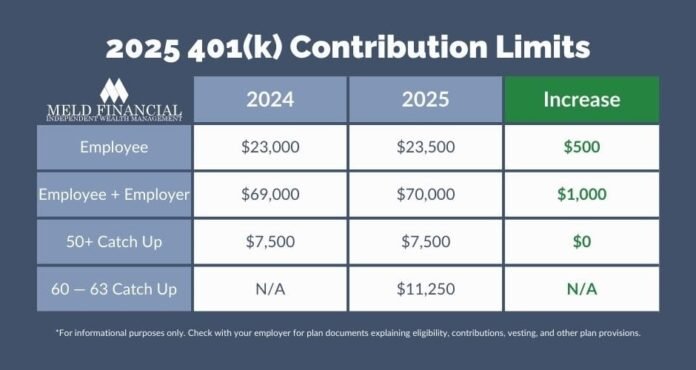

For 2025, the IRS has raised the annual contribution limit for Roth 401(k) accounts to $23,500, up by $500 from the 2024 cap. This increase applies strictly to employee contributions and does not include any employer matches, which remain separate.

The rules for catch-up contributions have also evolved, offering greater flexibility for older savers:

- Age 50 and older: Eligible participants can contribute an additional $7,500, bringing their total Roth 401(k) contributions to $31,000 in 2025.

- Ages 60 to 63: Thanks to the SECURE 2.0 Act, individuals in this age bracket may qualify for an enhanced catch-up of $11,250 (if their employer plan allows), raising their total contribution potential to $34,750 for the year.

These adjustments give retirement savers more room to maximize tax-advantaged growth and take advantage of higher contribution ceilings at key points in their career.

Key Points Summary

Quick Facts at a Glance

- Standard Limit: $23,500 for Roth and traditional 401 k (combined employee portion)

- Catch-Up (50+): +$7,500 → Total $31,000

- Enhanced Catch-Up (60–63): +$11,250 → Total $34,750 (if allowed)

- Combined Employer + Employee Limit: $70,000 total, plus catch-ups

- Mega Backdoor Roth: Access up to $70,000 using after-tax contributions and conversions

What the Numbers Mean for You

- Under age 50: You can contribute up to $23,500 to your Roth 401(k) in 2025.

- Ages 50–59 (or 64 and older): You qualify for the standard $7,500 catch-up, allowing total contributions of up to $31,000.

- Ages 60–63: If your plan permits, you may take advantage of the enhanced catch-up of $11,250, boosting your total contribution limit to an impressive $34,750.

These tiered limits are designed to help savers maximize their retirement accounts at different stages of life—giving younger workers steady growth opportunities while allowing those closer to retirement to accelerate their savings.

Read also-Roth 401 K Withdrawal Rules: What You Need to Know in 2025

Combined Contribution Limits: Employees + Employers

Your personal contribution limits only tell part of the story. Employers can also contribute to your Roth 401(k)—through matches, profit sharing, or other plan features.

- Standard limit (employee + employer): In 2025, the combined maximum contribution is $70,000.

- With standard catch-up (age 50+): Your total contribution limit increases to $77,500.

- With enhanced catch-up (ages 60–63, if eligible): The ceiling climbs even higher to $81,250.

These higher thresholds mean that, depending on your age and employer match, you could set aside significantly more for retirement—helping you build tax-advantaged wealth faster.

Mega Backdoor Roth: Maximizing Your Savings Potential

For high-income earners and aggressive savers, the mega backdoor Roth can be a game-changing strategy—provided your employer’s plan allows after-tax contributions and in-plan Roth conversions.

Here’s how it works: after contributing the maximum to your Roth 401(k), you can make after-tax contributions up to the overall $70,000 combined limit (including employer contributions). Those extra after-tax dollars can then be converted into your Roth account, effectively bypassing the standard contribution caps.

This strategy allows you to supercharge your Roth savings, creating far more room for tax-free growth over the long term. For those who qualify, it’s one of the most powerful tools available to accelerate retirement wealth.

Roth 401 k vs Roth IRA: Why the Difference Matters

| Feature | Roth 401 k (2025) | Roth IRA (2025) |

|---|---|---|

| Contribution Limit (Under 50) | $23,500 | $7,000 |

| Catch-Up (50+) | +$7,500 (or +$11,250) | +$1,000 |

| Income Limits | None | Phased out above income thresholds |

| Employer Contributions | Allowed (counts toward combined cap) | Not applicable |

| RMDs | Pending elimination under SECURE 2.0 | None during owner’s life |

Roth 401 k allows higher limits, no income limits, and employer contributions. Roth IRA offers flexibility and favorable withdrawal rules.

Planning Strategies to Make the Most of 2025 Roth 401(k) Limits

The IRS contribution increases for 2025 present a valuable opportunity for retirement savers. But to truly maximize the benefits, you’ll need a plan. Here are several strategies that can help you take full advantage of the new Roth 401(k) limits:

1. Contribute early to capture more growth.

If your cash flow allows, consider front-loading your contributions at the beginning of the year rather than spreading them out evenly over 12 months. By investing more money earlier, you give your contributions a longer runway to compound tax-free throughout the year. Even small differences in timing can add up significantly over decades.

2. Take full advantage of catch-up contributions.

For savers age 50 and older, catch-up contributions are one of the most powerful tools available. In 2025, you can add an extra $7,500, boosting your total Roth 401(k) savings to $31,000. For those in the special 60–63 age window, the enhanced catch-up raises your annual limit even further—to $34,750. This can be especially beneficial if you’re behind on retirement savings or want to accelerate growth in your peak earning years.

3. Explore the mega backdoor Roth option.

If your employer plan permits, the mega backdoor Roth strategy can transform your savings potential. After you’ve maxed out your regular Roth 401(k) contributions, you may be able to make after-tax contributions and then roll or convert them into your Roth account. When combined with employer contributions, this approach can bring your total up to the $70,000 cap in 2025 (or even higher with catch-ups). This strategy is complex, but for high-income earners, it can be one of the most effective ways to stockpile tax-free assets.

4. Coordinate with a Roth IRA for extra flexibility.

A Roth 401(k) and a Roth IRA can complement each other beautifully. While both accounts grow tax-free, Roth IRAs often provide greater flexibility, such as penalty-free withdrawals of contributions and no required minimum distributions (RMDs) during your lifetime. Contributing to both—if your income allows—ensures you maximize available tax-advantaged space while creating more flexible retirement income options later.

5. Keep a close eye on employer contributions.

Employer matches are free money, but they also count toward your overall contribution limit. For 2025, the combined cap for employees and employers is $70,000, or higher if catch-ups apply. Be sure to monitor contributions throughout the year so you don’t inadvertently exceed IRS limits, which can trigger taxes and penalties.

By combining these strategies—front-loading, using catch-ups, exploring advanced options like the mega backdoor Roth, and coordinating with other retirement accounts—you’ll not only meet the 2025 contribution limits but also maximize the long-term tax advantages of your savings. Thoughtful planning today can translate into significantly greater financial security in retirement.

Important Considerations for 2025 Roth 401(k) Contributions

While the higher 2025 contribution limits open up greater opportunities, it’s important to be aware of a few key rules and potential pitfalls:

1. The $23,500 employee limit applies to both Roth and Traditional 401(k) contributions combined.

You can choose to split your contributions between a Roth 401(k) and a Traditional 401(k), but together they cannot exceed $23,500 in 2025 (before catch-ups). For example, if you contribute $15,000 to a Roth 401(k), you can only put $8,500 into a Traditional 401(k) that year.

2. Avoid excess contributions to prevent costly penalties.

If you contribute more than the annual limit, the IRS treats those excess amounts as taxable twice—once when contributed and again upon withdrawal—unless you correct the mistake promptly. Be sure to track your payroll contributions and employer match carefully to avoid unpleasant surprises at tax time.

3. Review your plan’s rules for catch-up contributions and Roth conversions.

Not every employer plan automatically allows for the enhanced age 60–63 catch-up or supports the mega backdoor Roth strategy. Always check your plan documents or speak with HR to confirm what options are available to you.

4. Stay alert to legislative and IRS updates.

Retirement savings rules continue to evolve under new legislation such as the SECURE 2.0 Act and periodic IRS adjustments. Contribution limits, catch-up provisions, and taxation rules may change in future years, so staying informed is essential for long-term planning.

By keeping these considerations in mind, you can confidently maximize your Roth 401(k) contributions while avoiding missteps that could reduce the benefits of your retirement savings strategy.

FAQs

1. What are Roth 401 k contribution limits for 2025?

Under 50: $23,500. Age 50+: $31,000. Age 60–63 (if allowed): $34,750.

2. What’s the maximum total contribution including employer match?

Up to $70,000, or $77,500 with standard catch-ups, up to $81,250 with enhanced 60–63 catch-ups.

3. How does the mega backdoor Roth strategy work?

It allows savers to make after-tax contributions and convert to Roth—potentially bringing total Roth savings up to $70,000.

Knowing your Roth 401 k contribution limits 2025 empowers you to make strategic retirement investments today and enjoy tax-free income tomorrow. Ready to optimize your retirement savings? Let me know if you’d like help creating a personalized savings strategy!

Disclaimer: This blog provides general information only. It does not constitute financial, tax, or legal advice. Individual situations vary. Please consult a qualified financial advisor or tax professional for guidance tailored to your personal circumstances.