2025 federal income tax brackets have officially been released, and the latest changes bring modest adjustments designed to reflect inflation. While the overall tax rate structure remains unchanged, income thresholds have been updated, and the standard deduction has increased, giving taxpayers more breathing room this year.

Recent Changes You Should Know

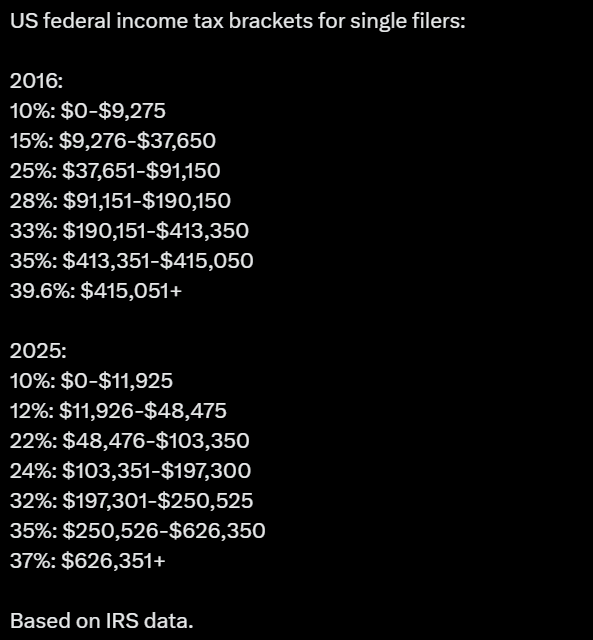

The federal income tax system in 2025 still uses the same seven brackets—10%, 12%, 22%, 24%, 32%, 35%, and 37%—but the government has introduced several updates to ensure taxpayers are not penalized by inflation. These changes may look small at first glance, but they can make a noticeable difference in how much you owe or save.

1. Wider Income Ranges for Brackets

Each tax bracket now covers a slightly higher range of income. This means that even if your salary went up due to cost-of-living adjustments or modest raises, you are less likely to be pushed into a higher tax rate. For example, in 2024, many middle-income earners were close to moving into the 24% bracket, but in 2025 the threshold has shifted upward, giving households more breathing room.

2. Top Rate Adjustment

The 37% tax rate, which applies to the highest earners, now kicks in at $626,350 for single filers and $751,600 for married couples filing jointly. By comparison, this threshold was lower in 2024, so wealthier households may see a small benefit as more of their income falls under the 35% bracket before reaching the top rate.

3. Standard Deduction Increases

The standard deduction—the amount of income you can earn before owing any federal income tax—has gone up significantly. For 2025, individuals can claim $15,000, while married couples filing jointly can deduct $30,000. This increase means more of your income is automatically shielded from taxation, especially benefiting low- and middle-income households who don’t itemize deductions.

4. Inflation Indexing Across the Board

One of the most important updates is the 2.8% inflation adjustment applied to income thresholds across all tax brackets. This adjustment is not random—it is part of the government’s annual effort to make sure tax policy stays fair. Without inflation indexing, workers would effectively face “bracket creep,” where they end up paying higher taxes even though their purchasing power hasn’t really increased.

Why These Updates Matter to You

These changes may look technical, but they affect almost every taxpayer. If you are a salaried employee, you may notice slightly smaller withholdings on your paycheck throughout the year. If you are self-employed or a business owner, these updates could alter your estimated tax payments. And if you are retired, higher standard deductions may reduce your taxable income, especially if you combine them with retirement account withdrawals.

In short, the 2025 tax adjustments are part of the government’s annual inflation indexing policy, which keeps the tax system aligned with the real cost of living. By widening brackets and raising deductions, taxpayers are less likely to face unfair increases in their tax bills simply because of rising prices.

Read Also-Federal Income Tax Definition and Key Updates (August 2025)

Key Points Summary – Quick Takeaway

✨ Fast readers, here’s your 2025 tax snapshot:

- Seven tax brackets remain unchanged in percentage rates.

- Bracket thresholds increase by about 2.8%.

- Standard deduction: $15,000 (single), $30,000 (married filing jointly).

- Top rate kicks in above $626K for singles, $751K for joint filers.

- Small changes could mean lower overall taxable income for many households.

Breakdown of the 2025 Federal Income Tax Brackets

Here’s how the new brackets look for 2025, broken down by filing status:

| Filing Status | 10% | 12% | 22% | 24% | 32% | 35% | 37% |

|---|---|---|---|---|---|---|---|

| Single | $0 – $11,925 | $11,925 – $48,475 | $48,475 – $103,350 | $103,350 – $197,300 | $197,300 – $250,525 | $250,525 – $626,350 | $626,350+ |

| Married Filing Jointly | $0 – $23,850 | $23,850 – $96,950 | $96,950 – $206,700 | $206,700 – $394,600 | $394,600 – $501,050 | $501,050 – $751,600 | $751,600+ |

| Head of Household | $0 – $17,000 | $17,000 – $64,850 | $64,850 – $103,350 | $103,350 – $197,300 | $197,300 – $250,500 | $250,500 – $626,350 | $626,350+ |

These new thresholds mean more of your income is taxed at lower rates compared to last year.

What This Means for Taxpayers

The adjustments to the 2025 tax brackets and deductions are not just technical updates; they directly affect how much money stays in your pocket and how you plan for the future. Here’s a closer look at what these changes mean for everyday taxpayers:

1. More Take-Home Pay

With income thresholds rising across all brackets, fewer dollars will be taxed at higher rates. This means that even if your salary increased slightly in 2025, the government is less likely to take a bigger portion simply due to inflation. For example, a worker earning $80,000 in 2024 might have seen part of that income taxed at the 24% rate, but in 2025 more of that same income could fall into the 22% bracket. Over a full year, these small differences can add up to several hundred dollars in extra take-home pay.

2. Bigger Standard Deduction

The jump in the standard deduction—$15,000 for individuals and $30,000 for married couples filing jointly—offers a significant benefit. For many households, this increase means they will owe taxes on a smaller portion of their income. It also simplifies the filing process, as fewer taxpayers will need to itemize deductions for mortgage interest, medical expenses, or charitable contributions. In practice, this helps middle-income earners keep more of their money while saving time and effort during tax season.

3. Planning Opportunities

Because tax brackets are tied to inflation, they can be used as part of a smarter financial strategy. Savvy taxpayers can take advantage of this stability to optimize their long-term planning. For instance:

- Retirement Savings: Higher thresholds make it a good time to increase contributions to tax-advantaged retirement accounts like 401(k)s or IRAs.

- Roth Conversions: Those considering converting traditional IRA funds to a Roth IRA may find 2025 favorable, since current tax rates remain relatively low.

- Income Timing: Small business owners, freelancers, or investors may choose to delay or accelerate income and deductions to minimize their overall tax bill.

These strategies, when planned carefully, can result in meaningful long-term savings.

4. Looking Ahead to 2026

One of the most critical points to remember is that the current tax structure stems from the Tax Cuts and Jobs Act of 2017, which is set to expire after 2025. Unless Congress acts to extend or revise it, tax brackets will revert to their pre-2017 levels in 2026—likely meaning higher rates for many households. For this reason, 2025 is a pivotal year for tax planning. Taxpayers may want to consider:

- Accelerating income into 2025 while rates are lower.

- Maximizing retirement contributions and charitable giving before potential changes.

- Meeting with a financial advisor or tax professional to build a personalized strategy.

In short, these updates are good news for 2025, but they also serve as a reminder that the current tax environment may be temporary. By planning ahead, taxpayers can take full advantage of the current system before possible rate increases in 2026.

Why the 2025 Federal Income Tax Brackets Matter

At first glance, the adjustments to the 2025 federal income tax brackets may seem modest, but their impact can ripple across household budgets, long-term financial planning, and even the broader economy. By raising income thresholds and increasing the standard deduction, the government ensures that taxpayers are not unfairly penalized by inflation. This adjustment prevents “bracket creep”—a situation where people are pushed into higher tax brackets even though their actual purchasing power hasn’t grown.

Impact on Middle-Income Families

For millions of households in the middle-income range, these changes translate directly into meaningful savings. A higher standard deduction means more income is automatically shielded from taxation. Combined with inflation-indexed brackets, families earning between $50,000 and $120,000 often see hundreds of dollars in tax relief. That extra money might cover a few months of groceries, help pay down credit card balances, or be redirected into retirement savings or education funds. For families already feeling the pinch of rising prices, this relief provides some much-needed breathing room.

Effect on High-Income Earners

For wealthier households, the widened upper brackets play a different but equally important role. The 37% top tax rate now begins at $626,350 for single filers and $751,600 for married couples. This means that a greater portion of high earners’ income will continue to be taxed at the 35% rate before jumping to the maximum rate. While the savings may not feel as dramatic as the benefits for middle-income taxpayers, these adjustments can influence investment strategies, retirement account conversions, and even decisions about when to realize capital gains. In many cases, wealthier households use this “extra room” within lower brackets to fine-tune their tax planning.

Broader Economic Implications

Beyond individual households, the changes help maintain consumer spending power in the economy. By keeping more money in the hands of taxpayers, these adjustments support both short-term spending and long-term savings. Economists argue that without inflation indexing, wage increases would be swallowed by higher taxes, leaving families with less real income. By countering that effect, the tax system remains better aligned with economic realities.

In short, the 2025 tax brackets matter because they protect households from hidden tax hikes, encourage smarter financial planning, and help preserve stability in the broader economy. Whether you’re a middle-class worker trying to stretch your budget or a high-income earner managing investments, these updates shape the way you approach your financial future.

Final Thoughts

Understanding the 2025 federal income tax brackets is essential for every taxpayer. The unchanged rates, paired with higher income thresholds and a larger standard deduction, provide both relief and planning opportunities. Whether you are an individual filer, a married couple, or head of household, these updates shape how much you will ultimately owe.

As filing season approaches, consider how these adjustments affect your situation. Smart planning now can save money later, and staying informed is the first step.