Planning for retirement is a marathon, not a sprint. While many financial experts recommend a “set it and forget it” approach to 401k contributions, unforeseen circumstances can sometimes necessitate tapping into those funds. A 401k loan allows you to borrow against your retirement savings, but it’s crucial to understand the repayment implications. This blog post dives into the world of 401k loan repayments and explores how a 401k loan repayment calculator can be your secret weapon for staying on track.

Understanding 401k Loans

Before delving into repayment strategies, let’s establish some ground rules. A 401k loan allows you to borrow a portion of your vested retirement savings, typically up to $50,000 or half of your vested balance, whichever is less. The repayment term is usually limited to five years, with interest charged on the loan. Here’s the catch: you’re essentially borrowing from yourself, but you’ll also be paying interest to yourself (at a rate set by your plan administrator).

There are significant advantages to a 401k loan. The interest you pay goes back into your account, and the loan doesn’t impact your credit score. However, there are also drawbacks. Withdrawing money from your retirement savings means missing out on potential investment growth. Additionally, if you leave your job before the loan is repaid, it may be considered a taxable distribution and incur a 10% penalty on top of income taxes.

Understanding the 401k Loan Repayment Calculator

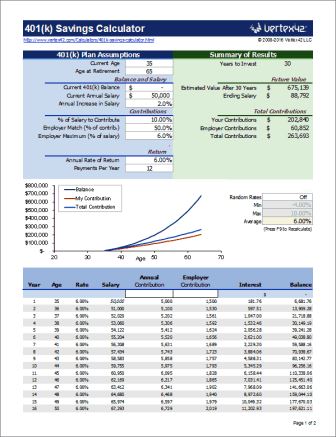

At its core, a 401k loan repayment calculator is a powerful online tool designed to help you comprehend the financial implications of borrowing from your 401(k) account. It takes into account various factors, such as the loan amount, interest rate, repayment period, and your current 401(k) balance, to provide you with a comprehensive overview of your repayment obligations.

By inputting your specific information, the calculator can generate detailed projections, including the total amount you’ll need to repay, the monthly payment amount, and the potential impact on your retirement savings growth. This information can be invaluable in helping you make an informed decision about whether taking out a 401(k) loan is the right choice for your financial situation.

Key Features of a 401k Loan Repayment Calculator

- Loan Amount: The calculator allows you to input the desired loan amount, ensuring accurate calculations based on your specific needs.

- Interest Rate: Most 401(k) loans carry an interest rate, which is typically determined by the plan provider. The calculator takes this rate into account to provide accurate repayment projections.

- Repayment Period: 401(k) loans typically have a repayment period of five years, although some plans may offer longer terms. The calculator allows you to specify the repayment period to align with your plan’s requirements.

- Current 401(k) Balance: By entering your current 401(k) balance, the calculator can provide insights into the potential impact of the loan on your overall retirement savings growth.

- Amortization Schedule: Many calculators offer an amortization schedule, which breaks down the repayment process into individual payments, showing you how much goes towards principal and interest with each installment.

Using the 401k Loan Repayment Calculator

Now, let’s explore how to calculate your 401k loan payments. We recommend using an online 401k loan repayment calculator. Here’s how it works:

- Enter Your Loan Amount: Input the amount you plan to borrow from your 401k.

- Interest Rate: Specify the interest rate for your loan. Remember, this interest goes back into your account.

- Payback Period: Determine the length of your loan (usually five years).

- Monthly Payment: The calculator will provide your estimated monthly payment.

Benefits of Using a 401k Loan Repayment Calculator

- Informed Decision-Making: By providing detailed projections, the calculator empowers you to make an informed decision about whether taking out a 401(k) loan is the right choice for your financial situation.

- Budgeting Assistance: The calculator helps you understand the monthly payment amount required to repay the loan, allowing you to plan and adjust your budget accordingly.

- Impact Assessment: By considering your current 401(k) balance, the calculator can estimate the potential impact of the loan on your retirement savings growth, helping you weigh the pros and cons.

- Comparison Tool: Some calculators offer the ability to compare different loan scenarios, enabling you to explore various options and choose the one that best suits your needs.

The Importance of Repaying Your 401(k) Loan

While taking out a 401(k) loan may seem like a convenient solution to your financial needs, it’s crucial to understand the importance of repaying the loan in a timely manner. Failing to do so can have severe consequences, including potential tax implications and penalties.

When you borrow from your 401(k), you’re essentially taking money out of your retirement savings account. This means that the borrowed funds are no longer earning potential investment returns, which can significantly impact the growth of your retirement nest egg over time.

By using a 401k loan repayment calculator, you can gain a better understanding of the repayment process and ensure that you’re on track to repay the loan within the specified timeframe. This not only helps you avoid potential penalties but also minimizes the impact on your long-term retirement savings goals.

Roth 401(k) vs. Regular 401(k) Calculator

When it comes to retirement planning, understanding the differences between a Roth 401(k) and a regular 401(k) is crucial. While both are excellent retirement savings vehicles, they differ in terms of tax treatment and contribution limits.

A Roth 401(k) vs. regular 401(k) calculator can help you compare the potential growth and tax implications of each option, taking into account factors such as your current income, expected retirement income, and investment time horizon. By using this calculator, you can make an informed decision about which type of 401(k) account aligns better with your long-term financial goals.

In conclusion, a 401(k) loan repayment calculator is an invaluable tool for anyone considering borrowing from their retirement savings account. By providing detailed projections and insights, it empowers you to make informed decisions about your retirement savings while minimizing the potential impact on your long-term financial goals. Whether you’re facing an unexpected expense or exploring different retirement planning options, leveraging the power of these calculators can help you navigate the complexities of retirement planning with confidence.

See Also- Can I Cancel My 401(k) and Cash Out While Still Employed