The new rules for 401k catch up contributions 2026 bring important updates for retirement savers — especially those 50 and older. The most recent IRS adjustments increase contribution limits and introduce new requirements for certain high-earners. This means many Americans will get a chance to save more, though some may need to alter how they contribute.

What’s New in 2026

Higher Contribution Limits

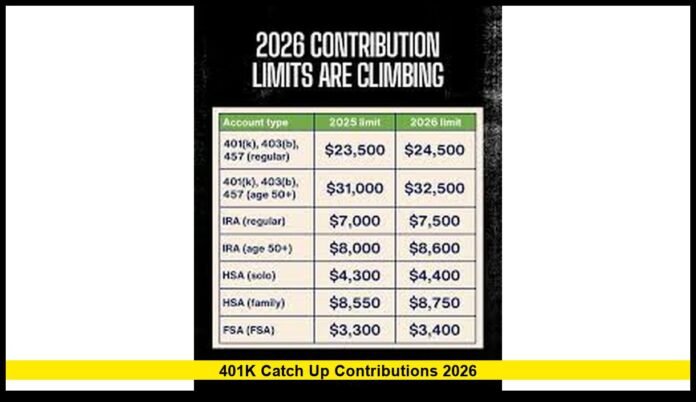

- For 2026, the standard annual elective deferral limit for 401(k), 403(b), most 457(b) plans, and the federal Thrift Savings Plan rises to $24,500.

- For participants aged 50 or older, the catch-up contribution limit increases to $8,000, up from $7,500 in 2025.

- For participants aged 60 to 63 (if their plan permits), a “super catch-up” option allows up to $11,250 in catch-up contributions.

- The overall limit on total contributions — employee deferrals plus employer match or profit-sharing — climbs to $72,000 in 2026 (up from $70,000), giving room for higher total plan funding.

These changes deliver the biggest opportunity yet for many workers to boost retirement savings as they approach retirement.

Roth-Only Catch-Up Rule for High Earners

A major policy shift under the law now requires certain high earners to treat catch-up contributions differently:

- If in 2025 a worker’s FICA-reported wages (Box 3 on the W-2) from their employer exceeded $150,000, then beginning in 2026 any catch-up contributions must be made on an after-tax Roth basis.

- This Roth-only requirement applies only to catch-up amounts (the extra contributions allowed beyond the standard deferral limit), not the base contribution.

- If the employer’s plan does not offer a Roth 401(k) option, then high earners who exceed the wage threshold may be unable to make catch-up contributions at all under the new rule.

This change shifts tax benefits: catch-up contributions no longer reduce taxable income in the contribution year. Instead, they grow tax-free and withdrawals in retirement are tax-free (if Roth rules are satisfied).

How the New Limits Work by Age

Here’s a breakdown of what typical savers can contribute in 2026, based on age and eligibility:

| Age / Situation | Employee Deferral Limit (2026) | Catch-Up Contribution | Total Potential Elective Deferrals |

|---|---|---|---|

| Under 50 | $24,500 | N/A | $24,500 |

| 50–59 (or 64+) | $24,500 | $8,000 | $32,500 |

| 60–63 (if plan allows) | $24,500 | $11,250 (“super” catch-up) | $35,750 |

Beyond those numbers, employer contributions (matching, profit sharing) may be added — as long as total contributions don’t exceed $72,000 for 2026.

What This Means for Different Groups of Savers

- Workers under 50: They continue with the standard contribution limit; no catch-up applies. The 2026 increase to $24,500 gives more room to defer income before tax.

- Workers 50 and older: The increased catch-up amount offers a valuable opportunity to accelerate retirement savings — especially for those who deferred less in earlier years.

- Workers 60–63: If their plan sponsors the “super catch-up,” these workers gain one of the most generous pre-retirement contribution opportunities.

- High earners (2025 wages over $150,000): For those eligible for catch-up, the mandatory Roth requirement means contributions will be after-tax. This could reduce upfront tax breaks but may pay off later with tax-free growth.

- Savers whose employer plan lacks a Roth option: High earners in that situation may lose the ability to make catch-up contributions in 2026 — unless the employer updates the plan.

Why the Changes Matter

These 2026 updates stem from two main forces: standard inflation adjustments to annual contribution limits, plus the implementation of provisions under the law designed to encourage Roth-type saving and to give older workers stronger savings tools as they near retirement.

The benefits are significant:

- Older savers have more capacity to accelerate retirement savings before they retire.

- The “super catch-up” helps those in their final working years make up for earlier savings shortfalls.

- The Roth requirement for high earners encourages after-tax savings — potentially reducing lifetime tax burden when withdrawals are tax-free.

For many, the increased limits may mark the best opportunity yet to maximize tax-advantaged savings before retirement. For high-income workers, the Roth shift marks a turning point for how catch-up dollars are treated.

What Savers Should Do Before 2026 Ends

To make the most of these changes, consider the following steps:

- Review your employer’s 401(k) plan details. Confirm whether your plan:

- Offers catch-up and super catch-up contributions,

- Includes a Roth 401(k) option (especially important if you may hit the high-earner threshold).

- Estimate your 2025 wages. Specifically, check your Social Security (Box 3) wages from your W-2 to see if you exceed $150,000.

- Decide on contribution timing and type. If eligible, plan whether you want to maximize deferrals and catch-up contributions, and whether to do so on a Roth (after-tax) or pre-tax basis (if allowed).

- Coordinate employer contributions. If you want full benefit from employer match or profit-sharing, build those into your contribution strategy — but ensure you stay under the total contribution cap.

- Adjust retirement projections. With higher savings allowed, consider revisiting retirement targets, withdrawal projections, and long-term tax planning.

Potential Implications for Retirement Planning

Bigger Nest Egg for Late-Career Savers

For many Americans, especially those who began saving late or boosted earnings later in their career, the 2026 limits offer a last-chance opportunity to significantly ramp up retirement savings.

The extra $8,000 (or $11,250) allowed for catch-up contributions can translate into substantial retirement fund growth — especially if earnings are reinvested and compounded over time.

Changes in Tax Strategy for High Earners

High earners who previously relied on pre-tax catch-up contributions may see a reduced immediate tax break. However, switching to Roth may offer long-term advantages: tax-free growth, tax-free withdrawals, and potential flexibility if tax rates rise or retirement spans many years. For some, this shift may align better with long-term financial planning than the short-term deduction benefit.

Employer Plan Readiness Becomes Critical

Employers must ensure their plans align with the new rules. If a plan lacks a Roth option, high-earning participants may lose catch-up eligibility. Similarly, not all plans may offer super catch-up. Savers should check with plan administrators to confirm what their 2026 options will be.

Retirement Savers Should Act Thoughtfully

These rule changes don’t just happen automatically. For workers 50 or older — especially high earners — it’s worth reviewing pay stubs, employer plan documents, and contribution elections before the end of 2026. The choices made now will influence both savings totals and tax treatment for decades.

Common Questions

Who qualifies for catch-up contributions in 2026?

Employees who are age 50 or older by December 31, 2026, and participate in a 401(k), 403(b), most 457(b), or federal Thrift Savings Plan that permits catch-up contributions. For the higher “super catch-up,” you must be 60–63 and in a plan that offers that option.

How much can I contribute if I’m 55?

A 55-year-old participant may contribute up to $32,500 in elective deferrals in 2026 ($24,500 plus $8,000 catch-up), assuming plan eligibility.

What if I’m 62 and my plan allows the super catch-up?

If eligible, you could contribute up to $35,750 total ($24,500 plus $11,250 super catch-up) in elective deferrals for 2026.

Will catch-up contributions always be pre-tax?

Not necessarily. If your FICA wages in 2025 exceed $150,000 and you’re catch-up eligible, any catch-up contributions in 2026 must be made as Roth (after-tax), assuming your employer plan offers a Roth option.

Do employer matches affect catch-up limits?

No. Catch-up limits refer only to elective deferrals by the employee. However, total plan contributions (employee + employer) still must remain under the $72,000 cap for 2026.

What if my employer plan doesn’t include Roth 401(k)?

High-earning employees may lose the ability to make catch-up contributions if the plan lacks a Roth option. In that case, you may need to explore other retirement savings alternatives.

Final Thoughts

For many Americans, the 2026 changes to 401(k) catch up contributions open a powerful window to accelerate retirement savings. The higher limits, combined with new Roth rules for some, make this a pivotal year for retirement planning. Especially if you’re 50 or older, take time soon to review your 2025 wages, evaluate your plan’s options, and decide how best to save before the year closes.

If you qualify, now could be the moment to significantly boost your retirement savings and strengthen your financial future.