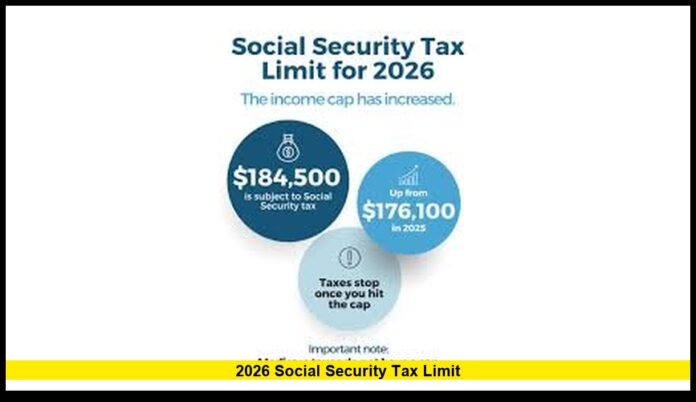

The 2026 social security tax limit has increased, affecting how much income Americans must pay into Social Security during the year.

Each year, the federal government adjusts the taxable wage base to reflect national wage growth. The 2026 update raises the amount of earnings subject to Social Security payroll tax, which mainly impacts higher-income workers while leaving tax rates unchanged.

Understanding the new wage cap helps employees, employers, and self-employed professionals plan payroll, taxes, and retirement contributions.

What Is the 2026 Social Security Tax Limit?

For 2026, the Social Security taxable wage base is $174,900.

This means only earnings up to that amount are subject to Social Security tax. Any income above the cap is not taxed for Social Security purposes, although Medicare taxes continue without a limit.

The increase reflects ongoing wage growth across the U.S. economy and follows the standard annual adjustment formula.

2026 Social Security Tax Rates Remain the Same

While the wage base increased, tax rates did not change.

Social Security tax rates for 2026:

- Employees: 6.2%

- Employers: 6.2%

- Self-employed workers: 12.4%

Because the rate stays fixed, the higher wage cap increases the maximum amount workers contribute rather than the percentage paid.

How the Wage Base Changed From 2025

Comparing yearly limits helps workers understand payroll differences.

| Year | Wage Base |

|---|---|

| 2025 | $168,600 |

| 2026 | $174,900 |

The taxable maximum increased by $6,300, continuing the pattern of steady annual growth.

This change means high earners will continue paying Social Security tax longer during the year.

Maximum Social Security Contribution in 2026

The higher wage base raises the maximum tax employees can pay.

Maximum employee contribution:

- 6.2% of $174,900

- $10,843.80

Employers contribute the same amount on behalf of each worker.

Self-employed individuals pay the combined maximum of $21,687.60, though tax deductions reduce the effective cost.

Who Will Notice the Change Most

The increase primarily affects workers whose earnings exceed the previous wage base.

Groups most impacted include:

- High-salary professionals

- Executives and senior leaders

- Business owners receiving wages

- Dual-income households with strong earnings

- Self-employed professionals

Workers earning below the taxable maximum will not see a change in Social Security withholding rates.

Impact on Paychecks

The updated limit slightly reduces take-home pay for higher earners because Social Security withholding continues longer.

In earlier years, some workers stopped paying the tax before year-end once they reached the cap. In 2026, that stopping point occurs later due to the higher threshold.

The change is incremental but noticeable for top earners.

Why the Social Security Tax Limit Increases

The taxable maximum rises when national wages increase. This adjustment supports program funding and keeps benefit calculations aligned with earnings trends.

The annual change serves several purposes:

- Strengthening Social Security financing

- Reflecting wage growth

- Maintaining fairness across income levels

- Gradually increasing payroll tax revenue

Recent years have shown consistent upward adjustments due to strong wage growth.

Connection to Future Benefits

Social Security benefits are calculated using lifetime taxable earnings. Because of this, a higher wage base can influence retirement benefits for higher earners.

Possible effects include:

- Higher recorded taxable earnings

- Slight increases in projected benefits

- Changes to long-term retirement planning assumptions

However, benefit formulas are progressive, so increases are moderated.

Employer Payroll Planning for 2026

Employers must apply the updated wage base starting January 2026.

Important payroll actions include:

- Updating payroll software thresholds

- Monitoring withholding accuracy

- Communicating changes to employees

- Reviewing compensation planning for high earners

Accurate implementation prevents reporting errors and compliance issues.

Considerations for Self-Employed Workers

Self-employed individuals must account for both portions of Social Security tax.

Planning steps for 2026 include:

- Adjusting quarterly estimated payments

- Preparing for a higher maximum tax liability

- Reviewing retirement contribution strategies

- Managing cash flow around payroll taxes

The higher wage base increases total exposure but remains predictable due to the fixed rate.

Economic Context Behind the Increase

The 2026 adjustment reflects continued wage growth and broader economic conditions. Rising incomes push the taxable maximum higher, which increases payroll tax revenue without changing rates.

The upward trend also contributes to ongoing policy discussions about long-term Social Security funding, including debates around the wage cap structure.

Key Takeaways on the 2026 Social Security Tax Limit

- The 2026 wage base is $174,900.

- Social Security tax rates remain unchanged.

- Higher earners will pay tax on more income.

- The maximum employee contribution increased.

- Payroll planning becomes more important for employers and self-employed workers.

Knowing the taxable maximum helps Americans anticipate paycheck changes and make informed retirement decisions.

How do you see the 2026 social security tax limit affecting your financial planning? Share your perspective and check back for future updates.