The 2026 capital gains tax brackets shape how much federal tax Americans pay when they sell stocks, real estate, or other assets for a profit during the 2026 tax year. These brackets determine whether long-term gains fall into the 0%, 15%, or 20% tax range, while short-term gains continue to follow ordinary income tax rates that were adjusted for inflation.

For U.S. taxpayers, understanding how these brackets work is critical. Investment timing, filing status, and total income all influence final tax liability. With updated thresholds now in place for 2026, many individuals will see changes in how their gains are taxed compared with prior years.

What Capital Gains Mean for U.S. Taxpayers

Capital gains arise when an asset is sold for more than its purchase price. The gain represents the profit portion of the transaction, and federal tax applies only to that amount, not the entire sale price.

Common taxable assets include publicly traded stocks, exchange-traded funds, mutual funds, investment real estate, business interests, and certain digital assets treated as property. Each sale must be evaluated individually, taking into account the holding period and the taxpayer’s overall income.

Capital gains taxation plays a major role in long-term financial planning because the tax rate depends not only on the gain itself, but also on how long the asset was held and how much income the seller earns from other sources.

Short-Term and Long-Term Capital Gains Explained

The tax system divides capital gains into two categories based on time.

Short-Term Capital Gains

Short-term capital gains apply when an asset is held for one year or less before being sold. These gains are taxed at the same rates as ordinary income, such as wages or business earnings.

This means short-term gains are added to total taxable income and taxed using the standard federal income tax brackets for 2026. For many taxpayers, this results in higher tax costs compared with long-term gains.

Long-Term Capital Gains

Long-term capital gains apply when an asset is held for more than one year. These gains receive favorable tax treatment through lower federal rates designed to encourage long-term investing.

The 2026 capital gains tax brackets for long-term gains consist of three tiers. Which tier applies depends on total taxable income and filing status.

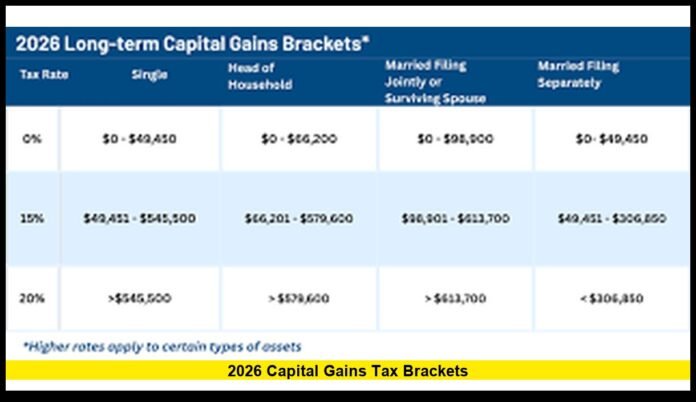

2026 Long-Term Capital Gains Tax Brackets

For the 2026 tax year, the federal government adjusted income thresholds upward to reflect inflation. The tax rates themselves remain unchanged.

Single Filers

- 0% tax rate on taxable income up to $49,450

- 15% tax rate on taxable income from $49,451 to $545,500

- 20% tax rate on taxable income above $545,500

Married Filing Jointly

- 0% tax rate on taxable income up to $98,900

- 15% tax rate on taxable income from $98,901 to $613,700

- 20% tax rate on taxable income above $613,700

Married Filing Separately

- 0% tax rate on taxable income up to $49,450

- 15% tax rate on taxable income from $49,451 to $306,850

- 20% tax rate on taxable income above $306,850

Head of Household

- 0% tax rate on taxable income up to $66,200

- 15% tax rate on taxable income from $66,201 to $579,600

- 20% tax rate on taxable income above $579,600

These thresholds apply to total taxable income, including wages, business income, and investment earnings.

How Short-Term Capital Gains Are Taxed in 2026

Short-term gains follow ordinary income tax rules. For 2026, the federal income tax system continues to use seven brackets.

- 10%

- 12%

- 22%

- 24%

- 32%

- 35%

- 37%

For example, a single filer whose total taxable income reaches the 24% bracket will pay that rate on short-term gains that fall within that income range. Because short-term gains stack on top of other income, they can push taxpayers into higher brackets.

How Capital Gains Are Calculated

Capital gains are calculated by subtracting the adjusted cost basis from the sale price of an asset. The cost basis generally includes the original purchase price plus eligible costs such as commissions or documented improvements.

Only the profit portion is taxable. Losses occur when an asset is sold for less than its adjusted cost basis and can be used to offset gains.

Accurate recordkeeping is essential. Purchase dates, sale dates, and transaction details determine both the holding period and the amount of taxable gain.

Layered Taxation and How Brackets Apply

Capital gains do not face a single flat rate. Instead, gains are layered across tax brackets based on income levels.

For example, part of a long-term gain may fall within the 0% range, while the remaining portion is taxed at 15%. Only income above the top threshold reaches the 20% rate.

This structure often surprises taxpayers who assume all gains are taxed at the highest applicable rate.

Net Investment Income Tax Considerations

Some higher-income taxpayers may owe an additional 3.8% tax on certain investment income, including capital gains. This tax applies when income exceeds specific thresholds.

Although it is separate from the capital gains brackets, it increases the overall tax burden for qualifying individuals and couples. It applies to both short-term and long-term gains.

Capital Gains on Real Estate Sales

Real estate transactions often involve substantial gains, especially in high-demand housing markets.

Homeowners selling a primary residence may qualify for an exclusion that allows a portion of the gain to be excluded from federal taxation.

- Up to $250,000 may be excluded for single filers

- Up to $500,000 may be excluded for married couples filing jointly

To qualify, ownership and use tests must be met. Gains above the exclusion amount are taxed using the 2026 capital gains structure.

Capital Losses and Offsetting Gains

Capital losses can reduce tax liability by offsetting capital gains dollar for dollar. If losses exceed gains, up to $3,000 may be used to offset ordinary income in a single year.

Unused losses can be carried forward to future years. This provision allows taxpayers to manage taxable income over time, especially during volatile market periods.

Why Filing Status Matters

Filing status directly affects which capital gains thresholds apply. Married couples filing jointly benefit from wider income ranges, while married filing separately faces narrower limits.

Choosing the correct filing status is essential for accurate reporting and minimizing tax exposure.

Timing Asset Sales to Manage Taxes

Many taxpayers plan asset sales around tax considerations. Holding an asset just a few extra months to cross the one-year mark can significantly reduce the tax rate applied to the gain.

Others spread large sales across multiple years to avoid pushing income into higher brackets. These timing decisions can make a meaningful difference in final tax outcomes.

State Taxes and Capital Gains

Federal capital gains taxes apply nationwide, but state treatment varies. Some states tax capital gains as ordinary income, while others impose no state income tax at all.

State taxes can add a significant layer to total tax liability and should be considered alongside federal brackets.

Common Capital Gains Misunderstandings

A frequent misunderstanding is that only wealthy individuals pay capital gains tax. In reality, many middle-income households owe capital gains tax when selling investments or property.

Another misconception is that gains are taxed immediately. Taxes apply only when gains are realized through a sale, not when asset values increase on paper.

Preparing for the 2026 Filing Season

Capital gains realized in 2026 will be reported when taxpayers file their federal returns in early 2027. Organized records and awareness of income thresholds reduce the risk of errors and delays.

Tax software and professionals will reflect the updated brackets automatically, but understanding the structure allows taxpayers to make better decisions throughout the year.

Why the 2026 Capital Gains Tax Brackets Matter

The 2026 capital gains tax brackets influence decisions across investing, real estate, and personal finance. Inflation-adjusted thresholds offer some relief, but higher incomes still face higher rates.

Knowing where income falls within the bracket structure helps taxpayers plan sales, estimate taxes, and avoid unexpected liabilities.

Final Perspective

Capital gains taxes remain a core part of the U.S. tax system. With updated thresholds and consistent rate tiers, the 2026 capital gains tax brackets provide a clear framework for taxing investment profits.

Understanding these rules empowers taxpayers to act confidently when selling assets and planning for future financial goals.

What impact do the 2026 capital gains tax brackets have on your financial decisions this year? Share your thoughts and stay informed as tax rules continue to evolve.