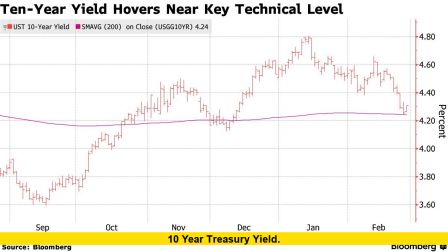

The 10 year treasury yield currently sits at 4.42% as of July 15, 2025, showing a minor decrease from recent highs. This pivotal rate continues to influence loan costs, mortgage rates, and investor sentiment worldwide. Investors are closely watching the U.S. bond market, as today’s yield reflects both underlying economic confidence and persistent caution as inflation and global economic uncertainties remain in focus.

10 year treasury yield: Market Movements and Investor Reactions

Trading early Tuesday showed the 10 year treasury yield hovering at 4.42%, down slightly by 0.01 percentage points. The minor drop comes as markets anticipate new inflation data, which could further impact Fed policy expectations. This yield remains well above the long-term average of around 4.25%, indicating that concerns about persistent inflation and future monetary policy are still prevalent.

Analysts note that the relatively stable movement of the 10 year treasury yield indicates limited volatility despite looming economic events. The spread between the 10 year yield and shorter-term rates remains narrow, hinting that investors are waiting for clearer economic signals before making bold moves.

Key Points Summary

- 10 year treasury yield at 4.42% as of July 15, 2025.

- Slight drop from previous session signals market caution.

- Upcoming inflation data expected to drive further moves.

- Yield remains above long-term averages, reflecting persistent inflation concerns.

- Narrow yield spreads suggest market is awaiting policy clarity.

What’s Next for the 10 year treasury yield?

With today’s modest change, attention turns to upcoming economic data releases. Market participants are monitoring every detail from the Federal Reserve and other central banks. Any signs of rate cuts or shifting inflation trends could quickly ripple through bond markets. For now, the 10 year treasury yield reflects a market in “wait-and-see” mode, balancing optimism with wariness in a still-uncertain global environment.

Let us know how you think bond yields will react to this week’s economic developments—leave a comment below or keep visiting for more updates!