The 10 year Treasury bond remains one of the most influential measures in global finance, shaping interest rates, stock prices, and economic sentiment. As of November 2025, its yield hovers around 4.28%, a level that signals both stability and uncertainty in equal measure.

After two years of intense volatility, the bond market has reached a delicate balance. Inflation is finally easing, growth is slowing, and the Federal Reserve is holding its policy rate steady. Together, these forces have set the stage for one of the most closely watched bond environments in over a decade.

Understanding the Role of the Benchmark

The 10-year Treasury is often described as the heartbeat of the U.S. economy. It represents the return investors demand for lending money to the federal government for a decade — and its yield affects almost every major corner of financial life.

From mortgage rates to auto loans to credit card interest, its influence extends beyond Wall Street. When the yield rises, borrowing becomes more expensive. When it falls, consumers and businesses often find easier access to credit.

In 2025, with inflation nearing the Federal Reserve’s target and global demand for safe assets rising, the 10-year note has settled into a range that reflects cautious optimism rather than fear.

A Look Back at Recent Volatility

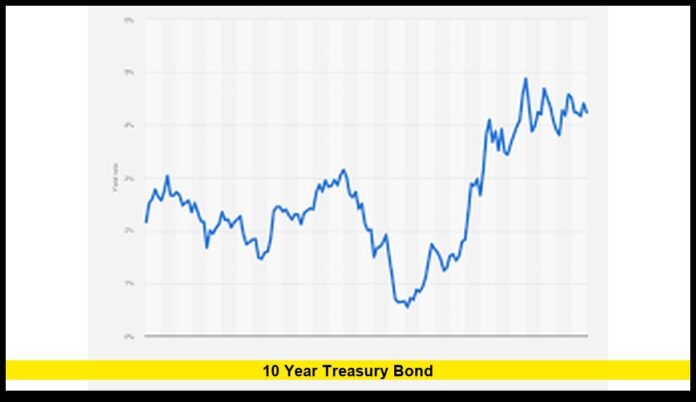

The journey to this point has been anything but smooth. In October 2023, the 10-year yield briefly crossed the 5% mark — the highest level since 2007. The spike alarmed investors, sent stocks tumbling, and raised concerns that borrowing costs would choke economic growth.

By mid-2024, yields began to ease as inflation pressures cooled and expectations shifted toward a slower, steadier economy. By early 2025, the yield had stabilized in the 4% range, where it remains today.

This new equilibrium reflects a changed world: one where investors expect modest growth, controlled inflation, and interest rates that stay higher for longer than in the past decade.

Where the Market Stands Now

Heading into late 2025, the Treasury market has settled into a rhythm of relative calm. The most recent auctions have shown healthy demand, with both U.S. institutions and overseas investors continuing to buy government debt in large quantities.

The 4.28% yield reflects a balancing act between opposing forces — easing inflation on one side and elevated government borrowing on the other. Investors are watching for signals from the Federal Reserve about when rate cuts might begin, but for now, the consensus view is that policy will remain unchanged until mid-2026.

This has created a period of steady yields and lower volatility compared to the past three years — a welcome change for markets adjusting to higher financing costs.

Impact Across the Economy

Movements in Treasury yields influence nearly every major financial decision in the U.S. economy.

- Homebuyers: Mortgage rates tend to track the 10-year yield closely. With the current yield in the low 4% range, average 30-year fixed mortgage rates have fallen slightly to around 6.6–6.8%. While still high compared to pre-2020 levels, the decline offers some relief to buyers after years of surging housing costs.

- Businesses: Companies benefit from lower borrowing costs when yields stabilize. This environment encourages corporate investment, mergers, and refinancing activity.

- Consumers: Credit card and auto loan rates also move in response to bond yields, influencing how much households spend or save.

The ripple effect of the Treasury market underscores why its movements are tracked so closely by economists, investors, and policymakers alike.

The Federal Reserve’s Tightrope

Federal Reserve policy continues to dominate the direction of Treasury yields. The central bank raised interest rates aggressively between 2022 and mid-2023 to fight inflation, lifting the benchmark rate to 5.25–5.50%, its highest in more than two decades.

By late 2025, the Fed has kept that range steady for 16 consecutive months. Inflation has slowed to 2.3%, nearly matching the bank’s 2% target, while unemployment has edged up to 4.1%, a sign of gentle cooling in the labor market.

Fed officials, including Chair Jerome Powell, have made it clear they want to see several months of consistent inflation improvement before cutting rates. Markets are pricing in potential rate reductions around mid-2026, depending on how economic data evolves.

This “pause phase” has been one of the key factors holding the 10-year yield near current levels — neither high enough to hurt growth, nor low enough to suggest an economic downturn.

The Broader Economic Picture

The health of the U.S. economy remains central to the direction of Treasury yields. Recent data paints a picture of resilience with signs of moderation:

- Growth: GDP increased at an annual rate of 1.8% in the third quarter, slower than earlier in the year but still positive.

- Inflation: Consumer prices have leveled off, with core inflation (excluding food and energy) at 2.4%.

- Jobs: Wage growth has cooled slightly, reducing inflation pressure but maintaining steady employment.

- Consumer spending: Retail activity remains steady, though households are showing more caution amid higher living costs.

These numbers suggest a soft landing — slower growth but no deep recession. That outcome supports current yield levels and reinforces investor belief in economic stability heading into 2026.

Foreign Demand Keeps the Market Balanced

The U.S. bond market continues to attract strong global demand. International investors view Treasuries as the safest store of value, particularly during times of uncertainty.

Foreign central banks and pension funds have increased their holdings this year, especially from Japan and Europe, where domestic yields remain lower. The yield gap between U.S. bonds and international alternatives has encouraged steady inflows of capital.

Geopolitical tension in other regions has also boosted demand for Treasuries as a haven. Despite record levels of U.S. government borrowing, global appetite for the 10-year note remains strong — helping to stabilize yields even as debt issuance rises.

The Role of the Federal Deficit

One of the key themes shaping Treasury yields in 2025 is the growing federal deficit. The U.S. government’s fiscal shortfall has reached an estimated $1.7 trillion this year, fueled by defense spending, infrastructure projects, and entitlement programs.

To finance this debt, the Treasury Department has ramped up bond issuance, selling hundreds of billions of dollars in new 10-year notes. In many periods, such high supply could push yields higher. However, demand from global investors and financial institutions has offset much of the pressure.

If deficits continue to expand in 2026 and beyond, analysts warn that yields could face renewed upward momentum. For now, market stability depends on sustained investor confidence in the U.S. government’s fiscal management and creditworthiness.

Investor Strategies and Sentiment

For investors, 2025 has been a year of cautious opportunity. With yields offering solid returns above inflation, Treasuries are once again seen as an attractive option for both income and safety.

- Institutional investors are locking in long-term bonds for consistent returns.

- Pension funds are buying aggressively to match long-term liabilities.

- Retail investors are returning to bond ETFs and mutual funds after fleeing during the 2022–2023 rate surge.

The broader sentiment is one of balance. While equities have recovered from 2024’s pullback, the bond market is providing stability and income — something investors have missed for much of the past decade.

Yield Curve Developments

One of the most watched signals in the bond market, the yield curve, has begun to normalize after nearly two years of inversion. Throughout 2023 and 2024, shorter-term yields were higher than long-term ones — a condition often viewed as a recession warning. 10 Year Treasury Bond

As of late 2025, the curve has flattened but is no longer deeply inverted. Two-year yields have declined faster than 10-year yields, suggesting that investors expect the Fed to maintain stability rather than tighten further.

This shift supports the narrative that the economy has avoided a severe downturn and may be heading toward a period of steady, moderate expansion.

Market Outlook for 2026

Looking ahead, most analysts expect the 10-year yield to trade between 3.8% and 4.5% over the next year. The trajectory will depend on three main factors:

- Inflation trends: Sustained price stability could nudge yields slightly lower.

- Federal Reserve decisions: Any clear sign of rate cuts would spark a bond rally.

- Economic growth: A sharp slowdown could boost demand for Treasuries, driving yields down further.

Conversely, stronger-than-expected growth or higher deficits could limit downward movement and keep yields near their current levels. 10 Year Treasury Bond

For now, the market appears to be entering a rare phase of calm after years of turbulence — though investors remain alert to how quickly conditions can change.

Why It Matters for Everyday Americans

While the Treasury market might seem distant from everyday life, its influence is deeply personal. It determines how much people pay for home loans, car financing, and student debt. It affects the cost of running small businesses, the performance of retirement accounts, and even the value of the U.S. dollar abroad.

A steady 10-year yield signals confidence — that the U.S. economy is growing at a sustainable pace, that inflation is contained, and that the financial system remains stable. For households and investors alike, that stability is a welcome sign after several years of uncertainty. 10 Year Treasury Bond

The direction of the 10-year yield will continue to shape America’s financial story in 2026. Do you think the economy is heading for steady growth or another round of surprises? Share your thoughts below and stay part of the discussion.